Government Stability in the Remittance-Economic Growth Link in Ghana

Eunice Adu-Darko1

Emmanuel K. Aidoo2*

1Department of Finance, Central University, Ghana. |

AbstractSeveral studies have revealed that many factors affect economic growth. Remittances and government stability have been identified as two of these factors. Over the years, remittances have become a major source of financial inflows, especially in Ghana. This study examines the role of government stability in the remittance-economic growth relationship in Ghana. Annual time series data from 1984 to 2020 was extracted from the World Development Indicators (WDI) and the International Country Risk Guide (ICRG). An ARDL model with a level structural break was estimated. The results show, first, that a cointegration relationship exists among the variables in the presence of structural breaks. Secondly, remittances and government stability have a significant, positive long-run impact on economic growth, while no significant impact of GDPPC and government stability on remittances was found. Thirdly, in the short run, remittances and government stability are not significantly associated with growth. The role of remittances in the economic growth of Ghana is important. When remittances increase, economic growth will likewise increase. Government policy-making should create an enabling environment to channel remittances into productive uses, including entrepreneurial ventures. Remittances must be received through proper channels for easy accountability, and government stability should be complemented by good governance to further foster economic growth. |

Licensed: |

|

Keywords: JEL Classification |

|

Received: 25 May 2022 |

Funding: This study received no specific financial support. |

Competing Interests:The authors declare that they have no competing interests. |

1. Introduction

1.1. Background and Problem

Government stability is crucial to peace and economic growth. When the governance of a state is unstable, the state is often characterized by the usurping of resources by organized criminals, terrorists, and other political groups. This is typically accompanied by destabilization of the economy, often the presence of violence, and a reduction in welfare and per capita growth for the population (Esener & İpek, 2018; Yeboua, 2021; Yohou, Goujon, & Ouattara, 2016) . In recent years, countries have attempted to institute structures and measures that aid the creation and maintenance of government stability. Government stability is widely considered a significant indicator of and contributor to economic performance. As an important measure of institutional quality, government stability provides an indication of political stability and the absence of violence (ICRG, 2020).

Broadly, the concept of institutional quality embodies the law, the rights of individuals, and government regulations and services that are deemed to be of high quality (Bruinshoofd, 2016). Thus, government stability as an indicator of institutional quality was seminally defined by Dowding and Kimber (1983) as “the state in which a government object exists when it possesses the capacity to prevent contingencies from forcing its non-survival; that is, from forcing a change in one or more of that object’s criteria of identity.” It is important to note, however, that although government stability is necessarily conducive to development, the extension of stability to good governance is absolutely imperative (Hussain, 2014). Indeed, the International Country Risk Guide (ICRG) database defines government stability as “the ability of a government to carry out its declared program(s), and to stay in office.” The stability of a government as a measure of institutional quality has been shown to interact with several macroeconomic indicators, paramount among which is the growth of the economy (Aisen & Veiga, 2013) and the level of inward remittances (Adams & Klobodu, 2016; Catrinescu, Leon-Ledesma, Piracha, & Quillin, 2009; Jewel, 2015) .

According to Page and Mercer (2012), remittances, which are funds sent home by citizens who live overseas, are good for an economy as they minimize shortages in foreign exchange and improve the balance of payment deficits without necessarily increasing imports. Furthermore, remittances supplement household incomes in the receiving countries and, at times, contribute to capital needed for business activities at the small-scale business level in poor countries (Coppola, 2020). According to Chami, Montiel, Abdih, and Dagher (2008), remittances, as a measure, are made up of three main parts. These are personal remittances, total remittances, and total remittances made up of transfers to non-profit institutions that provide services to households. Indeed, remittances can increase GDP growth by boosting household consumption (Bonsu & Muzindutsi, 2017; Perez-Saiz, Dridi, Gursoy, & Bari, 2019).

The growing volumes of remittances to recipient countries are quite notable. The World Bank’s Migration and Development Brief indicates that the total value of inward remittances to low and middle-income countries was $529 in 2019. This was 9.6% more than in 2017, which had previously been the highest recorded value. Indeed, when high-income countries are added, the figure balloons to $689 billion in 2019 from $633 billion in 2018. In 2018, the top five remittance recipients were India ($79 billion), followed by China ($67 billion), Mexico ($36 billion), the Philippines ($34 billion), and Egypt ($29 billion). Ghana was the second highest recipient of remittances to sub-Saharan Africa in the same year (World Bank, 2019). Studies on the links between remittances and growth continue to yield various results in the literature (Esener & İpek, 2018; Yeboua, 2021).

1.2. Ghana’s Context

The political stability and absence of violence index that captures the stability of a government indicates that for the last four decades, Ghana has typically been under a relatively stable governance regime following a period of instability and frequent coup d’états (Kwasi, 2015). Between 1981 and 1991, the PNDC government ruled as a military government, having overthrown the democratically elected government of the day (Gebe, 2008). The same party, under a different name, governed for eight years after Ghana became a democratically driven state in 1992. From 1992 to date, the stability of Ghana’s government has been relatively steady, as each elected government has managed to complete its full term. However, challenges arise when a change in government results in the cutting short of various programs instituted to enhance welfare and economic growth. Elected governments have frequently won power as a result of various social insurance programs they promise to provide for the populace. However, the element of instability creeps in when governments are voted out when they are in the process of implementing these programs. Typically, the new government will abandon the existing programs and set new ones in motion. In Ghana, this phenomenon has occurred frequently in the areas of education, healthcare and housing, and foreign policy (Makinde, 2005; Siaw, 2015; Twumasi-Ampofo, Osei-Tutu, Decardi-Nelson, & Ofori, 2014) .

Given that the stability or instability of a government – a measure of political stability and the absence of violence and terrorism in a state – is associated with many macroeconomic variables, paramount among them economic growth (Aisen & Veiga, 2013; Akpa, 2018), it is important to investigate the nature and direction of the association between government stability and economic growth in Ghana.

Again, remittances have been shown to be associated with political stability and the absence of violence, represented by government stability in this paper. For example, Ogunniyi, Mavrotas, Olagunju, Fadare, and Adedoyin (2020) found that political stability and consistency in government policies tended to demonstrate a sound environment and hence increased remittance inflows. The literature in Ghana on the effect of remittances is largely mixed (Nketiah, Adjei, Boamah, & Adu-Gyamfi, 2019; Oteng-Abayie, Awuni, & Adjeidjei, 2020). Ghana’s remittances have generally seen an upward trend over the last 20 to 30 years (WDI, 2021). Remittances to Ghana hit $3.8 billion in 2018, an increase of 7.3% from the previous period. Consequently, the role these remittances play in the economy and in the presence of a stable government needs to be investigated.

