The Effect of Foreign Direct Investments on Trade Balance in Southeast Europe during the Period 2000–2018

Driton QEHAJA1

Fatlum ZEKA2

Arber HOTI3*

1,3Economic Faculty, University of Prishtina ‘Hasan Prishtina’, Kosovo. |

AbstractThis paper explores fertility preference and its associated factors among older Nigerian women within the reproductive ages 40 to 49. It considers the impact of proximate factors of place, wealth, education, use of contraceptives, and other associated factors on fertility preference. Using Nigeria Demographic and Health Survey (NDHS 2018) data, responses of 1357women of ages 40-49 years in the couples recode file were considered. Fertility preference is measured by “the desire for another child”. We use descriptive statistics and logistic regression to identify the associating factors and impacts of identified explanatory variables on the desire for another child. Result revealed up to 25% of women within ages 40-49 desire to have another child while 35% uses contraceptives. The desire by older women to have another child is higher in the rural areas than in urban areas while more than 50% with desire for another child have no education and are found practising Islam. Logistic regression result indicates that older women not using contraceptive have higher odd ratio with the desire for another child, those in urban areas have lower odd ratio while women in the Northeast and the Northwest have more than 2.5 chance of desiring for another child than those in the Southwest. This study concludes that the desire for pregnancy at later end of reproductive years must be controlled through women's education and community-based sensitization programs. |

Licensed: |

|

Keywords: |

|

Received: 4 May 2022 |

Funding: This study received no specific financial support. |

Competing Interests: The authors declare that they have no competing interests. |

1. Introduction

For a long time, the theory of Foreign Direct Investment (FDI) was kept separate from the theory of commerce and trade balance to provide the basis for investment. However, in the 1980s, a shift in trade theory occurred that included the diversification of services, the economy, and schools, as well as the concept of imperfect markets and their sources of multinational investment (Herrmann & Jochem, 2005).

When it comes to developing country exports, empirical research shows that the most important drivers are those that have an impact on supply rather than demand (Funke & Holly, 1992). For a variety of reasons, many analysts believe that the Western Balkan nations should also begin by increasing domestic production and economic capacity to improve their export performance (Gashi, 2019).

Trivić and Klimczak (2015) examined the variables that influence commerce between Western Balkan countries, including a variety of economic and social aspects that, in theory, would not affect areas that have not experienced violence. The variables representing the ease of direct communication and the similarities between religious systems were shown to be among the most significant factors determining the degree of commerce among these nations. Trivić and Klimczak (2015) concluded that non-economic variables have the greatest influence on the degree of commerce between nations in the Western Balkans area (Trivić & Klimczak, 2015).

Different variables may influence the level of exports, according to the findings of studies that have tried to discover the most significant influences on the amount of trade among the Western Balkan nations and with other countries. Botrić (2013) attempted to determine the most important factors influencing the volume of trade within the same sector between the Western Balkan nations and the European Union using a gravitational field model. The findings of the study revealed that the respective incomes of the nations, the distance between the countries, the relative ownership of the means of production, and the relative costs of trade are the most important drivers of the volume of trade between these countries (Botrić, 2013).

Montanari (2005) reported that based on his econometric model that attempted to assess whether the Western Balkans region (including Bulgaria and Romania) was utilizing its full trade potential with European countries, there was a large space for trade between the Western Balkans and Europe, particularly in exports from the Balkans to Europe. In terms of exports from European nations to the Western Balkans, the countries with whom the Western Balkans have the greatest commercial links have made the most of their export potential to the Balkans. On the other hand, Bulgaria and Romania outperformed the model's predictions, exporting more to European economies than the model indicated. This reveals why the asymmetric trade liberalization that resulted from agreements between European countries in the 1990s and the sanctioning treatment of Yugoslavia during this period was accompanied by lower levels of exports from countries leaving Yugoslavia after its dissolution (Montanari, 2005).

Our study aims to examine empirically how FDI has impacted the trade balances of the Western Balkan nations (Kosovo, Albania, Northern Macedonia, Montenegro, Bosnia and Herzegovina, and Serbia). The reason we want to analyze this impact is that the Western Balkan countries face a very high negative trade balance and channel their policies towards attracting as much FDI as possible. Therefore, through this research, we will try to answer the question of whether FDI has contributed to the reduction of the negative trade balance or not. Analyses of this kind have been conducted for a variety of developed and developing nations, but none have specifically evaluated this relationship for these particular countries.

