International Commodity Price and Economy Growth: Panel Data Analysis in Sub- Saharan Africa

Mohamed Ben Omar Ndiaye1

Ebrima K. Ceesay2*

Yahaya M. Moussa3

1University Cheikh Anta Diop, Dakar, Senegal. |

AbstractIn the theoretical literature, the relationship between primary producer commodity prices and economic change has been confirmed. Therefore, this paper examines sub-Saharan African countries’ experiences pertaining to commodity price variation. The main purpose of this article is to examine the impact of commodity price instability in sub-Saharan Africa. To do so, panel data models are used to solve the problems of unobserved variables. The results reveal that the current growth of commodity prices has a positive effect on the growth of the economy. However, the logs of the lags and logs of the leads of the commodity price have negative impacts on the growth of the economy. That means that commodity price variations will continue to harm the economies of sub-Saharan African countries. |

Licensed: |

|

Keywords: JEL Classification |

|

Received: 18 May 2022 |

Funding: This study received no specific financial support. |

Competing Interests:The authors declare that they have no competing interests. |

1. Introduction

Fluctuations in the international primary commodity price have affected many African countries. This fluctuation imposes serious challenges for policymakers when trying to boost economic growth and development. Therefore, the comparative advantage they obtain from primary commodities such as the export of oil, mineral, and agricultural products when accessing the international financial markets for their investment projects has become problematic (Deaton, 1999). According to Blattman, Hwang, and Williamson (2007), countries that experience commodity price variation tend to grow slowly. In fact, according to Sachs and Warner (1999), the commodities price boom has been perceived as a source of laziness, leading African countries to delay their development because they became dependent on commodities and consequently abandoned their industrialization efforts. This dependence was noticed in the 1980s when the commodities price collapsed causing an estimated decrease of 40% to 60% in real purchase power for many economies (Dutch syndrome). Poor performance in the long term has been explained in the literature by corruption, overconfidence, misjudgment of impending risk, over-commitment to projects leading to debt, poor fiscal arrangements with no long-term investment to reap benefits, and a lack of diversity. Therefore, this analysis shows conclusively that commodity price booms can be either a ‘curse’ or a ‘blessing’ to economic growth Sala-i-Martin (2003); Raddatz (2007). The evidence from Africa has shown that commodities price volatility positively affects economic growth Addison and Ghoshray (2013); Jayne, Chamberlin, Benfica, Jayne, and Chamberlin (2018). However, Tiawara (2015) concluded that the effects of commodity price volatility on economic growth were inconclusive but were more likely to benefit than hurt the economy. Collier and Goderis (2012) found that an increase in commodity price only had a positive impact on production in the short term but the long-term effects were negative. Indeed, commodity price volatility induces fluctuations in real national incomes, making macroeconomic management challenging (Deaton & Miller, 1996). On the other hand, however, Bleaney and Greenaway (2001) found that trade volatility and economic growth were negatively correlated.

Our study examines evidence from sub-Saharan Africa by exploring the effects of international commodities prices using panel data analysis from 35 sub-Saharan African countries from 2000 to 2018. The specific question we address is the impact of commodity price instability on countries’ economic growth. The main contribution of this paper is in the different panel data models that were used to identify which produced biased results, which produced unbiased results, and which produced constant results. The study differs from most previous research on the impact of commodity price instability in Africa in three ways. First, we selected 35 countries in sub-Saharan Africa and selected the one commodity on which each was the most dependent. Secondly, we used the lag, no lag, and lead of the variables of primary producer commodity price and the economic progress nexus, as well as other control variables, to understand how commodity price affected sub-Saharan Africa in the past, present, and future. Thirdly, we used panel data fixed effects to understand the factors behind this impact.

2. Literature Review

The relationship between commodity price and economic growth is theoretically underpinned by the Prebisch-Singer hypothesis, according to which, in the long run, the price of primary goods declines relative to that of manufactured goods. This means that economies that depend on the primary good may lose out due to a reduction in the relative price of exports compared to imports. This implies that an increase in revenue may temporarily occur as a result of an increase in world commodity prices but that this price change might lead to economic instability. However, the Prebisch-Singer hypothesis is valid when economies are less developed. Indeed, when the prices of primary products fall, the cost of production falls also, meaning that the profits, producer surplus, and wealth of the country grow and increase the benefits gained from the primary production of the commodity and trade. Falling costs can conceivably offset the adverse effects of lower prices and declining terms of trade for the primary producers of commodities (Tilton, Humphreys, & Radetzki, 2012). The application of this hypothesis in African countries has been highlighted by Arezki, Hadri, Loungani, and Rao (2014), who studied 25 primary commodity prices over the period 1900 to 2005. Their results revealed that all the series are stationary after allowing for endogenous multiple break points. Likewise, Cavalcanti, Mohaddes, and Raissi (2012) explored commodity price volatility and the economic growth of 118 countries utilizing the General Method of Moments and augmented varieties of the pooled mean group estimator. They showed that the trade volatility of commodity prices affects production growth negatively. Collier and Goderis (2012) examined the relationship between commodity prices and growth in selected African countries using the vector autoregressive method. They discovered that increases in commodity prices significantly boosted the growth of primary commodity exporters in African countries. Moreover, Deaton (1999) investigated the impact of commodity prices on economic growth in 35 African economies using the ordinary least squares and vector autoregressive models and showed that commodity prices negatively affected economic growth in Africa. Additionally, Jayne et al. (2018) showed that periods of high global commodity prices were one of the main drivers of Africa’s economic transformations, guaranteeing economic growth.