1.3. Problem Statement

Previous studies on the remittance-economic growth association have yielded conflicting results. A positive link between the two was found by Nyeadi and Atiga (2014) and Cazachevici, Havranek, and Horvath (2020), while Oteng-Abayie et al. (2020) and Chami, Fullenkamp, and Samir (2003) established a negative link between remittances and economic growth. When a country is characterized by a stable governance regime, an efficient allocation of resources is hypothesized to be the result, which will eventually yield increased growth and productivity (Perez-Saiz et al., 2019). Given that inward remittances are a notable source of financial inflows to developing countries, the need for stability cannot be overemphasized. This is especially true when structural breaks are considered. Research conducted on Ghana has largely been restricted to remittances and economic growth, among other subjects, but has not focused on government stability and economic growth. The literature on research involving all three variables (government stability, remittances, and economic growth) is scanty, which means the combination of these three variables in Ghana has been inadequately researched so far. Therefore, this study aims to bridge the gap by considering the possible associations between all three variables in Ghana when the effect of a level break is considered. This research examines the role of government stability in the link between remittance and economic growth in Ghana.

1.4. Research Hypotheses

The following research hypotheses are proposed:

H01: There is no significant relationship between remittances and economic growth in Ghana.

H02: There is no significant relationship between remittances and government stability in Ghana.

H03: There is no significant relationship between government stability and economic growth in Ghana.

1.5. Literature Review

This section reviews related literature on the impact of government stability on remittances and economic growth and focuses primarily on how existing studies have examined similar relationships.

1.5.1. Remittances and Economic Growth

Both empirical and anecdotal research have yielded conflicting results over the years (Cazachevici et al., 2020; Perez-Saiz et al., 2019). To investigate the link between remittances and economic growth in Ghana, Nyeadi and Atiga (2014) used annual time series data from 1980 to 2012. They established that remittances led to economic growth in Ghana, although economic growth did not result in a significant change in remittances. Using the neo-classical framework, multiple regression analysis technique, double log-linear Cobb-Douglas production function, and unbalanced panel data from 1980 to 2004, Fayissa and Nsiah (2010) concluded that remittances exerted a positive influence on economic growth in African countries (Agyei, 2021; Meyer & Shera, 2017). Goschin (2014) concluded that remittances, as capital flows with macroeconomic potential, had a positive influence on both absolute and relative GDP growth in selected Central and Eastern European countries. The results remained robust even though emigration can adversely affect GDP. Additionally, remittances have been found to provide stable support for the growth of the macroeconomy, even during a crisis (Combes & Ebeke, 2011; Goschin, 2014).

However, there is also evidence to support the claim that inward remittances negatively affect economic growth. Ferdaous (2016) confirmed this when applying the neoclassical growth theory to a pooled ordinary least square estimation technique to investigate the associations between the two. In addition, Ferdaous (2016) discovered that there is typically an altruistic rather than profit-driven rationale for inward remittances. This was in response to the finding that in developing economies, inward remittances are usually channeled into non-productive uses. To examine whether workers’ remittances have a direct relationship with economic growth, Barajas, Chami, Fullenkamp, Gapen, and Montiel (2009) used the growth accounting framework within the least square regression model. They found that over several decades, private income transfers have not made a significant contribution to remittance-receiving economies. Indeed, in some of these economies, remittances may have actually delayed growth. Secondly, Barajas et al. (2009) asserted that well-specified and instrumented growth equations with properly measured remittance variables typically reveal an inverse link between remittances and growth. The negative impact of remittances on growth was also found by Chami et al. (2003), who gathered annual data of 113 countries spanning 1970 to 1998 from the World Bank’s World Development Indicators (WDI), the International Monetary Fund, and data on per capita GDP from the PennWorld tables. Chami et al. (2003) found that remittances that are essentially compensatory are inversely associated with economic growth (See also (Cazachevici et al., 2020; Gjini, 2013)).

1.5.2. Government Stability, Remittances, and Economic Growth

Various studies have generated interesting results on the relationship between government stability and economic growth. Hellström and Walther (2019) posited that the stability of a government may be affected by the performance of an economy, especially when the government is a minority government. Using a Cox proportional hazards model on a sample of 18 West European countries from 1945–2013, they concluded that economic changes do matter for government terminations, among other findings. Government stability was directly associated with macroeconomic indicators, particularly unemployment and inflation. Indeed, economic deterioration and decline tend to be associated with an unstable government and the associated conflict and violence (Yerrabati & Hawkes, 2015).

Given a democratic and stable governance regime, the impact of remittances on growth is typically positive. Adams and Klobodu (2016) used data from 1970 to 2012 and a general method of moments technique to examine how remittances were affected by the durability of a regime and the growth of the economy for 35 countries in sub-Saharan Africa. The effect of remittance inflows has been largely without consensus in the growth literature; possible moderating economic indicators, such as government stability, can play an important role in remittances’ impact on growth. Adams and Klobodu (2016), having discovered the contribution of remittances to welfare, household consumption, and growth, advocated for the implementation of effective government policies with the potential to enhance the formal flow of inward remittances. The extent to which governments institute and successfully undertake programs and policies is an indication of stability. As such, a stable regime is more able to implement tax exemptions, relaxation of controls over foreign currency transactions, and the provision of better financial services, among other measures, to attract more remittances.

The literature has further identified the importance of structural breaks to the various associations discussed. It is important to note that structural breaks, when ignored, may lead to the misspecification of models and hence spurious results (Im, Lee, & Tieslau, 2010). Das, McFarlane, and Jung (2019) tested the remittance-GDP nexus in Jamaica with an ARDL model using data from 1976 to 2014. Das et al. (2019) found that the two were cointegrated and positively reinforced each other. However, they only tested for the existence of structural breaks in the unit root test and not the cointegrating model. This study extends the structural break to the cointegration relationship (See (Gregory & Hansen, 1996; Hatemi-J, 2008; Westerlund, 2006) ). Akpa (2018) tested the relationship between private remittances and household consumption in Ghana using an ARDL bounds testing approach with data from 1980 to 2016, controlling for multiple level breaks based on Bai and Perron's (2003) structural breaks. Akpa (2018), unlike many previous tests, found a positive but insignificant association between them in both the short and long run.

Regarding the theoretical inferences, this study follows the neoclassical growth model, which views remittances as a determinant of economic growth (see Oteng-Abayie et al. (2020) for a comprehensive review of the theoretical foundations of the remittance-growth nexus). The literature review above provides a strong indication that conflicting directions exist in the remittance-economic growth nexus. Secondly, the verdict on whether government stability enhances the remittance-economic growth link is still open. This study, set in Ghana, aims to contribute to the scanty literature by attempting to establish the existence and nature of a relationship among all three variables. Indeed, the literature suggests that there is a need to conduct further studies to widen the scope of the topic to achieve a better understanding; hence, we researched the interactions and interrelations among remittances, economic growth, and the stability of governance in Ghana, and the conclusions may possibly be generalized to other developing countries.

2. Method

2.1. Variable Description

Economic growth: In this study, economic growth was measured as GDP per capita. Fayissa and Nsiah (2010) and Aisen and Veiga (2011), among others, have measured economic growth using GDP per capita. Data on GDP per capita was sourced from the World Bank’s World Development Indicators (WDI) and will be indicated as GDPPC in current US dollars.

Remittances: These are defined as “all current transfers received by resident households from non-resident households” (World Bank, 2016). Remittances are usually referred to as some quantum of funds sent from one party, who is usually overseas, to another. The purpose of transfers could be personal or business-related. In this study, remittances were measured as “personal remittances,” defined as the income migrant workers living in another country remit to members of their family and other close alliances (Agbegha, 2006). The data on personal remittances was sourced from the WDI and captured as a percentage of GDP. Remittances were expected to have a positive coefficient as an explanatory variable because it was assumed that increases in personal remittances to the receiving country would increase economic growth (GDP per capita). Remittances were abbreviated as REM.