As a result of this study, policymakers will be able to make evidence-based judgments on how to implement economic policies to attract foreign investment and enhance the country's trade balance. Additionally, this study paves the way for future studies on the effect of FDI in Western Balkan nations and the most influential variables affecting exports, imports, and the trade balance in general.

2. Literature Review

The theoretical literature that has attempted to explain disparities in trade balances between nations with comparable levels of economic and social development has identified various characteristics that impact the trade balance between countries. According to the theoretical literature, some of the causes of long-term changes in the trade balance include macroeconomic changes, such as exchange rate fluctuations, domestic revenues of the nation, a surplus of money in circulation, and others Bahmani-Oskooee (1992).

Empirical scholars have developed and utilized several theoretical models to explain variations in nations' trade balances. When it comes to explaining the balance of trade, the most frequent technique relies on a nominal depreciation of the country's currency. This is known as the elasticity versus trade balance approach (Bickerdike, 1920).

Another method of calculating the trade balance dates back to the 1950s. This strategy, known as the absorption approach, examines the balance of trade rather than the trade balance. To improve the trade balance, a gain in income must be matched by an equal decrease in total domestic spending (Alexander, 1959).

However, empirical research using real-world data to evaluate these hypotheses has provided conflicting results. A study conducted by Bahmani-Oskooee (1992) revealed that in the long run, the full employment budget and, in certain circumstances, the quantity of money in circulation substantially influence a country's trade balance, whereas the exchange rate and trade agreements have little long-term impact (Bahmani-Oskooee, 1992).

There is a difference in the trade balance for countries that have a positive balance of FDI revenues; specifically, the exchange rate has a smaller effect on a country's trade balance for countries with a positive balance of FDI, which is usually associated with the existence of a negative trade balance (Falk, 2008).

According to Bajo-Rubio and Esteve (2016), there is no obvious empirical relationship between the exchange rate and the trade balance among Southern European countries that are members of the Eurozone (Greece, Italy, Portugal, and Spain). Spain and Italy have done well, despite their economies’ lower productivity and their incapacity to engage in the monetary and exchange rate sectors, because their major exports originate from large domestic enterprises (Bajo-Rubio & Esteve, 2016).

Shawa and Shen (2013) found that the factors influencing Tanzania's trade balance are often not included in empirical research. Their research aimed to identify the determinants of Tanzania's trade balance by analyzing several factors, such as FDI, human capital development, household expenditures, government expenditures, and others. Based on their results, they proposed that policies aimed at improving trade balance circumstances should center on these indicators (Shawa & Shen, 2013).

Duasa (2007) constructed a dynamic model of the trade balance that tested the short-term and long-term effects of several factors on the Malaysian trade balance to see whether there was any form of dynamic equilibrium between the trade balance and the real exchange rate, income, and money supply in this country. An examination of the long-term correlation between Malaysia's trade balance and its drivers revealed that the trade balance is linked with revenues and money supply, but it has no long-term association with the exchange rate (Duasa, 2007).

Using data from 1970 to 2005, Kakar, Waliullah, Khan, and Khan (2010) tested a model of the Pakistani economy using the technique proposed by Duasa (2007). They discovered both a short- and long-term association between the trade balance and revenues, money supply, and exchange rates in the Pakistani economy. While the exchange rate does influence the trade balance, its effect is far smaller than that of economic growth and monetary policy (Kakar et al., 2010).

2.1. Factors Affecting Exports

Research to identify the factors that drive export growth has mostly been based on examinations of individual enterprises and their features, looking at the many techniques that can be used to address these qualities to enhance export volume and improve a country's trade balance. The empirical studies have led to different conclusions, meaning that the factors that drive export growth at the business level remain a source of debate. Some of these factors include:

- Size of the firm: According to various researchers, the bigger the enterprise, the more likely it is to export (Cavusgil & Naor, 1987), and the larger the company, the more likely it is to participate in export-related activities (Reid, 1983). On the other hand, other researchers have found little evidence of a substantial influence of firm size on export volume (Diamantopoulos & Inglis, 1988).