Of the few studies addressing the relationship between commodity prices and economic growth in sub-Saharan Africa, Mputu (2016) found a positive and significant relationship between terms of trade and GDP per capita. Also, Addison, Ghoshray, and Stamatogiannis (2016) revealed that very little evidence exists for the effect of positive or negative agricultural price shocks on per capita economic growth. Furthermore, by examining the impact of terms of trade on Namibia’s economy using data from 1980 to 2012 projected using the vector autoregressive (VAR) model, Kalumbu and Sheefeni (2016) highlighted that non-renewable natural resources are depleted over time. Consequently, in the long run, natural resources-dependent economies might have a trade deficit that reduces economic growth. This is highlighted by the trade theories that suggest that economic growth may lead to a country being worse off than before the growth. Called immiserizing growth, this is a long-term phenomenon that occurs when the gain in a country’s social welfare arising from economic growth is more than offset by the loss in such welfare associated with an adverse shift in the terms of trade (Bhagwati, 1958). Additionally, in South Africa, Ntshwe and Garidzirai (2021) revealed that commodity prices and trade openness increase economic growth when all other things are held constant by employing the Johansen co-integration method and Vector Error Correction Model (VECM) to data from 1984 to 2019.

This study differs from the abovementioned prior research in terms of the number of countries (35) and the number of commodities investigated per country (one per country), the lag, no lag, and lead of the variables of primary producer commodity price, and the control variables including trade, gross capital formation, real effective exchange rate index, Agricultural raw materials exports, CPIA property rights and rule-based governance rating, exports of goods and services, imports of goods and services, energy use, coal rents, natural gas rents, ore and metal exports, electricity production from natural gas sources, inflation, consumer prices index, crop names, and commodity prices.

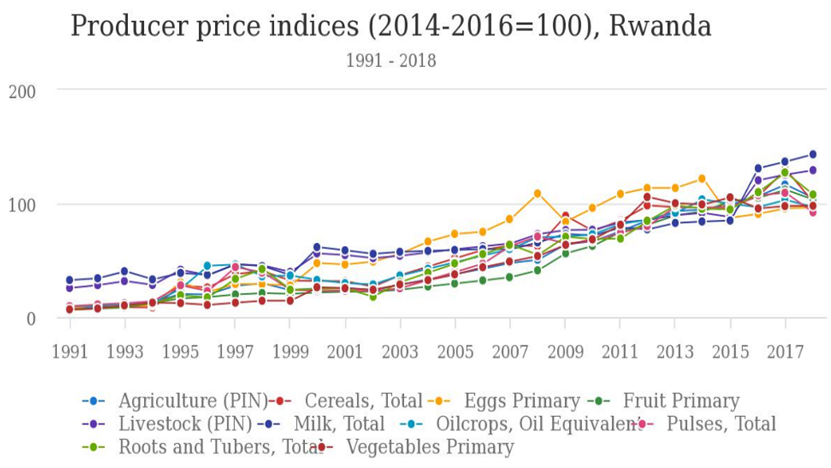

3. Methodology

This study explored the case of sub-Saharan Africa by investigating the effects of international commodities prices using panel data analysis of data from 2000 to 2018 obtained from FAOSTAT. It considered 35 sub-Saharan African countries with their GDP in current U.S. dollars as the dependent variable. Also, this paper used the model previously applied by Collier and Goderis (2012); Daron, Johnson, Robinson, and Yared (2001); Ceesay, Belford, Fanneh, and Drammeh (2019); Menegaki (2011); Fowowe (2016); Belford, Huang, Ceesay, Ahmed, and Jonga (2020) and Rafiq and Bloch (2016). The contribution of this paper is in its use of different panel data models, such as fixed effect, random effect, and pooled Ordinary Least Squares (OLS), which were used to identify which ones had biased results, which had unbiased results, which method was a combination of all-biased and unbiased, and which obtained constant results.

3.1. The Countries, Years, and Variables Selected

This study used annual data over the period 2000 to 2018 from 35 sub-Saharan African countries, specifically, Angola, Benin, Botswana, Burundi, Cameroon, Central African Republic, the Democratic Republic of the Congo, the Republic of the Congo, Cote d’Ivoire, Equatorial Guinea, Eritrea, Ethiopia, Gabon, Gambia, Ghana, Guinea, Guinea Bissau, Kenya, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritania, Mauritius, Mozambique, Namibia, Niger, Nigeria, Rwanda, Senegal, Sierra Leone, South Africa, Togo, Zambia, and Zimbabwe. The data were collected from FAOSTAT. Our dependent variable was GDP per capita in current U.S. dollars. The explanatory variable of primary interest was the producer commodity price based on the commodities of bananas, cassava, maize, chicken meat, palm oil, potatoes, millet, rice, yams, green coffee, dry beans, mangoes, guavas, tomatoes, cotton lint, dry onions, and sorghum. These commodities were selected according to their volume as the country's main commodity export. The variables of Trade (% of GDP) - Trade, Gross capital formation (current US$) - GCF, Real effective exchange rate - REER, Agricultural raw materials exports (% of merchandise exports) - AGRME, CPIA property rights and rule-based governance rating (1=low to 6=high) - GOVN, Exports of goods and services (BoP, current US$) - EGS, Imports of goods and services (BoP, current US$) - IMGS, GDP (current US$) - GDP Current, Energy use (kg of oil equivalent per capita) - EGU, Coal rents (% of GDP) - COALRT, Natural gas rents (% of GDP) - NGASRT, Ore and metal exports (% of merchandise exports) - OME, Electricity production from natural gas sources (% of total) - ELCNGAS, and Inflation consumer prices index (annual %) - I - were the control variables.