Government stability was measured using the political risk component of the International Country Risk Guide (ICRG), which assesses the political stability and absence of violence and terrorism in a country. Government stability comprises both the ability of a government to carry out its declared program(s) and its ability to stay in office (Armah, 2010). The subcomponents include government unity, legislative strength, and popular support. Data on government stability was collected from the ICRG. A more stable government environment was expected to have a positive impact on both GDP per capita and remittances. Thus, the coefficient of government stability was expected to be positive. Government stability was denoted as GSTAB and ranged from 0 to 4, where 0 indicated a very high risk and 4 a very low risk.

Inflation: This is defined as the rise in general price levels of goods and services in an economy. It entails a fall in the purchasing power of a country’s currency. Inflation is measured by the annual inflation rate percentage (Chitambara, 2019). Inflation was expected to have a negative coefficient since an increase in inflation decreases GDP per capita growth. Data on inflation was sourced from the WDI. Inflation was abbreviated as INF.

Foreign Direct Investment (FDI): This is the direct investment equity flow in an economy. It is the sum of shareholders' capital, reinvested earnings, and other capital. It denotes a cross-border investment involving a resident of one economy who has control or a significant influence over the affairs of a company resident in another economy. Following Gjini (2013), FDI as a percentage of GDP was used and was expected to have a positive coefficient because an increase in FDI increases GDP per capita growth. Data on FDI was collected from the WDI.

Exchange Rate: This is the official exchange rate from the WDI, which is typically supplied by a country’s national authorities. It can also be the rate determined by a sanctioned exchange market that is legally established. Based on monthly averages, was determined as an annual average and quoted as local currency units relative to the U.S. dollar.

2.2. Source of Data

Annual time series secondary data spanning 37 years from 1984 to 2020 from the WDI as well as the ICRG was used in this study. This selection was based largely on the availability of data.

2.3. Model Specification

2.4. Stationarity Testing

The paper employed both the Augmented Dickey and Fuller (1979) and Phillips and Perron (1988) tests to determine the existence of a unit root in the model.

2.4.1. Augmented Dickey-Fuller (ADF)

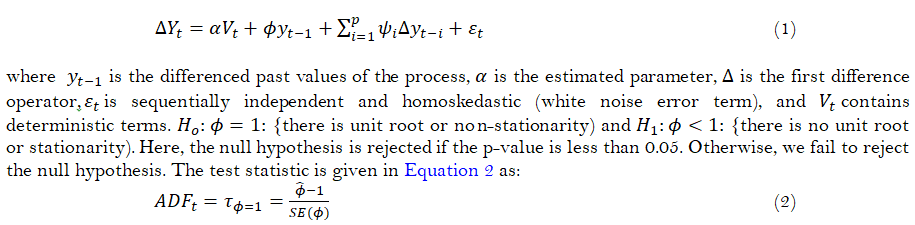

The generalized form of the ADF is stated in Equation 1 as:

2.4.2. The Phillips-Perron (PP) Test

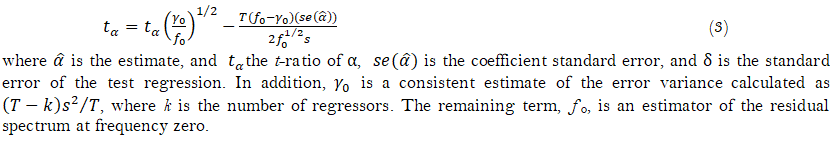

The PP unit root test is a unit root test that controls series with higher correlation when testing for a unit root. The PP test is based on the statistic in Equation 3:

2.5. ARDL Model

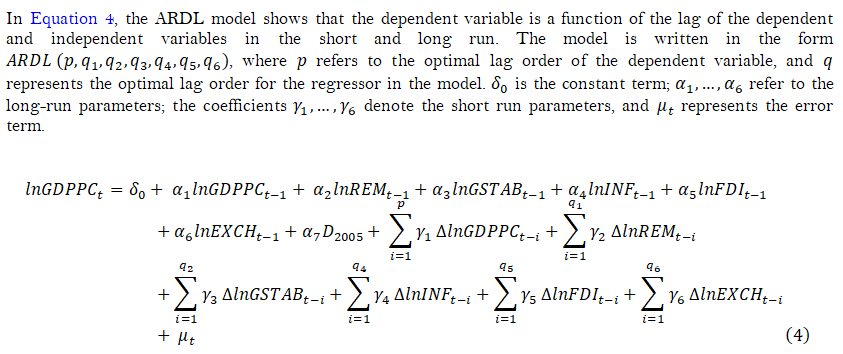

Pesaran and Hashem (1995), Pesaran and Shin (1995) and Pesaran et al. (2001) pioneered the cointegration estimation technique known as the ARDL bounds test, which offers some advantages over other cointegration techniques. First and foremost, the ARDL technique can be used to produce much more reliable results when the sample size is relatively small (Ghatak & Siddiki, 2001). Pesaran et al. (2001) emphasized the merits of using ARDL when the variables are strictly integrated of order one, I (1), or order zero, I (0), or a mixture of both, but not at a higher order. Additionally, the ARDL approach is still valid even when there are endogenous variables and when the data generating process is not symmetrical and the optimal lags are not equal for all variables (Bist & Bista, 2018). The general model specification of the ARDL test is given in Equation 4 and includes both the short run and long run.

2.6. Diagnostic Testing

Several diagnostic tests were conducted to ensure the robustness of the results obtained. The diagnostic tests included the normality test, serial correlation test, heteroskedasticity test, and model stability test. Serial correlation and heteroskedasticity were investigated using the Breusch-Godfrey LM test and the ARCH-Lagrange Multiplier test, respectively (Bist & Bista, 2018). In these tests, the null hypotheses of no serial correlation and homoskedasticity were tested against the alternative hypotheses of serial correlation and heteroskedasticity. The null hypothesis is not rejected if the probability values are greater than 0.05, which indicates the absence of serial correlation and heteroskedasticity in the model. However, if the probability values are less than 0.05, the null hypothesis is rejected, and this indicates the presence of serial correlation and heteroskedasticity in the model.

The normality test and functional form test, which determine whether the series are normally distributed and the model is correctly specified, respectively, were also conducted. In these tests, the null hypotheses of normal distribution and accurate model specification were tested against the alternative hypotheses of no normal distribution and the model being misspecified. The Jarque-Bera and the Ramsey reset tests were used, respectively. Finally, the plots of cumulative sum and cumulative sum of squares tests were used to determine stability in this paper.

3. Results

This section is primarily a presentation and discussion of the study results. The section contains four subsections; the first and second focus on the descriptive and unit root analysis, respectively, whilst the third and fourth sub-sections contain the optimal lags selections and ARDL estimation with the bounds test (short and long-run estimates).