- Export experience: Some studies have suggested that a company’s export experience has a beneficial influence on future exports (Madsen, 1989), whereas other research contradicts this theory (Diamantopoulos & Inglis, 1988).

- Manufacturing Technology: While most research has revealed a positive association between perceived technical advantages and the desire to export (Aaby & Slater, 1989), other studies have found no link between the level of technology a firm employs and the number of exports it produces (Christensen, Da Rocha, & Gertner, 1987).

- Price: Several studies have demonstrated a relationship between the price of a company's products and the level of its exports, namely that the more competitive the price, the higher the level of exports (Madsen, 1989). However, a company’s advantage in terms of price has not been demonstrated to be an indicator of success for companies from developing countries throughout the development of their exports (Diamantopoulos & Inglis, 1988; Dominguez & Sequeira, 1993; Madsen, 1989) .

A great deal of research has sought to discover the crucial factors that contribute to a country's export performance in the context of the nation in general. Strong ties to worldwide markets, the country's physical infrastructure, the quality of the country's macroeconomic system, and the quality of its institutions are among the most important indicators for exports at the national level. However, depending on how developed a nation's external sector is, the relative significance of each element may vary (Panitchpakdi, 2005).

One approach that policymakers might pursue is to facilitate market access for local enterprises by motivating and supporting their attempts to enter new markets. The reduction of trade obstacles to developing nations on the part of industrialized countries is an essential aspect of this approach. This includes not only explicit barriers imposed by developed countries but also non-tariff barriers that negatively affect developing countries, such as the regulations countries must follow, the various quality standards companies in developing countries must meet despite the high costs, sanitation measures, environmental protection conditions, as well as structures and practices that create non-competitive conditions for companies in developing countries (Panitchpakdi, 2005).

Over 40% of developing-country exports go to other developing nations. Because it is difficult to reach multilateral agreements within the World Trade Organization that address the needs of developing countries, many developing countries establish separate agreements with other developing countries that facilitate trade relations between these countries. These agreements provide the basis for regional and global collaboration among nations that have a vested interest in mutual trade and economic cooperation by extending their businesses’ access to new markets (Panitchpakdi, 2005).

The most notable deal of this kind for the Western Balkan nations is the Central European Free Trade Agreement (CEFTA), which was signed by the countries of the Western Balkans in 2007, except for Macedonia, which has been a member of this agreement since 2006 (GAP, 2011).

Despite having access to worldwide markets, many developing nations, such as those in the Western Balkans, nevertheless struggle with export performance due to domestic issues, sometimes known as supply-side factors. To sustain the state's competitiveness in the international arena, these issues and FDI must be given particular consideration by policymakers in the long term (Jongwanich, 2010).

2.2. List of Factors

a. Internal Infrastructure of the Country

The amount of expansion in production capacity, and what the country, therefore, can offer the world market, is heavily reliant on the country's physical infrastructure, which includes everything from roads and ports to energy and technical structures. The country's infrastructure is significant in the long term because it lowers the costs of export-related transactions, promotes export diversification, and aids in the development of international production networks in the global market (Collier, 2002; Mayer, Butkevicius, Kadri, & Pizarro, 2003).

b. Macroeconomic Environment

The real exchange rate, which represents the relative price movement of local and imported goods, plays an important role in determining a country's export performance. A 1% depreciation of the currency is likely to enhance exports by 6–10%. This does not mean that nations should necessarily devalue, but it highlights the significance of productivity growth in boosting global competitiveness. This is especially apparent in developing nations, which rely on manufacturing to export labor-intensive items that demand more labor and less capital. Because more developed nations export capital-intensive items, they are less influenced by a fixed exchange rate that prevents them from influencing price competitiveness (Panitchpakdi, 2005).

c. Foreign Direct Investment

Export-oriented FDI has a favorable influence on export promotion by boosting supply – a fact that holds true for most levels of export performance and time periods analyzed. Beyond capital, foreign investments improve the trade balance by improving the country's image, providing innovative technology, increasing enterprise productivity in the same industry, and advancing policies that strengthen its competitiveness (Loewendahl, 2001). No matter how competitive a nation is, it will not be able to attract export-oriented investment unless it educates investors about what it can provide (Panitchpakdi, 2005).