3.2.Theoretical Model

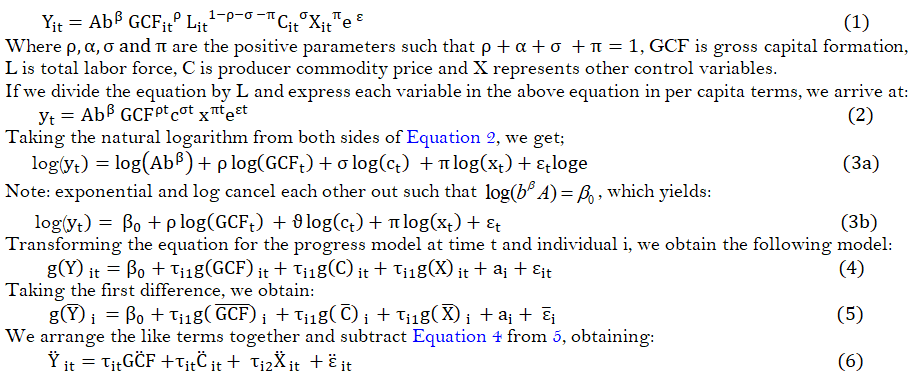

The theoretical relationship between commodity price variability and economic growth in sub-Saharan African countries is based on the neoclassical growth model proposed by Solow, which is connected to the Keynesian national income identity model through the Cobb-Douglas function. The Cobb-Douglas production function for the effect of international commodities prices on economic progress in sub-Saharan African countries is presented as follows:

This is the fixed effect transformation. The unobserved factors in our model disappear. This suggests we should evaluate the model using pooled OLS. The pooled OLS estimator grounded on time demeaned variables is called the fixed effect estimator or within estimator.

The GDP is a function of domestic absorption and trade (% of GDP).

Where YDA is national savings, private and public; I is private domestic investment; r is the real interest rate; y is domestic output; REER is the real effective exchange rate.

Trade does not always balance, consequently ![]() . The reaction of export to the REER rests on the supply reaction. In most sub-Saharan African countries, the supply reaction is feeble, causing the REER elasticity of the export supply to be inelastic and the price elasticity of export to be almost perfect.

. The reaction of export to the REER rests on the supply reaction. In most sub-Saharan African countries, the supply reaction is feeble, causing the REER elasticity of the export supply to be inelastic and the price elasticity of export to be almost perfect.

4. Results

Few previous studies have employed panel data models, such as fixed and random effects models, to discover the relationship between commodity price and economic growth in Africa. Most studies tend to employ panel VAR and Granger causality tests. This study, however, employed a panel data model to account for the countries' unobserved fixed effect and random error terms. The results, as shown in Table 1, revealed that currently, an increase in the commodity price has a positive influence on the economic growth of the 35 sub-Saharan African countries we studied. However, according to the random effect models, the lags and leads have negative impacts on the progress of the economy. We attribute this to bad governance, poor institutions, exchange rate fluctuations, high inflation, failures in informal sectors, corruption, conflict, and a lack of regulation to monitor changing market prices for the various commodities we used in this study. Commodities can be an important determinant of a country’s growth and prosperity. Deaton (1999), for instance, demonstrated how a plant such as cotton might bring wealth to a few, but poverty to many due to bad governance. Tiawara (2015) used panel fixed effect estimation to study how commodity prices affected African economic welfare for 49 African countries from 1994 to 2014; however, the results were unconvincing, and the estimates of the effects of commodity prices on growth in Africa were statistically insignificant. This study did not manage to elucidate the persistent problems commodity prices have caused in the past and are expected to cause in the future unless policy interventions are imposed. Deaton and Miller (1996) empirically studied the costs of commodity price booms in a cross-segment of African countries and challenged the conventional wisdom that commodity price booms are so damaging because they are mishandled. The results for commodity prices and other control variables showed positive effects on economic progress in the present day, although, in the future, increasing commodity prices may hurt the progress of sub-Saharan African countries due to bad governance and climate change effects. Nevertheless, the empirical evidence regarding the impact of natural resource prices on economic growth is mixed, with some studies confirming (Sachs & Warner, 1999) the result that they have a negative effect on growth, such as Rodriguez and Sachs (1999), Gylfason, Herbertsson, and Zoega (1999), and Brunnschweiler, Bulte, Technische, and Zürich (2006), among others. On the other hand, a growing number of papers provide evidence against the resource curse hypothesis (Alexeev & Conrad, 2009; Brunnschweiler & Bulte, 2008). This is the case for the results of the current study, in which the random effect model was shown to be more appropriate for the analysis. The results further reveal that the logs of the lags and the logs of the lead of the commodity price have reduced the economic growth of sub-Saharan African countries. The results of our study also confirmed that other control variables, including the log of agricultural raw materials exports and the log of electricity production from natural gas sources, have a significant negative impact on the log of economic progress in the sub-Saharan African countries.

Table 1. Results of the fixed effect, random effect, and pooled OLS models applied in 35 sub-Saharan African countries from 2000 to 2018 on the log of economic progress. |