3.1. Descriptive Statistics

Table 1 shows the descriptive properties, including the minimum, maximum, mean, and standard deviation of each variable. The mean reveals the central tendencies of the data, while the standard deviation demonstrates the level of dispersion of the market returns. The average log of GDPPC for Ghana was 6.520, with a low standard deviation of 0.770. The average personal remittances received over the period were 1.790% of GDP and ranged from 0.010 to 10.085, showing a high degree of volatility, with a standard deviation of 2.541. The government stability index ranged from 5 to 11, with an average of 7.70.

| Variables | Observations |

Mean |

Std. Dev. |

Maximum |

Minimum |

| LGDPPC | 37 |

6.520 |

0.770 |

7.770 |

5.550 |

| REM | 37 |

1.790 |

2.541 |

0.010 |

10.085 |

| GSTAB | 37 |

7.705 |

1.672 |

5.000 |

11.000 |

| INF | 37 |

24.947 |

14.662 |

7.112 |

80.755 |

| FDI | 37 |

3.302 |

2.905 |

0.045 |

9.467 |

| EXCH | 37 |

1.280 |

1.630 |

5.600 |

0.000 |

3.2. Stationarity Analysis

The unit root tests adopted in this study were the Augmented Dickey-Fuller (ADF) and Phillips-Perron (PP) tests. Table 2 presents the results of the ADF and PP unit root tests. The results indicate that, at level, only the inflation rate was stationary. This implies that the changes in the inflation rate were independent of time. The rest of the variables were found not to be stationary at level. The unit root results from the first difference show that all the remaining variables were I (1) or stationary at first difference. Therefore, the log of GDPPC, remittances, government stability, FDI, and exchange rate exhibited unit root properties. These results confirmed that the variables under consideration were a mix of I (1) and I (0) variables. Based on the results of the unit root tests, an ARDL model was specified as the most appropriate form of cointegration to estimate the possible long-run association between the variables.

| Variables | Series | ADF |

PP |

||

C |

C, T |

C |

C, T |

||

| LGDPPC | Level 1st diff |

-0.047(0) -5.145(0)*** |

-1.622(0) -5.156(0)*** |

-0.119(1) -5.153(0)*** |

-1.684(1) -5.163(0)*** |

| REM | Level 1st diff |

2.972(9) -5.691(2)*** |

3.084(9) -3.920(6)** |

-1.412(1) 12.613(25)*** |

-3.272(2)* -23.714(34)*** |

| GSTAB | Level 1st diff |

-1.844(0) -5.881(0)*** |

-1.550(0) -5.882(0)*** |

-1.881(1) -5.869(1)*** |

-1.592(1) -5.868(2)*** |

| INF | Level 1st diff |

-5.117(0)*** -9.036(0)*** |

-5.736(0)*** -5.138(0)*** |

-5.112(2)*** -24.845(34)*** |

-6.133(8)*** -31.334(34)*** |

| FDI | Level 1st diff |

-1.662(0) -4.935(0)*** |

-1.652(0) -4.940(0)*** |

-1.660(0) -4.871(3)*** |

-1.830(1) -4.861(3)*** |

| EXCH | Level 1st diff |

5.034(0) -3.019(0)** |

1.291(0) -4.540(0)*** |

4.613(2) -2.984(3)** |

1.123(1) -4.544(0)*** |

Note: * Significant at the < 0.1 level, ** Significant at the < 0.05 level; *** Significant at the < 0.01 level; Lag and bandwidth order are shown in parenthesis for ADF and PP, respectively. Model with constant and trend. Critical value based on MacKinnon approximate. H0: series is non-stationary. |

3.3. Stationarity Testing with Breaks

Research has shown that unit root tests that do not include structural breaks may be working with misspecified models and thus be biased. This is likely when the data under consideration incorporates economic events capable of causing changes in the parameter estimates (Aue & Horváth, 2013). Therefore, this paper employed the Zivot and Andrews (1992) and Dickey and Fuller (1979) t-test with one level break. The results are presented in Table 3. The results from the unit root tests with a level break provide evidence that structural breaks existed in the series. With the log of GDPPC, both Zivot and Andrews and the Augmented Dickey-Fuller t-test suggested a break point in 2005. Remittances, GDPPC, and inflation were stationary at level with diverse break points. Interestingly, the inflation variable remained stationary with or without a break. The logs of GDPPC and remittances also changed to I (0) variables in the presence of a level break, whilst government stability, FDI, and exchange rate continued to exhibit I (1) properties even with a level break in the model.

| Variables | Zivot and Andrews test |

Dickey-Fuller t-statistic |

||

Statistics |

Break date |

Statistics |

Break date |

|

| LGDPPC | -5.081[7]** |

2005 |

-4.631[0]** |

2005 |

| REM | -5.123[6]** |

2011 |

-2.338[0] |

2010 |

| GSTAB | -3.629[0] |

1995 |

-2.182[0] |

1991 |

| INF | -5.976[0]** |

2006 |

-6.866[0]*** |

2006 |

| FDI | -3.765[8] |

2007 |

-3.237[0] |

2005 |

| EXCH | -3.181[5] |

2006 |

-4.093[9] |

2008 |

Note: ** Significant at the < 0.05 level; *** Significant at the < 0.01 level; Lag and bandwidth order are shown in parenthesis for ADF and PP, respectively. Model with level break and trend. Critical value based on MacKinnon approximate. H0: series is non-stationary. |

3.4. Optimal Lag Selection

The results depicted in Table 4 describe the information criteria for lag-length selection. The Log-likelihood (LL), likelihood ratio (LR), final prediction error (FPE), Akaike’s information criterion (AIC), Schwarz’s Bayesian information criterion (SC), and the Hannan and Quinn information criterion (HQIC) lag-order selection statistics are presented for a series of vector autoregressions. Most of the results showed that the optimal lag length of the dependent variables was 1.

Lag |

LL |

LR |

FPE |

AIC |

SC |

HQIC |

0 |

-292.751 |

NA |

760.0968 |

17.98488 |

18.16627 |

18.04591 |

1 |

-203.293 |

151.8068* |

8.942398* |

13.53291* |

14.43988* |

13.83808* |

2 |

-198.694 |

6.688924 |

18.70957 |

14.2239 |

15.85645 |

14.7732 |

3 |

-190.841 |

9.518806 |

34.68365 |

14.71766 |

17.07579 |

15.5111 |

4 |

-170.959 |

19.28005 |

35.42315 |

14.48235 |

17.56606 |

15.51992 |

Note: * Significant optimal lag. |

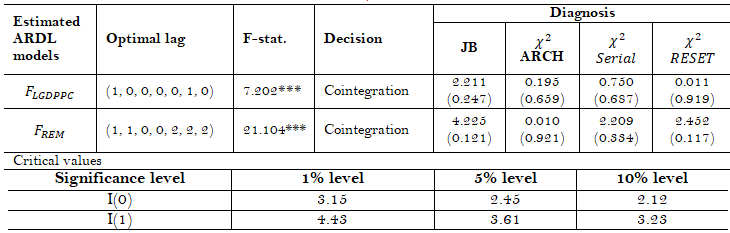

3.4 1. Estimates of ARDL Models and Bounds Test of Cointegration

The results of the structural break incorporated unit root tests provided evidence of structural breaks in the series. As such, the estimation of the cointegrating relationships needed to incorporate the effect of structural breaks. Therefore, taking into account the mixed order of integration of the variables in the form of I (1) and I (0) properties and the evidence of structural breaks, this study used the ARDL approach to cointegration to estimate the long-run relationship between government stability, remittances, and economic growth.