d. Institutions

As a nation transitions from a closed to an open economy, institutions are expected to play a significant role in export promotion. However, owing to the interdependence of the many elements involved when trying to quantify the quality of institutions, research has found it difficult to distinguish the influence of institutional change on exports. It has been suggested that improving the quality of institutions is linked to improving macroeconomic conditions or increasing FDI. It has also been suggested that improving the quality of institutions can have a substitutive effect on the macroeconomic environment concerning the development of exports. As a result, the biggest impact of institutions may be observed in countries that have attained a high degree of production chain development, where FDI is directed to more capital-intensive sectors, where property rights are better protected, and where institutions are most effective (Panitchpakdi, 2005).

2.3 Factors Affecting Imports

The import of capital is critical to a country's economic growth because it encourages investment, which in turn kick-starts a country's economy (Egwaikhide, 1999). Researchers have used a variety of models to accurately pinpoint the factors that influence imports. Assumptions and fundamental theories are key components of these models. Thursby and Thursby (1984) investigated which functional model best fits reality because of the worry of utilizing more than one functional model to evaluate the elements that impact the import quantity. For each country, they looked at the data using nine different models to arrive at a total of 324 model specifications. They concluded that no single model adequately captures all states and time periods (Thursby & Thursby, 1984).

A comparable study, this time focusing on the factors affecting imports in Fiji, yielded similar findings. In the short run, the real exchange rate and the country's revenues as reflected by GDP were of significant importance to the level of imports, and the fact that a 1% increase in Fiji's GDP (ceteris paribus) resulted in a 0.9 percent increase in imports in the short term showed that domestic demand, which is driven by revenue growth, is very important for the level of imports. In the long term, GDP continues to play an unusually significant role, which has economic ramifications for the trade balance, since increases in revenues, and therefore aggregate demand, are not supported by increases in the country's production capacity. Meeting this demand will require an increase in imports that is greater than the rise in exports, resulting in a worsening of the trade balance (Rogers, 2000).

The exchange rate and the power of competent authorities to control the relative price of imported items in proportion to local products are very important to most imports. In this regard, capital product imports are particularly susceptible to changes in relative pricing, implying that exchange rate management and government policies targeted at affecting relative import prices may have a considerable influence on overall import levels (Egwaikhide, 1999).

Using an econometric model of co-integration, Horton and Wilkinson (1981) demonstrated that the short-term variables that have the largest influence on imports are also the ones that impact domestic demand, based on an analysis of the flow of imports into Australia from 1974 to 1989. While the variables that influence the relative pricing of items have a short-term effect, it is only minor. On the other hand, in the long term, the variables affecting products’ relative prices tend to be the most important, while the factors driving domestic demand are substantial but have less influence (Horton & Wilkinson, 1981).

The amount of economic openness, as well as the removal of tariff and non-tariff barriers, has affected numerous categories of imports for the Australian state. Specifically, the level of imports of consumer and intermediate items has been heavily influenced by economic openness and the removal of trade barriers, although, at the aggregate level, obstacles have had no substantial effect on Australia's imports of commodities (Dwyer & Kent, 1993). While the impact of capital-goods import restrictions is substantially less, Dwyer and Kent (1993) rationalized this by pointing out that capital is difficult to replace via local manufacturing.

Horton and Wilkinson (1981) discovered that the amount of imports is also affected by the relative export price of local items. They offered two explanations: first, as export prices rise, a country increases its demand for imports because more money enters the country, even though export prices have not changed in real terms, and thus GDP has not changed; second, as export prices rise, the demand for additional capital to invest in export products rises, and thus capital imports rise (Horton & Wilkinson, 1981).

Another study, conducted by Al-Hazaimeh, Al-Hyari, and Marwan (2011), focused on determining the variables that impacted the level of imports in Jordan, concluding that GDP, relative import prices, capital investments, and the level of exports were the most important determinants. They claimed that a large portion of imports was utilized to manufacture items that were later exported, or were capital goods that sped up the manufacturing process; thus, their total impact on the economy was beneficial, even if the trade balance was negative (Al-Hazaimeh et al., 2011).