| Variables | Pooled OLS |

Fixed effect |

Random effect |

||||

Std. Err. |

Std. Err. |

. |

Std. Err. |

||||

| Ln Commodity Price | 0.1504*** |

0.0194 |

0.1529*** |

0.0199 |

0.1505*** |

0.0194 |

|

| Ln X | -0.0033*** |

0.0006 |

-0.0035*** |

0.0006 |

-0.0033*** |

0.0006 |

|

| Ln G_L1 | 0.5*** |

0.0195 |

0.5184*** |

0.0202 |

0.5*** |

0.0196 |

|

| Ln CommodityPrice_L1 | -0.0752*** |

0.0141 |

-0.0784*** |

0.0146 |

-0.0752*** |

0.0141 |

|

| Ln X_L1 | 0.0017*** |

0.0004 |

0.0018*** |

0.0005 |

0.0017*** |

0.0004 |

|

| Ln GDP_lead1 | 0.5*** |

0.0195 |

0.4899*** |

0.0261 |

0.5*** |

0.0195 |

|

| Ln Commodity Price_d1 | -0.0752*** |

0.0141 |

-0.0746*** |

0.0145 |

-0.0752*** |

0.0147 |

|

| Ln X_lead1 | 0.0016*** |

0.0004 |

0.0017*** |

0.0005 |

0.0017*** |

0.0004 |

|

| Cons | -2.93e-14 |

0.0216 |

-0.0028 |

0.0218 |

-2.75e-12 |

0.0216 |

|

| R-squared | 0.9988 |

F(0.638) |

0.7226 |

Wald chi2(8) |

583438.09 |

||

| Number of observations | 682 |

682 |

682 |

||||

Note: Level of sig: 1% (***). |

Furthermore, Edo, Osadolor, and Dading (2020) found that the variables turn negative in the long run, similar to the present study.We found that trade as a percentage of GDP , one of the control variables, had a significant negative impact on GDP growth in the sub-Saharan African countries.

In contrast, Akadiri, Gungor, Akadiri, and Bamidele‐Sadiq (2020), using panel bootstrapping cointegration techniques and the Granger causality test, found bidirectional causality between foreign direct investment (FDI), trade openness, and economic progress. Furthermore, we found that that the projected progress rate of energy use, the projected growth rate of agriculture raw material exports, the projected progress rate of exports of goods and services, and other projected control variables had a significant positive impact on economic progress in sub-Saharan African countries.In contrast, Djokoto’s (2011) study in Ghana using a sim Granger causality test revealed that FDI ratios did not Granger cause agriculture progress, and agriculture progress did not Granger cause FDI ratios, indicating the existence of an indirect relationship between FDI ratios and agriculture progress in Ghana.

4.1. Hausman Specification Test

To decide between fixed and random effects, we conducted a Hausman test where the null hypothesis was that the most suitable model was random effects rather than the alternative fixed effects (Greene, 2002). The Hausman test essentially checks whether the sole errors (ui) are connected to the explanatory variables; the null hypothesis is they are not. Thus, we ran a fixed effects model and stored the estimates, then we ran a random effects model and saved the estimates; finally, we conducted the Hausman specification test. The result of the test suggested the random effect model was more appropriate because the chi-square was 0.4029, which is greater than 0.05. Therefore, the random effect model was more suitable to analyze the relationship between producer commodity price, other control variables, and the economic progress of 35 sub-Saharan countries.

4.2. Testing for Random Effects: Breusch-Pagan Lagrange Multiplier (LM)

The LM test informs the choice between a random effects regression and OLS. The null hypothesis in the LM test is that variances across entities are zero. Thus, there is no important transformation across units. Here, we failed to reject the null hypothesis and determined that random effects were not suitable when associated with the pooled OLS. That is, there was no indication of important differences across countries.

5. Discussion of Results

Few previous studies have employed panel data models, such as fixed and random effects models, to discover the relationship between commodity price and economic growth in Africa. Most studies tend to employ panel VAR, panel VECM, and panel Granger causality tests. This study employed panel fixed effect and panel random effect models to account for whether the countries’ unobserved fixed effect and random error terms were correlated or uncorrelated with the predictors or explanatory variables in the model.

In our results, we discovered that the current growth of commodity prices has a positive influence on the economic growth of 35 sub-Saharan African countries. This conforms with Deaton (1999), who, in his study of economic growth and commodity prices using pooled OLS, showed that the growth of commodity prices has a positive coefficient and the lags also have a positive sign. The results confirmed that the current growth of commodity prices has a positive impact on the economic growth of sub-Saharan African countries, although the lags and the leads, according to the pooled OLS, random effect, and fixed effect models, have negative impacts on economic growth in this region. We attribute this effect to bad governance, poor institutions, exchange rate fluctuations, high inflation, failures in informal sectors, corruption, conflict, and a lack of regulation to monitor changing market prices for the various commodities used in this study.

Nonetheless, this study still does not clearly elucidate the persistent problems commodity prices have had in the past and are expected to have in the future unless policy intervention takes place. These results are similar to those of Tiawara (2015), who used panel fixed effect estimation to inspect how commodity prices upset African economic welfare in 49 African countries from 1994 to 2014.

Moreover, Bleaney and Greenaway (2001) displayed that an increase in commodity prices can be undesirable in terms of trade instability and investment due to real exchange rate variability. Nonetheless, according to the Hausman specification test, the random effect was more appropriate, and, according to our analysis, an increase in commodity prices leads to the growth of the economy in sub-Saharan African countries.

Deaton and Miller (1996) empirically inspected the costs of commodity price booms in a cross-section of African countries and challenged the conventional wisdom that commodity price booms are destructive because they are mishandled.

The results for commodity prices and other control variables show that they have positive effects on current economic growth but any future increase in commodity prices may hurt sub-Saharan African countries’ economic growth due to bad governance and climate change effects. This is confirmed by Belford et al. (2020), who noted that the agriculture sector and temperatures have negative impacts on GDP growth in Anglophone West African countries. Nevertheless, the empirical evidence vis-à-vis the influence of natural resource prices on economic growth is mixed, with some providing evidence (Sachs & Warner, 1999) for undesirable consequences for growth (see (Brunnschweiler et al., 2006; Rodriguez & Sachs, 1999)).

On the other hand, a growing number of papers provide evidence against the resource curse hypothesis (see (Alexeev & Conrad, 2009; Brunnschweiler et al., 2006)). This is also true for the results of the current study; the pooled OLS and the random effect model were more suitable, and the fixed effect model was not appropriate for the analysis. When we compared the random effect model with pooled OLS, the result was that the pooled OLS was more suitable. The results of the pooled OLS, as well as the random effect model, showed that the increase in commodity price impacts positively on economic growth and that this effect is significant at 1%. The results further revealed that the logs of the lags and the logs of the lead of the commodity price both reduced the economic growth of the sub-Saharan African countries during the period in which the study was conducted.