The results in Table 5 show that with the bound tests from both equations, the F-statistics (7.20 and 21.10) are higher than the upper bound critical value of 4.43 at a 1% level of significance. This implies that there exists a cointegration relationship among the variables in the presence of structural breaks. Secondly, the diagnostic statistics indicate that the ARDL model used is data congruent and free from specification errors. The result shows that the error terms are normally distributed (JB test), serially independent (LM test), dynamically stable (Ramsey Test), and exhibit homoskedasticity (ARCH Test). Hence, the relationship between government stability, remittances, and economic growth, based on the ARDL models, does not appear to be spurious.

3.5. ARDL Long-Run Estimates

Having confirmed cointegration among the variables, the long-run parameters were estimated. Table 6 shows the long-run regression estimates when economic growth was the dependent variable, and Table 7 shows the same with remittances as the dependent variable. The results in Table 6 indicate that remittances and government stability had a significant positive effect on economic growth, while inflation had a significant negative relationship with economic growth. In line with theoretical assumptions, FDI had a significant positive relationship with economic growth. The structural break was also significant, showing a significant change in Ghana’s level of economic growth in 2005. The break may be due to the presidential elections that were held in 2004. The results presented in Table 7 indicate that even though economic growth had a positive relationship with remittances, it was not significant. Indeed, when the dependent variable was remittances, the effect did not hold. In fact, no significant long-run impact of GDPPC and government stability on remittances was found. Only the break, constant, and exchange rate were significant.

| Variables | Coefficient |

Std. Error |

t-Statistic |

Prob. |

| REM | 0.179 |

0.003 |

64.827 |

0.010 |

| GSTAB | 0.084 |

0.002 |

51.274 |

0.012 |

| INF | -0.020 |

0.000 |

-51.287 |

0.012 |

| FDI | 0.183 |

0.003 |

55.410 |

0.012 |

| EXCH | 0.595 |

0.008 |

75.347 |

0.008 |

| Break | -0.674 |

0.029 |

-22.920 |

0.028 |

| Constant | 5.637 |

0.015 |

388.730 |

0.002 |

Note: Long-run estimates with L(GDPPC) as the dependent variable. |

| Variables | Coefficient |

Std. Error |

t-Statistic |

Prob. |

| LGDPPC | 0.739 |

0.550 |

1.343 |

0.194 |

| GSTAB | 0.000 |

0.058 |

0.005 |

0.996 |

| INF | -0.005 |

0.007 |

-0.731 |

0.473 |

| FDI | -0.069 |

0.075 |

-0.916 |

0.370 |

| EXCH | 0.421 |

0.140 |

3.016 |

0.007 |

| Break | 3.525 |

0.685 |

5.148 |

0.000 |

| Constant | 6.087 |

4.224 |

1.441 |

0.165 |

Note: Long-run estimates with remittances (REM) as the dependent variable. |

3.6. ARDL Short-Run Estimates

The results of the short-run analysis are reported in Tables 8 and 9. The error correction term was negative and significant (b = -0.15; p <0.001, b = -0.62; p <0.001). This implies that the speed of adjustment to equilibrium after a shock was 15% and 62% in the economic growth and remittances models, respectively. In the short-run analysis with LGDPPC as the dependent variable, remittances were not significantly associated with growth. However, the exchange rate was significant at 10%. The results further revealed that the relationship between inflation and economic growth, as well as that between inflation and remittances, was negative.

| Variables | Coefficient |

Std. Error |

t-Statistic |

Prob. |

| D(REM) | 0.012 |

0.021 |

0.577 |

0.568 |

| D(GSTAB) | -0.012 |

0.038 |

-0.315 |

0.755 |

| D(EXCH) | -0.283 |

0.160 |

-1.770 |

0.087 |

| D(FDI) | 0.034 |

0.025 |

1.388 |

0.175 |

| D(IN) | -0.004 |

0.002 |

-2.610 |

0.014 |

| Break | 0.736 |

0.084 |

8.721 |

0.000 |

| EC1(-1) | -0.152 |

0.019 |

-7.850 |

0.000 |

| R-squared | 0.695 |

|||

| Adjusted R-squared | 0.677 |

|||

| F-statistic | 37.636 |

|||

| Prob(F-statistic) | 0.000 |

|||

| Durbin-Watson stat | 1.954 |

Note: Short-run estimates with D(LGDPPC) as the dependent variable. |

| Variables | Coefficient |

Std. Error |

t-Statistic |

Prob. |

| D(LGDPPC) | 0.012 |

0.021 |

0.577 |

0.568 |

| D(GSTAB) | -0.154 |

0.092 |

-1.679 |

0.113 |

| D(EXCH) | 1.671 |

0.521 |

3.208 |

0.004 |

| D(FDI) | 0.185 |

0.066 |

2.797 |

0.011 |

| D(INF) | -1.436 |

0.104 |

-13.856 |

0.000 |

| Break | -2.413 |

0.686 |

-3.517 |

0.003 |

| EC1(-1) | -0.616 |

0.057 |

-10.715 |

0.000 |

| R-squared | 0.935 |

|||

| Adjusted R-squared | 0.915 |

|||

| F-statistic | 46.669 |

|||

| Prob(F-statistic) | 0.000 |

|||

| Durbin-Watson stat | 2.117 |

Note: Short-run estimates with remittances D(REM) as the dependent variable. |

3.7. Stability Plots

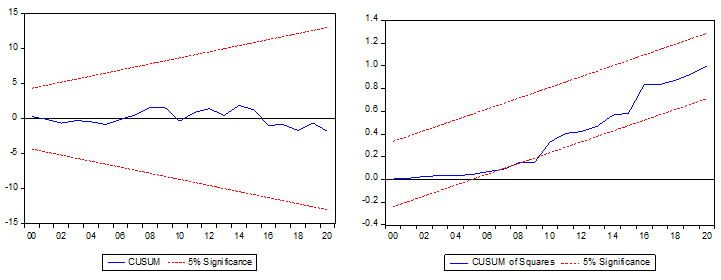

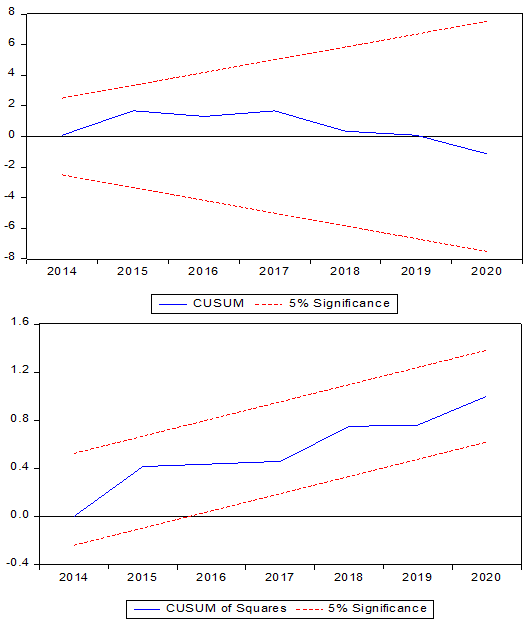

In the study, the Cumulative Sum (CUSUM) of Recursive Residuals and Cumulative Sum of Square (CUSUMSQ) of Recursive Residuals stability tests were performed. Figures 1 and 2 are the CUSUM and CUSUMSQ plots for the GDPPC and remittances models, respectively. They show that the plots of the CUSUM and CUSUMSQ statistics are well within critical bounds, implying that both models are stable over time.