Braga and Willmore (1991) used a new method to assess imports carried out by businesses. They conducted a study using a logit model to determine which characteristics influenced the likelihood that a firm would import technology from another nation, participate in research and development, and maintain control over the quality of its goods. They used data from 4,342 Brazilian businesses. According to their findings, the likelihood of a firm importing technology from another country rises dramatically if it is foreign-owned or if it exports; also, the bigger the company is, the more likely it is to import technology.

3. Data Description

We investigated how FDI has influenced the Western Balkan nations' trade balance. Albania, Kosovo, Montenegro, Northern Macedonia, Bosnia and Herzegovina, and Serbia were the nations examined as part of this study. Because the primary goal of the research was to make recommendations for the state of Kosovo, based on its level of economic development and political position, Croatia was excluded from this analysis in order to avoid giving the impression that the impact is other than what it actually is. For a variety of reasons, international companies tend to invest in the countries where they do business, and their reasons for doing so in the countries included in this study appear to be comparable. However, an international investor may have chosen to invest in Croatia for a different set of reasons, which could have an impact on the trade balance implications of those investments.

Data from the years 2000 to 2018 were utilized for the investigated nations, and a balanced panel database with 114 observations was produced. Panel data are sets of information that comprise more than one entity and more than one time period. Analyses utilizing these sorts of data are fairly common since they allow for the evaluation of more observations than time series and interpersonal data. Furthermore, panel data analysis allows the isolation of fixed impacts that appear in different places and allows the researcher to control for phenomena that may have an impact on the results of the analysis but do not change significantly from year to year, such as cultural aspects of the society being analyzed, the economic structure of the country, people's attitudes toward foreign investors, tax policies and rates, the government's attitude toward foreign investors, and so on.

The World Bank database was utilized wherever feasible because of the consistency of the data and the uniform manner in which they are presented in the database. It also gathers and integrates data from several international organizations and institutions, resulting in a comprehensive database that allows for comparisons across various nations and years. It is well accepted that published data does not always represent reality when taken in isolation. However, when examined together, public data may be more useful since it allows one to understand the differences and patterns in how various indicators move over time. Only if the data's computation and presentation are consistent across years and nations can they be utilized in this way. Since the information we required could be found in summary databases like that of the World Bank, it was utilized in this study wherever feasible.

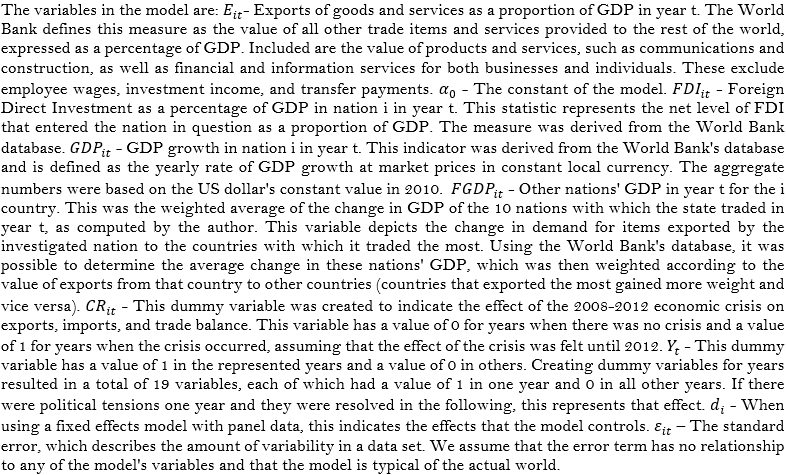

Table 1 shows the eight variables that were utilized, with two more variables that were not included in the table since they were dummy variables with values of 0 or 1. Exports as a percentage of GDP, imports as a percentage of GDP, trade balance as a percentage of GDP, FDI as a percentage of GDP, GDP change, inflation, and GDP of other countries were the variables for which data is gathered.

Other nations' GDP was derived as the weighted average of the change in GDP of the 10 countries with whom the studied countries reported the most significant trade links. For unknown reasons, Kosovo was not included in the list of Western Balkan nations; however, this was presumably related to the country's political circumstances. The nations with whom the examined countries are said to have the most trade links are:

For Kosovo: Serbia, Germany, Turkey, China, Albania, Macedonia, Italy, Greece, Slovenia, Poland.