6. Conclusion and Policy Implications

Most countries in sub-Saharan Africa are affected by commodity price volatilities; therefore, this paper has contributed to the investigation of this phenomenon by looking at fluctuations in commodity prices in the past, present, and future. In most of the studied countries, the price of the selected commodity was statistically significant and had a negative impact on economic progress. As livelihoods and a county’s overall standard of living depend on commodity prices, consumption and investment are associated with commodity price volatility in sub-Saharan Africa. This study investigated the impact of commodity prices on economic progress in 35 sub-Saharan African countries for the period 2000–2018. First, the results of the pooled OLS and the random effect model showed that commodity price increases have a positive impact on economic progress that is significant at 1%. Secondly, the results further showed that the logs of the lags of the commodity price reduced the economic progress of sub-Saharan African countries in the studied period. Thirdly, the logs of the lags of expected commodity prices will continue to reduce economic progress unless policy interventions are implemented as follows:

- Improve the quality of governance and institutions, thereby reducing the level of corruption.

- Solve the problems of heterogeneity issues associated with countries’ specific fixed effects.

- Deal with cartels.

- Deflate price levels to control inflation.

- Reduce the tax burden on food prices.

- Regulate the exchange rate.

References

Addison, T., & Ghoshray, A. (2013). Agricultural commodity price shocks and their effect on growth in Sub-Saharan Africa. WIDER Working Paper No . 2013 / 098.

Addison, T., Ghoshray, A., & Stamatogiannis, M. P. (2016). Agricultural commodity price shocks and their effect on growth in Sub-Saharan Africa. Journal of Agricultural Economics, 67(1), 47-61.Available at: https://doi.org/10.1111/1477-9552.12129 .

Akadiri, A. C., Gungor, H., Akadiri, S. S., & Bamidele‐Sadiq, M. (2020). Is the causal relation between foreign direct investment, trade, and economic growth complement or substitute? The case of African countries. Journal of Public Affairs, 20(2), e2023.Available at: https://doi.org/10.1002/pa.2023 .

Alexeev, M., & Conrad, R. (2009). The elusive curse of oil. The review of Economics and Statistics, 91(3), 586-598.Available at: https://doi.org/10.1162/rest.91.3.586 .

Arezki, R., Hadri, K., Loungani, P., & Rao, Y. (2014). Testing the Prebisch – Singer hypothesis since 1650 : Evidence from panel techniques that allow for multiple breaks. Journal of International Money and Finance, 42, 208-223.Available at: https://doi.org/10.1016/j.jimonfin.2013.08.012 .

Belford, C., Huang, D., Ceesay, E., Ahmed, Y., & Jonga, R. (2020). Climate change effects on economic growth: Mixed empirical evidence. International Journal Hum Cap Urban Manag, 5(2), 99-110.

Bhagwati, J. (1958). Immiserizing growth: A geometrical note. The Review of Economic Studies, 25(3), 201-205.Available at: https://doi.org/10.2307/2295990 .

Blattman, C., Hwang, J., & Williamson, J. G. (2007). Winners and losers in the commodity lottery: The impact of terms of trade growth and volatility in the Periphery 1870 – 1939. Journal of Development Economics, 82, 156–179.Available at: https://doi.org/10.1016/j.jdeveco.2005.09.003 .

Bleaney, M., & Greenaway, D. (2001). The impact of terms of trade and real exchange rate volatility on investment and growth in sub-Saharan Africa. Journal of Development Economics, 65(2), 491-500.Available at: https://doi.org/10.1016/s0304-3878(01)00147-x .

Brunnschweiler, C. N., Bulte, E. H., Technische, E., & Zürich, H. (2006). CER-ETH - Center of economic research at ETH Zurich the resource curse revisited and revised: A tale of paradoxes and red herrings economics Working Paper Series.

Brunnschweiler., C. N., & Bulte, E. H. (2008). The resource curse revisited and revised: A tale of paradoxes and red herrings. Journal of Environmental Economics and Management, 55(3), 248-264.

Cavalcanti, T. V. D. V., Mohaddes, K., & Raissi, M. (2012). Commodity price volatility and the sources of growth.IMF Working Paper 202, 1–38.

Ceesay, E. K., Belford, C., Fanneh, M. M., & Drammeh, H. (2019). Relationship between export, imports and economic growth: An export-led growth strategy for the Gambia using the granger causality test. International Journal of Social Sciences Perspectives, 4(2), 38-47.Available at: https://doi.org/10.33094/7.2017.2019.42.38.47 .

Collier, P., & Goderis, B. (2012). Commodity prices and growth: An empirical investigation. European Economic Review, 56(6), 1241-1260.Available at: https://doi.org/10.1016/j.euroecorev.2012.04.002 .

Daron, A., Johnson, S., Robinson, J. A., & Yared, P. (2001). Income and democracy. American Economic Review, 98(3), 808-842.

Deaton, A., & Miller, R. (1996). International commodity prices, macroeconomic performance and politics in sub-Saharan Africa. In Journal of African Economies, 5(3), 99-191.

Deaton, A. (1999). Commodity prices and growth in Africa. Journal of Economic Perspectives, 13(3), 23-40.Available at: https://doi.org/10.1257/jep.13.3.23 .

Djokoto, J. G. (2011). Inward foreign direct investment flows, growth, and agriculture in Ghana: A Granger causal analysis. International Journal of Economics and Finance, 3(6), 188-197.Available at: https://doi.org/10.5539/ijef.v3n6p188 .