Figure 1. CUSUM and CUSUMSQ plots for the economic growth (GDPPC) model.

Figure 2. CUSUM and CUSUMSQ plots for the remittances model.

4. Discussion of the Results

The findings show that remittances do not have a significant impact on economic growth. As such, when remittances increase, economic growth does not respond in the short run. This result contradicts the findings of Nomor and Iorember (2017) and Jawaid and Raza (2012), who found a positive and significant short-run relationship between remittances and economic growth, and Oshota and Badejo (2015), who found that remittances had a significant negative relationship with output in the short run. The negative association may be attributable to the fact that a significant number of remittances are channeled toward non-productive uses, and the motive behind remitting to the home country is mostly altruistic rather than profit-driven. Alkhathlan (2013) similarly found a negative and significant relationship between remittances and economic growth.

However, in the long run, remittances were found to make a positive and significant contribution to economic growth, although the reverse is not the case for the hypothesis that economic growth impacts remittances. Remittances boost the balance of payments and increase national income (Pandikasala, Vyas, & Mani, 2022). In Ghana, received remittances are used in several ways that contribute to economic growth, for instance, through the financing of projects such as the building of houses, consumption in the local economy, and launching entrepreneurial ventures. Remittances ensure financial inclusion through their receiving channels, such as bank accounts and mobile money services. Moreover, remittances contribute significantly to poverty reduction and income equality (Apatinga, Asiedu, & Obeng, 2022). Policymakers must therefore put mechanisms and strategies in place to increase the flow of remittances into Ghana. These strategies may include reducing transaction or transfer costs, strengthening the formal financial infrastructures, and improving access to financial services (Adenutsi, 2011). The government should also focus on educating citizens on how to channel received remittances into productive use.

Government stability was found to have a positive relationship with economic growth in the long run (Yeboua, 2021), but an insignificant relationship with growth in the short run. The insignificant relationship could be attributable to the fact that although a country may be stable with respect to its government, when this stability is within the premise of bad governance, the stability will not have a positive impact on economic growth. In the long run, government stability promotes the necessary conditions for development, allowing a government to execute its developmental projects and implement developmental policies to foster economic growth. When the governance of a state is unstable, its resources are often usurped by organized criminals, terrorists, and other political groups. This is often accompanied by destabilization of the economy and sometimes by violence, reduction in welfare, and hence per capita growth for the population (United States Institute of Peace, 2021).

FDI has a positive association with economic growth, as evidenced by the findings of Tee, Larbi, and Johnson (2017), who concluded that increased FDI inflows have significantly increased Ghana’s GDP. It not only stimulates capital formation but also improves the quality of the country's social capital. This is consistent with Zekarias (2016), who concluded that FDI was a key driver of economic growth and a catalyst of economic conditional convergence in Eastern Africa, meaning that the sub-region needed to attract more FDI by improving its investment environment, strengthening regional integration, developing human capital and basic infrastructures, and promoting export-oriented investment. However, Laurance (2017) found that FDI had a negative impact on economic growth in West Africa in the short run, and Dinh, Vo, The Vo, and Nguyen (2019) likewise concluded that FDI had a negative impact on economic growth.

The existing literature largely supports the claim that FDI is a key factor in nations’ economic growth and development and needs to be encouraged. FDI contributes to employment creation, and thus increases the productivity in the host country. This is because when FDI increases, there are also increased demands on the labour force, which facilitates the exchange of skills. To encourage FDI, Ghana needs to reduce restrictions thereon, provide investors with tax incentives, and encourage education among citizens so that they can gain skills; also, resources should be made more affordable to investors.

The exchange rate was shown to have a significant and positive association with both economic growth and remittances in Ghana in the period under study. Additionally, inflation had a negative relationship with economic growth as evidenced by its negative coefficient. This means that when inflation increases, economic growth will decrease. This is consistent with Kasidi and Mwakanemela (2013), who concluded that inflation had been harmful to economic growth in Tanzania in the short run. However, other studies disagree with this suggestion. Ahmad and Joyia (2012) concluded that there was a positive relationship between inflation and economic growth in Pakistan and that inflation boosted productivity and output levels. Inflation can be reduced by tightening fiscal policy, raising interest rates, and encouraging competition in the market by ensuring an open market to increase supply and lower prices. Generally, higher inflation rates hurt Ghana’s economic growth.

5. Policy Implications

Received remittances must be put into productive use. The government needs to formulate policies that help educate citizens on how to direct remittances towards productive ventures, such as entrepreneurship, the expansion of existing businesses, and investment in other financial securities. There must be mechanisms and structures to ensure that remittances pass through formal channels that will route them through the country’s financial system. In Ghana, as in many economies marked by informality, a sizeable amount of received remittances are channeled into the country through unapproved routes, which makes the measurement of remittances quite difficult and inaccurate.

Government stability in the form of good governance needs to be ensured. The government must make timely and feasible development plans and execute them. In addition, policies should not be politicized but implemented progressively to ensure the smooth and continuous development of the country. Governments should not take advantage of the current stable environment to exploit the citizenry. To ensure government stability and hence good governance, a government should avoid complacency, be held accountable for every action they take, and should be made to bear the consequences of their actions.

The study results point to the fact that the channels of remittances to receiving countries could be a factor affecting the flow of remittances. Further studies should be conducted in that area as well as on the determinants of remittances. Lastly, it would be interesting to extend this study to other countries in Africa and other emerging economies to examine the associations between these variables in a wider locational context.

References

Adams, S., & Klobodu, E. K. M. (2016). Remittances, regime durability and economic growth in Sub-Saharan Africa (SSA). Economic Analysis and Policy, 50, 1-8.Available at: https://doi.org/10.1016/j.eap.2016.01.002.

Adenutsi, D. E. (2011). Financial development, international migrant remittances and endogenous growth in Ghana. Studies in Economics and Finance, 28(1), 68-89.Available at: https://doi.org/10.1108/10867371111110561.

Agbegha, V. O. (2006). Does political instability affect remittance flows? , Doctoral Dissertation.

Agyei, S. A. (2021). The dynamics of remittances impact: A mixed-method approach to understand Ghana’s situation and the way forward. Social Sciences, 10(11), 1-21.Available at: https://doi.org/10.3390/socsci10110410.

Ahmad, N., & Joyia, U.-T. S. (2012). The relationship between inflation and economic growth in Pakistan: An econometric approach. Asian Journal of Research in Business Economics and Management, 2(9), 38-48.

Aisen, A., & Veiga, F. J. (2013). How does political instability affect economic growth? European Journal of Political Economy, 29, 151-167.Available at: https://doi.org/10.1016/j.ejpoleco.2012.11.001.