For Albania: Italy, Serbia, China, Greece, Macedonia, Germany, Turkey, Romania, Spain, France.

For Bosnia and Herzegovina: Germany, Italy, Serbia, Croatia, Slovenia, Austria, China, Turkey, Russia, Hungary.

For Macedonia: Germany, Serbia, Greece, Great Britain, Bulgaria, Italy, China, Turkey, Romania, Belgium.

For Montenegro: Serbia, China, Germany, Italy, Bosnia and Herzegovina, Greece, Croatia, Turkey, Slovenia, Hungary.

For Serbia: Germany, Italy, Russia, China, Bosnia and Herzegovina, Hungary, Romania, Poland, Slovenia, Turkey.

| Variables | Mean |

Standard Deviation |

Min. |

Max. |

Observations |

||

| Export | Overall | 31.70 |

10.47 |

5.61 |

60.34 |

Total: |

112 |

| Between countries | 8.59 |

18.04 |

40.95 |

States: |

6 |

||

Mean of years: |

18.67 |

||||||

| Import (% of GDP) |

Overall | 54.99 |

10.83 |

14.32 |

92.82 |

Total: |

112 |

| Between countries | 7.67 |

45.89 |

64.82 |

States: |

6 |

||

Mean of years: |

18.67 |

||||||

| Balance of Payments (% of GDP) |

Overall | -23.29 |

10.05 |

-53.3 |

-4.46 |

Total: |

112 |

| Between countries | 7.56 |

-33.62 |

-13.42 |

States: |

6 |

||

Mean of years: |

18.67 |

||||||

| FDI (% of GDP) |

Overall | 6.79 |

5.36 |

0.54 |

37.27 |

Total: |

96 |

| Between countries | 4.47 |

3.83 |

16.13 |

States: |

6 |

||

Mean of years: |

16 |

||||||

| Change in GDP | Overall | 3.73 |

3.49 |

-5.8 |

26.97 |

Total: |

113 |

| Between countries | 0.84 |

2.77 |

5.02 |

States: |

6 |

||

Mean of years: |

18.83 |

||||||

| Inflation | Overall | 5.24 |

11.90 |

-9.35 |

89.24 |

Total: |

107 |

| Between countries | 5.24 |

2.15 |

15.69 |

States: |

6 |

||

Mean of years: |

17.83 |

||||||

| GDP of other states (difference from year to year) | Overall | 2.72 |

2.06 |

-4.73 |

6.06 |

Total: |

114 |

| Between countries | 0.64 |

1.78 |

3.45 |

States: |

6 |

||

Mean of years: |

19 |

||||||

Note: The mean of years shows the number of years for which we have data for each state in the study. If each state's data were made public, the total should be 19. |

As seen in Table 1, there are major variances between nations. For example, when we look at exports as a percentage of GDP, we can see that the lowest average is 18.04 percent of GDP, which is the average of Kosovo's exports from 2000 to 2018, while the greatest average (that of Northern Macedonia) is 40.95 percent of GDP.

The data in the "Between countries" rows in Table 1 reflect the average lowest and average highest when calculating the average at the national level, as well as the standard deviation of this average. The figures in the "Overall" rows in Table 1 represent the overall average of the utilized data, as well as the minimum, maximum, and standard deviation of the data.

Table 1 shows that all the analyzed countries had a negative trade balance, with imports exceeding exports for all countries on average. Kosovo had the most negative balance, with a trade balance of -33.62 percent of GDP on average from 2000 to 2018, while Serbia had the least negative, with a trade balance of -13.42 percent of GDP on average from 2000 to 2018.

4. Research Methodology

The impacts of FDI on the nations’ trade balance were studied using an econometric model based on Mencinger's (2008) paper, which used a panel data method with fixed effects. The main reason we selected this technique was that the fixed effects specification allows the "stripping" of the unique effects of each country that remain constant across time, allowing us to estimate the explanatory indicators' net impacts on the dependent variable. The fixed effects specification's key assumption is that these non-year-dependent individual characteristics of states are unique to each nation and unrelated to the individual characteristics of other countries. Because each location in the panel is distinct, the error term and the constant (which records the individual impacts) are independent. If the constant and error terms turn out to be correlated amongst individuals (or locations, in our example), then the definition of the fixed effects is inadequate (Mencinger, 2008).