Edo, S., Osadolor, N. E., & Dading, I. F. (2020). Growing external debt and declining export: The concurrent impediments in economic growth of Sub-Saharan African countries. International Economics, 161, 173-187.Available at: https://doi.org/10.1016/j.inteco.2019.11.013.

Fowowe, B. (2016). Do oil prices drive agricultural commodity prices? Evidence from South Africa. Energy, 104, 149-157.Available at: https://doi.org/10.1016/j.energy.2016.03.101 .

Greene, W. (2002). Time series models. In econometric analysis (5th ed., pp. 608-662). Upper Saddle River, NJ: Prentice Hall.

Gylfason, T., Herbertsson, T. T., & Zoega, G. (1999). A mixed blessing: Natural resources and economic growth. Macroeconomic Dynamics, 3(2), 204-225.Available at: https://doi.org/10.1017/s1365100599011049 .

Jayne, T. S., Chamberlin, J., Benfica, R., Jayne, T. S., & Chamberlin, J. (2018). Africa ’ s unfolding economic transformation Africa ’ s unfolding economic transformation. The Journal of Development Studies, 54(5), 777–787.Available at: https://doi.org/10.1080/00220388.2018.1430774 .

Kalumbu, S., & Sheefeni, J. P. S. (2016). Terms of trade and economic growth in Namibia terms of trade and economic Growth in Namibia.

Menegaki, A. N. (2011). Growth and renewable energy in Europe: A random effect model with evidence for neutrality hypothesis. Energy Economics, 33(2), 257-263.Available at: https://doi.org/10.1016/j.eneco.2010.10.004 .

Mputu, C. L. (2016). Terms of trade, trade openness and economic growth in Sub-Saharan Africa.

Ntshwe, I., & Garidzirai, R. (2021). Exploring the influence of commodity prices, real exchange rate and trade openness on economic performance in an emerging country. International Journal of Financial Research, 12(5), 1-9.Available at: https://doi.org/10.5430/ijfr.v12n5p80 .

Raddatz, C. (2007). Are external shocks responsible for the instability of output in low-income countries? Journal of Development Economics, 84(1), 155-187.Available at: https://doi.org/10.1016/j.jdeveco.2006.11.001 .

Rafiq, S., & Bloch, H. (2016). Explaining commodity prices through asymmetric oil shocks: Evidence from nonlinear models. Resources Policy, 50, 34-48.Available at: https://doi.org/10.1016/j.resourpol.2016.08.005 .

Rodriguez, F., & Sachs, J. D. (1999). Why do resource-abundant economies grow more slowly?

Sachs, J. D., & Warner, A. M. (1999). The big push, natural resource booms and growth. Journal of Development Economics, 59(1), 43-76.Available at: https://doi.org/10.1016/s0304-3878(99)00005-x .

Sala-i-Martin, X. (2003). Addressing the natural resource curse.

Tiawara, H. N. O. (2015). The effect of commodity prices on African economic growth.

Tilton, J. E., Humphreys, D., & Radetzki, M. (2012). Investor demand and spot commodity prices: Reply 2. Resources Policy, 37(3), 403-404.Available at: https://doi.org/10.1016/j.resourpol.2012.03.001.