Aisen, A., & Veiga, F. J. (2011). IMF working paper: How does government instability affect economic growth. International Monetary Fund Working Paper, No. WP/11/12.

Akpa, E. (2018). Private remittances received and household consumption in Ghana (1980-2016): An ARDL analysis with structural breaks. International Journal of Management and Economics Invention, 4(5), 1771-1777.Available at: https://doi.org/10.31142/ijmei/v4i5.10.

Alkhathlan, K. A. (2013). The nexus between remittance outflows and growth: A study of Saudi Arabia. Economic Modelling, 33, 695-700.Available at: https://doi.org/10.1016/j.econmod.2013.05.010.

Apatinga, G. A., Asiedu, A. B., & Obeng, F. A. (2022). The contribution of non-cash remittances to the welfare of households in the Kassena-Nankana District, Ghana. African Geographical Review, 41(2), 214-225.Available at: https://doi.org/10.1080/19376812.2020.1870511.

Armah, S. E. (2010). Does political stability improve the aid-growth relationship? A panel evidence on selected Sub-Saharan African countries. African Review of Economics and Finance, 2(1), 54-76.

Aue, A., & Horváth, L. (2013). Structural breaks in time series. Journal of Time Series Analysis, 34(1), 1-16.Available at: https://doi.org/10.1111/j.1467-9892.2012.00819.x.

Bai, J., & Perron, P. (2003). Computation and analysis of multiple structural change models. Journal of Applied Econometrics, 18(1), 1-22.

Barajas, A., Chami, R., Fullenkamp, C., Gapen, M. T., & Montiel, P. J. (2009). Do workers’ remittances promote economic growth? Working Paper, WP/09/153. Washington DC: International Monetary Fund.

Bist, J. P., & Bista, N. B. (2018). Finance–growth nexus in Nepal: An application of the ARDL approach in the presence of structural breaks. Vikalpa, 43(4), 236-249.

Bonsu, C. O., & Muzindutsi, P.-F. (2017). Macroeconomic determinants of household consumption expenditure in Ghana: A multivariate cointegration approach. International Journal of Economics and Financial Issues, 7(4), 737-745.Available at: https://doi.org/10.3390/economies7040096.

Bruinshoofd, A. (2016). Institutional quality and economic performance. (No. 1/22). Rabobank Economic Research. Retrieved from: https://economics.rabobank.com/publications/2016/january/institutional%2Dquality%2Dand%2Deconomic%2Dperformance/.

Catrinescu, N., Leon-Ledesma, M. A., Piracha, M. E., & Quillin, B. (2009). Remittances, institutions and economic growth. World Development, 37(1), 81-92.Available at: https://doi.org/10.1016/j.worlddev.2008.02.004.

Cazachevici, A., Havranek, T., & Horvath, R. (2020). Remittances and economic growth: A meta-analysis. World Development, 134, 105021.Available at: https://doi.org/10.1016/j.worlddev.2020.105021.

Chami, M. R., Montiel, M. P. J., Abdih, M. Y., & Dagher, J. (2008). Remittances and institutions: Are remittances a curse? IMF Working Papers 2008/029, International Monetary Fund.

Chami, R., Fullenkamp, C., & Samir, J. (2003). Are immigrant remittance flows a source of capital for development? IMF Working Paper No. WP/03/189.

Chitambara, P. (2019). Remittances, institutions and growth in Africa. International Migration, 57(5), 56-70.Available at: https://doi.org/10.1111/imig.12542.

Combes, J. L., & Ebeke, C. (2011). Remittances and household consumption instability in developing countries. World Development, 39(7), 1076-1089.

Coppola, M. S. (2020). Three essays on the human and social capital effects and entrepreneurial firm performance. Doctoral Dissertation, Clemson University.

Das, A., McFarlane, A., & Jung, Y. C. (2019). Remittances and GDP in Jamaica: An ARDL bounds testing approach to cointegration. International Economic Journal, 33(2), 365-381.Available at: https://doi.org/10.1080/10168737.2019.1597144.

Dickey, D. A., & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74(366a), 427-431.Available at: https://doi.org/10.2307/2286348.

Dinh, T. T.-H., Vo, D. H., The Vo, A., & Nguyen, T. C. (2019). Foreign direct investment and economic growth in the short run and long run: Empirical evidence from developing countries. Journal of Risk and Financial Management, 12(4), 1-11.Available at: https://doi.org/10.3390/jrfm12040176.

Dowding, K. M., & Kimber, R. (1983). The meaning and use of ‘government stability. European Journal of Government Research, 11(3), 229-243.

Esener, S. C., & İpek, E. (2018). The impacts of public expenditure, government stability and corruption on per capita growth: An empirical investigation on developing countries. Sosyoekonomi, 26(36), 11-32.Available at: https://doi.org/10.17233/sosyoekonomi.2018.02.01.

Fayissa, B., & Nsiah, C. (2010). The impact of remittances on economic growth and development in Africa. The American Economist, 55(2), 92-103.Available at: https://doi.org/10.1177/056943451005500210.

Feng, G. F., Wang, Q. J., Chu, Y., Wen, J., & Chang, C. P. (2021). Does the shale gas boom change the natural gas price-production relationship? Evidence from the US market. Energy Economics, 93, 104327.Available at: https://doi.org/10.1016/j.eneco.2019.03.001.

Ferdaous, J. (2016). Impact of remittances and FDI on economic growth: A panel data analysis. Journal of Business Studies Quarterly, 8(2), 58.

Gebe, B. Y. (2008). Ghana’s foreign policy at independence and implications for the 1966 Coup D’état. The Journal of Pan African Studies, 2(3), 160-186.

Ghatak, S., & Siddiki, J. U. (2001). The use of the ARDL approach in estimating virtual exchange rates in India. Journal of Applied statistics, 28(5), 573-583.Available at: https://doi.org/10.1080/02664760120047906.

Gjini, A. (2013). The role of remittances on economic growth: An empirical investigation of 12 CEE countries. International Business & Economics Research Journal (IBER), 12(2), 193-204.Available at: https://doi.org/10.19030/iber.v12i2.7631.

Goschin, Z. (2014). Remittances as an economic development factor. Empirical evidence from the CEE countries. Procedia Economics and Finance, 10, 54-60.Available at: https://doi.org/10.1016/s2212-5671(14)00277-9.

Gregory, A. W., & Hansen, B. E. (1996). Practitioners corner: Tests for cointegration in models with regime and trend shifts. Oxford Bulletin of Economics and Statistics, 58(3), 555-560.Available at: https://doi.org/10.1111/j.1468-0084.1996.mp58003008.x.

Hatemi-J, A. (2008). Tests for cointegration with two unknown regime shifts with an application to financial market integration. Empirical Economics, 35(3), 497-505.

Hellström, J., & Walther, D. (2019). How is government stability affected by the state of the economy? Payoff structures, government type and economic state. Government and Opposition, 54(2), 280-308.Available at: https://doi.org/10.1017/gov.2017.21.

Hussain, Z. (2014). Can political stability hurt economic growth (pp. 06-06). Submitted to World Bank Reports on.