During the investigation, three basic models with comparable structures were built to assess the influence of FDI on the investigated nations' exports, imports, and trade balance. To assess the effect of FDI on exports, the following model was developed:

This model focuses on the influence of FDI on exports, whereas the other indicators are control variables that might have an impact on exports as a result of FDI. Incorporating these factors allowed us to calculate FDI's net impact and eliminated model bias caused by leaving out variables linked to the dependent variable and their influence.

Mencinger (2008) utilized a model similar to this one to assess how FDI influenced the current account balances of nations. However, this model includes additional factors that may have a bearing on the Western Balkans' particular circumstances.

In line with this basic export model, the following import model was formulated:

All the same indicators from the export model are utilized here. Furthermore, is also included. Iit displays, at time t, the imports relative to GDP for nation i. In the World Bank database, this term is defined as the total value of all products and services received from other countries and regions. Infit is the country's inflation rate in year t. In the World Bank's database, this statistic is defined as the domestic GDP deflator's annual growth rate, which represents the country's overall price change rate. The import model is fairly similar to the one used by Mencinger (2008), which was adapted for use in this study; a few minor changes and additions were made throughout the analysis to ensure it was as close to the structure of the studied nations as feasible.

The trade balance was the third and last model we constructed, and it reflects, in theory, the difference between the two previous models (export minus import). The trade balance model takes the same indicators into consideration as the import model and may be expressed as follows:

This model includes all the same elements as the import model, except for the dependent variable. In this model, the dependent variable is BTit - trade balance expressed as a percentage of GDP for country i, in year t. This is a World Bank database indicator that is defined as the external balance of goods and services, which is equal to the level of goods and services exported minus the level of goods and services imported.

The specification with random effects is appropriate if we consider that country differences may influence the dependent indicator (imports, exports, and trade balance) (random effects estimation). While time-invariant indicators cannot be used as explanatory indicators in the fixed effects specification, they may be used as explanatory indicators when using this specification. Our model assumes that any fluctuation across states is uncorrelated with the other explanatory indicators; therefore, we utilized random effects specification to ensure this separation. It is not straightforward to identify individual effects that may have an impact on the dependent variable when using a specification with random effects, meaning that there is a danger of leaving out crucial indicators and thus biasing the model due to the indicators that are omitted from the model (Mencinger, 2008).

We provide the outcomes of both types of specifications, although the analysis was based more on the fixed effects specification findings. This was indicated because of the nature of the model and the assumption that the individual impacts of states, which may change from year to year, had no influence on the dependent indicator or were recognized in the model.

Because of changes in the various states that were analyzed in the study, our models differ from Mencinger's (2008) models, and we have incorporated extra control variables. It should be noted that the number of years for which we obtained published data was insufficient to draw definitive conclusions about the implications that FDI may have on the trade balances of the countries under consideration, and the veracity of the data is not guaranteed, as is common in many developing or transition countries. Many publications that employ quantitative data to investigate causal relationships between indicators have highlighted the Western Balkan nations' lack of accurate data.

5. Econometric Results

In accordance with quantitative social science research, the STATA program was used for empirical analysis and model calculations. Results from the fixed effects and random effect panels are both presented, but the emphasis is on the fixed effects panel specification. Considering the P-values for the models, aside from the random effect model for imports, all are significant and represent strong evidence in support of our model. Furthermore, the R-squared and Adj R-Squared all have high values, which indicate that these models are effective at explaining the variance of the dependent variables.