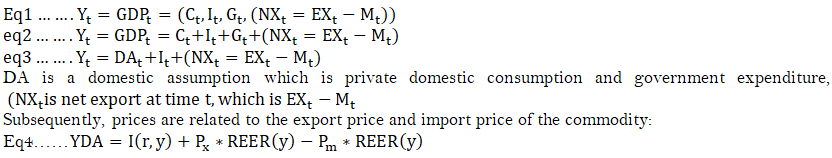

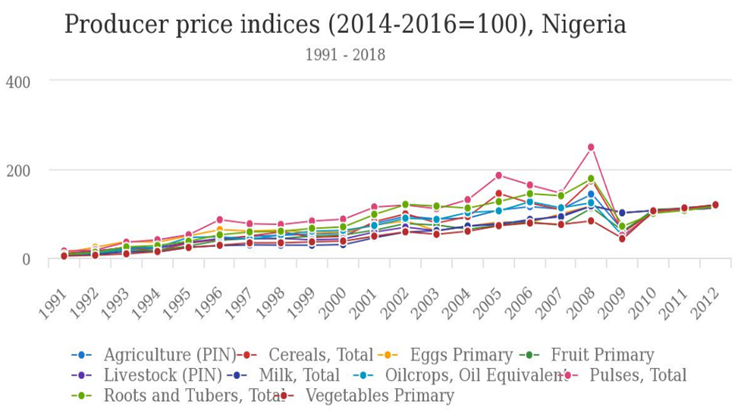

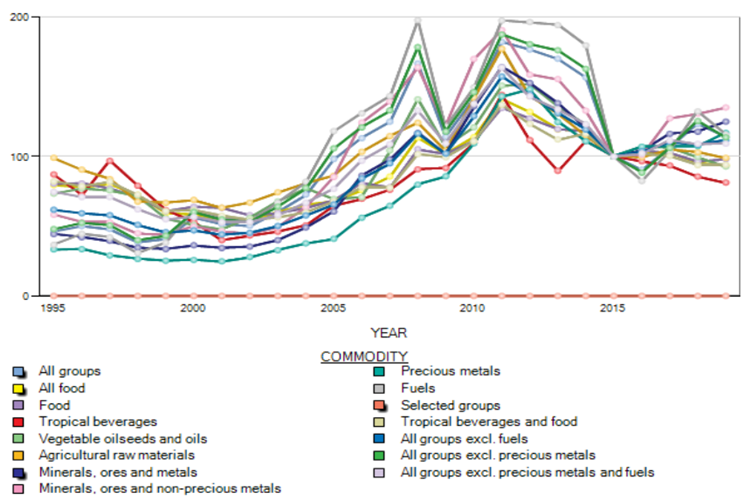

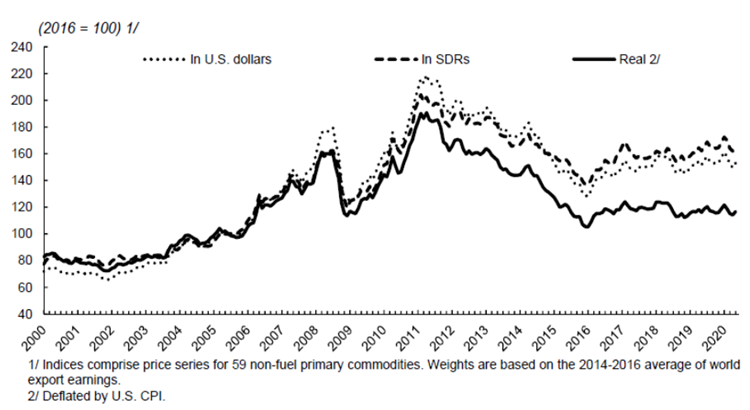

Appendix: Different Graphs of the behaviours of commodity prices in Sub-Saharan African Countries

Appendix 1. Food price indices in Nigeria.

Appendix 2. Foof price indices in Rwanda.

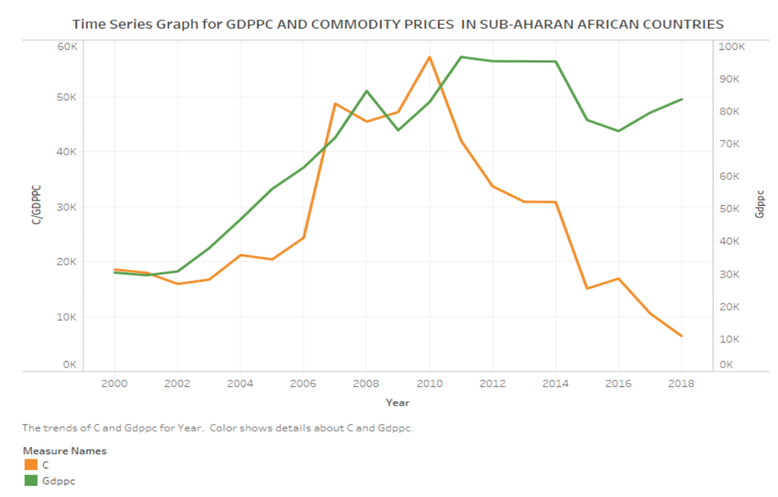

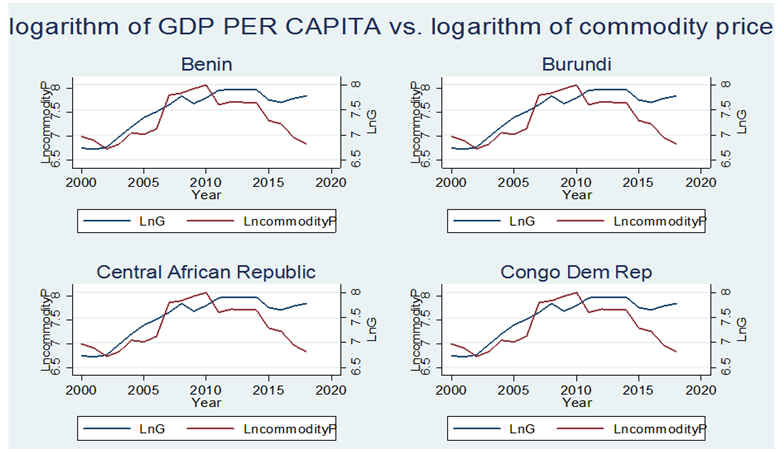

Appendix 3. Time series graph for GDP per capita versus producer commodity price in the Sub-Saharan African Countries.

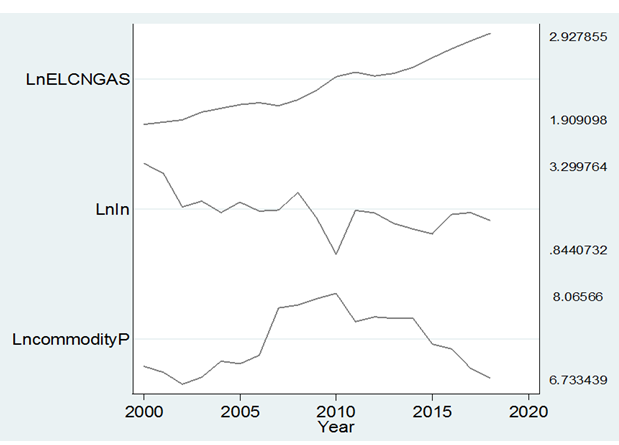

Appendix 4. Change in the electricity and gas price (up), in the log of inflation (Middle).