ICRG. (2020). International country risk guide (ICRG) Researchers Dataset. Retrieved from: https://doi.org/10.7910/DVN/4YHTPU, Harvard Dataverse, V9, UNF:6:UsSrUAVgGhE1GXc/I94ckg== [fileUNF].

Im, K. S., Lee, J., & Tieslau, M. (2010). Panel LM unit root tests with trend shifts. Available at https://ssrn.com/abstract=1619918 or http://dx.doi.org/10.2139/ssrn.1619918.

Jawaid, S. T., & Raza, S. A. (2012). Workers' remittances and economic growth in China and Korea: An empirical analysis. Journal of Chinese Economic and Foreign Trade Studies, 5(3), 185-193.Available at: https://doi.org/10.1108/17544401211263946.

Jewel, F. R. (2015). Political stability, foreign direct investment and remittance inflow in Bangladesh: An empirical analysis.

Kasidi, F., & Mwakanemela, K. (2013). Impact of inflation on economic growth: A case study of Tanzania. Asian Journal of Empirical Research, 3(4), 363-380.

Kwasi, D.-B. (2015). Political leadership in Ghana: 1957 to 2010. African Journal of Political Science and International Relations, 9(2), 49-61.Available at: https://doi.org/10.5897/ajpsir2014.0730.

Laurance, T. (2017). The effect of remittances and foreign direct investment on economic growth in Jordan. Doctoral Dissertation.

Lee, J., & Strazicich, M. C. (2004). Minimum LM unit root test with one structural break. Appalachian State University Working Papers, 04/17, 1-15.

Makinde, T. (2005). Problems of policy implementation in developing nations: The Nigerian experience. Journal of Social Sciences, 11(1), 63-69.Available at: https://doi.org/10.1080/09718923.2005.11892495.

Meyer, D., & Shera, A. (2017). The impact of remittances on economic growth: An econometric model. EconomiA, 18(2), 147-155.Available at: https://doi.org/10.1016/j.econ.2016.06.001.

Nketiah, E., Adjei, M., Boamah, B. B., & Adu-Gyamfi, G. (2019). The impact of remittance on the real exchange rate in Ghana. Open Journal of Business and Management, 7(4), 1862-1879.Available at: https://doi.org/10.4236/ojbm.2019.74128.

Nomor, T. D., & Iorember, P. T. (2017). Political stability and economic growth in Nigeria. IOSR Journal of Economics and Finance, 8(2), 45-53.Available at: https://doi.org/10.9790/5933-0802034553.

Nyeadi, J. D., & Atiga, O. (2014). Remittances and economic growth: Empirical evidence from Ghana. European Journal of Business and Management, 6(25), 142-149.

Ogunniyi, A. I., Mavrotas, G., Olagunju, K. O., Fadare, O., & Adedoyin, R. (2020). Governance quality, remittances and their implications for food and nutrition security in Sub-Saharan Africa. World Development, 127, 104752.Available at: https://doi.org/10.1016/j.worlddev.2019.104752.

Oshota, S. O., & Badejo, A. A. (2015). Impact of remittances on economic growth in Nigeria: Further evidence. Economics Bulletin, 35(1), 247-258.

Oteng-Abayie, E. F., Awuni, P. A., & Adjeidjei, T. K. (2020). The impact of inward remittances on economic growth in Ghana. African Journal of Economic Review, 8(3), 49-65.

Page, B., & Mercer, C. (2012). Why do people do stuff? Reconceptualizing remittance behaviour in diaspora-development research and policy. Progress in Development Studies, 12(1), 1-18.

Pandikasala, J., Vyas, I., & Mani, N. (2022). Do financial development drive remittances? Empirical evidence from India. Journal of Public Affairs, 22(1), e2269.Available at: https://doi.org/10.1002/pa.2269.

Perez-Saiz, H., Dridi, M. J., Gursoy, T., & Bari, M. (2019). The impact of remittances on economic activity: The importance of sectoral linkages: International Monetary Fund.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289-326.Available at: https://doi.org/10.1002/jae.616.

Pesaran, B., & Hashem, P. M. (1995). A non-nested test of level-differenced versus log-differenced stationary models. Econometric Reviews, 14(2), 213-227.Available at: https://doi.org/10.1080/07474939508800316.

Pesaran, M., & Shin, Y. (1995). An autoregressive distributed lag modelling approach to cointegration analysis: Faculty of Economics, University of Cambridge.

Phillips, P. C., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75(2), 335-346.

Siaw, K. E. (2015). Change and continuity in Ghana’s foreign policy: Focus on economic diplomacy and good neighbourliness under rawlings and Kufuor. Doctoral Dissertation, University of Ghana.

Tee, E., Larbi, F., & Johnson, R. (2017). The effect of foreign direct investment (FDI) on the Ghanaian economic growth. Journal of Business and Economic Development, 2(5), 240-246.

Twumasi-Ampofo, K., Osei-Tutu, E., Decardi-Nelson, I., & Ofori, P. A. (2014). A model for reactivating abandoned public housing projects in Ghana.

United States Institute of Peace. (2021). Stable governance. Retrieved from: https://www.usip.org/guiding-principles-stabilization-and-reconstruction-the-web-version/stable-governance.

WDI. (2021). Personal remittances of Ghana. World Development Indicators Retrieved from: https://databank.worldbank.org/source/world-development-indicators.

Westerlund, J. (2006). Testing for panel cointegration with multiple structural breaks. Oxford Bulletin of Economics and Statistics, 68(1), 101-132.Available at: https://doi.org/10.1111/j.1468-0084.2006.00154.x.

World Bank. (2016). Personal remittances. World development indicators. Retrieved from: http://data.worldbank.org/indicator/BX.TRF.PWKR.CD.DT.

World Bank. (2019). Personal remittances. World development indicators. Retrieved from: http://data.worldbank.org/indicator/BX.TRF.PWKR.CD.DT.

Yeboua, K. (2021). Foreign direct investment and economic growth in Africa: New empirical approach on the role of institutional development. Journal of African Business, 22(3), 361-378.Available at: https://doi.org/10.1080/15228916.2020.1770040.

Yerrabati, S., & Hawkes, D. (2015). Economic governance and economic growth in South and East Asia & pacific region: Evidence from systematic literature reviews and metaanalysis. Advances in Economics and Business, 3(1), 1-21.Available at: https://doi.org/10.13189/aeb.2015.030101.

Yohou, H. D., Goujon, M., & Ouattara, W. (2016). Heterogeneous aid effects on tax revenues: Accounting for government stability in WAEMU countries. Journal of African Economies, 25(3), 468-498.Available at: https://doi.org/10.1093/jae/ejw003.

You, K., & Sarantis, N. (2013). Structural breaks, rural transformation and total factor productivity growth in China. Journal of Productivity Analysis, 39(3), 231-242.

Zekarias, S. M. (2016). The impact of foreign direct investment (FDI) on economic growth in Eastern Africa: Evidence from panel data analysis. Applied Economics and Finance, 3(1), 145-160.Available at: https://doi.org/10.11114/aef.v3i1.1317.

Zivot, E., & Andrews, D. W. K. (1992). Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. Journal of Business & Economic Statistics, 20(1), 251-270.