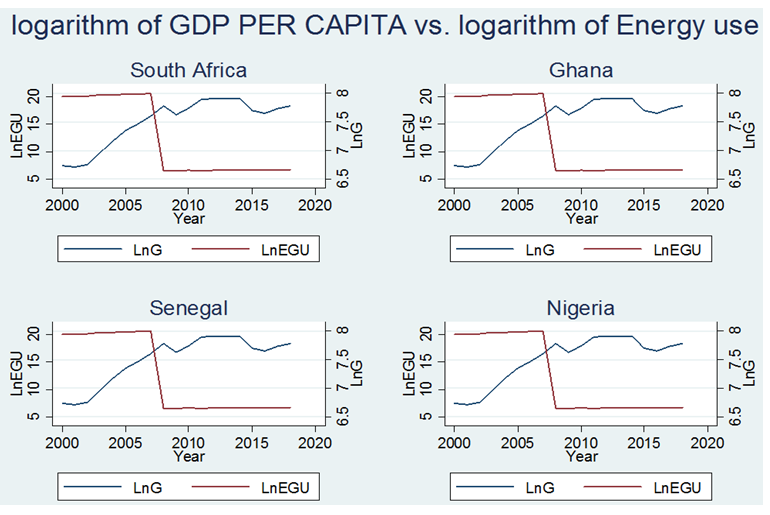

Appendix 5. The growth rate of GDP per capita vs. the growth rate of energy uses in the selected countries from our data.

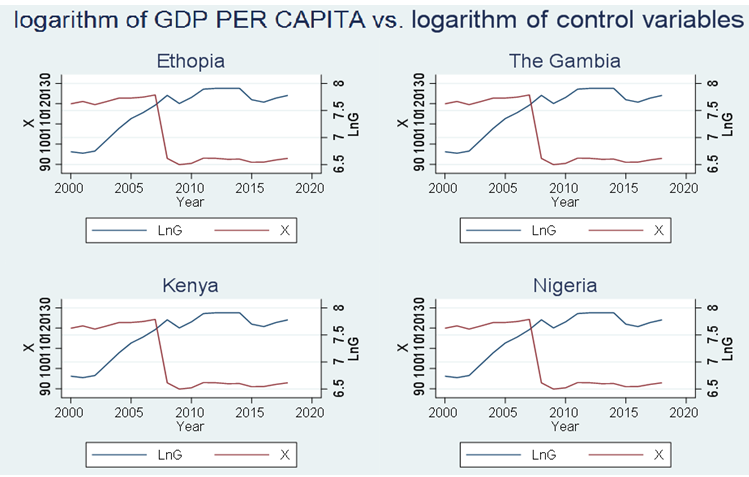

Appendix 6. Changes in GDP per capita vs. agriculture value added, inflation, energy price, coal price, and other control variables in the above model specification. |

Appendix 7. Growth rate of GDP per capita versus growth rate of commodity price in the selected country from our data set.

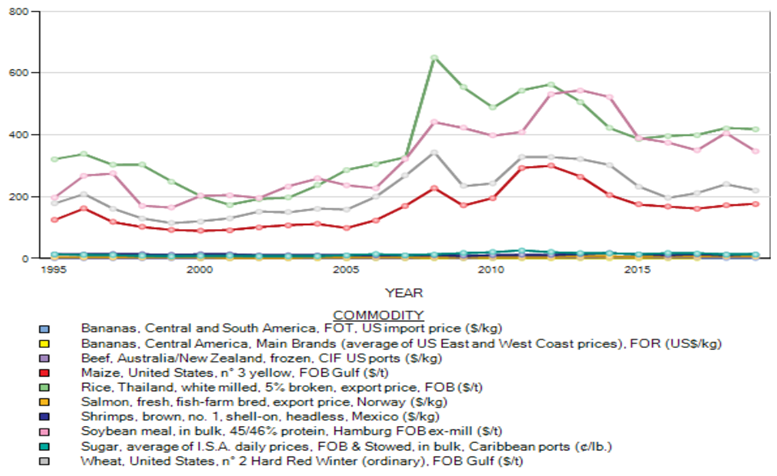

Appendix 8. Commodity price in the world.

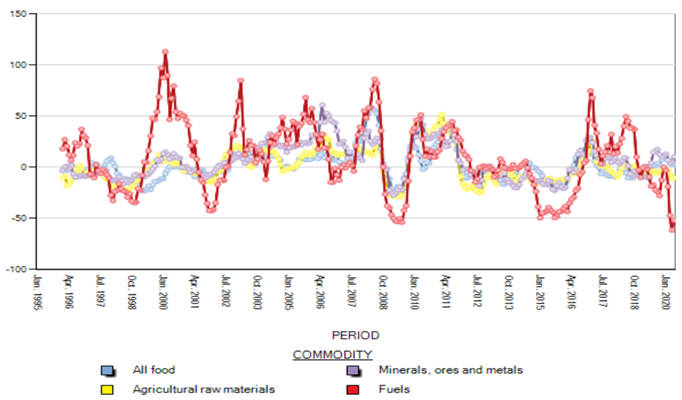

Appendix 9. Selected variables commodity price time series trend.

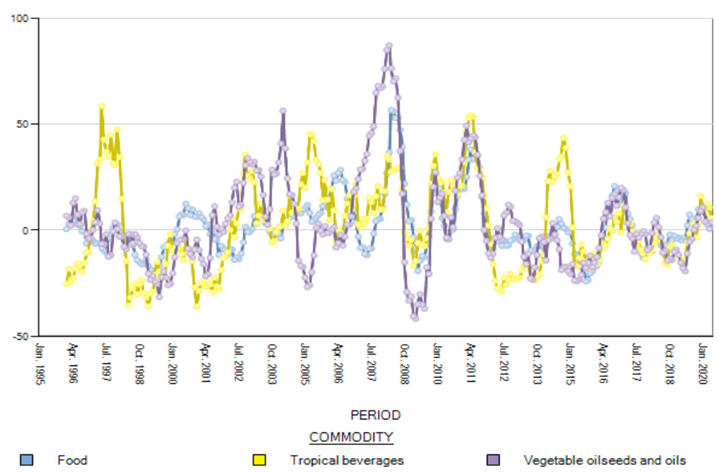

Appendix 10. Food price volatility in t he World.

Appendix 11. All the groups combined versus other variables price variations.

Appendix 12. Indices of non-fuel primary commodity prices.