As stated in the methodology section, the model used to assess the impact of FDI on exports is as follows:

Variables |

Export - E |

Import - I |

Balance of trade - BT |

|||||

Fixed Effect |

Random Effect |

Fixed Effect |

Random Effect |

Fixed Effect |

Random Effect |

|||

FDI |

0.254** (0.127) |

0.290 (0.199) |

0.581** (0.234) |

0.598*** (0.221) |

-0.319* (0.163) |

-0.287* (0.173) |

||

GDP |

0.714** (0.266) |

-0.769 (0.562) |

1.913*** (0.495) |

1.045* (0.633) |

-1.142*** (0.345) |

-1.694*** (0.496) |

||

FGDP |

-0.445 (1.061) |

-2.648* (1.378) |

0.610** (0.271) |

0.459 (0.378) |

-0.407** (0.189) |

-0.107 (0.296) |

||

CR |

-5.603 (3.649) |

-17.867*** (6.802) |

2.297 (1.976) |

2.266 (1.563) |

-2.964** (1.376) |

-5.243*** (1.224) |

||

Inf |

11.861* (6.744) |

8.334 (7.534) |

-17.925*** (4.699) |

-26.756*** (5.899) |

||||

Constant |

38.964*** (3.240) |

51.004*** (5.741) |

40.496*** (5.966) |

43.958*** (6.358) |

-1.621 (4.156) |

6.591 (4.978) |

||

Year Dummies |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

||

P-value of F-Test |

0.000 |

0.003 |

0.018 |

0.390 |

0.000 |

0.000 |

||

R-Square |

0.9001 |

0.6664 |

0.8385 |

|||||

Adj R- Square |

0.8625 |

0.5339 |

0.7743 |

|||||

Note: Standard errors in parentheses (* p < 0.05, ** p < 0.01, *** p < 0.001). |

As can be seen from the regression results in Table 2 , FDI has a positive and significant effect on export levels, although using the random effects panel, the effect of FDI is positive but not significant. This finding demonstrates that foreign investors have a major influence on the development of exports in host nations. According to the findings, FDI has a positive impact on exports both in the short and medium term. Furthermore, multinational firms are more likely than local firms to be significant exporters because of foreign investment, which is often made by firms that have previously exported (Khan & Kim, 1999). Due to a lack of data, our research cannot show the long-term impact of FDI on the nations investigated; nevertheless, in the case of Pakistan, the long-term effect of FDI on exports was favorable but not substantial, although it had a positive and substantial impact on imports in the long term, resulting in a worsening of the trade balance (Tabassum, Nazeer, & Siddiqui, 2012).

From the econometric results of the fixed effect modeling, we can see that changes in GDP have a positive and significant influence on the amount of exports. For the random-effects specification, the impact of GDP changes on exports is negative but not significant at any recognized level of significance.

Changes in the GDP of nations with which countries have trade links have a negative influence, although they are not significant at established levels of significance, in the fixed effect model. Although not statistically significant, this conclusion is intriguing since it implies that when other nations' economies expand, exports from the investigated countries decline. In the random effects specification, the findings are negative and significant. This may have different implications depending on the level of development of the exporting country, but one may be that the countries to which the Western Balkan nations export their goods consider some of these products to be inferior, which means that demand for these products decreases as people's income level rises.

According to the fixed effects model, the 2008–2012 economic crisis had no statistically significant impact on the level of exports. This might be because GDP declined at a ratio comparable to the actual level of exports during the crisis, and therefore the effect on exports as a proportion of GDP was minimal.

Moving on to the second part of the table, FDI in the Western Balkans had a positive and significant effect on import levels, in both the fixed and random effect models. This finding suggests that the demand for imported goods rises as FDI in Western Balkans nations increases. It is beyond the scope of this study to determine what these goods are or whether they are primary, intermediate, or consumer goods. However, there are at least two explanations for the increase in imports caused by FDI. One might be a rise in the demand for primary goods and services that foreign corporations cannot obtain in the place where they invest. In addition, FDI may improve people's disposable income, which may raise demand for foreign items and thus increase the flow of imports. These two mechanisms may cause imports to increase to a higher level. Our results are in line with a wide body of research that has examined this causal relationship in underdeveloped nations. According to Tabassum et al. (2012), FDI and imports have a strong long-term association in Pakistan. They determined that FDI in Pakistan has been directed toward companies that encourage import substitution rather than toward industries that boost exports (Tabassum et al., 2012).

Foreign investments, according to Demertzis and Pontuch (2013), initially produce an increase in demand that must be matched by imports, but, over time, they may have a favorable impact on the trade balance. Also, Mencinger (2008) showed that foreign investment has had a negative impact on the trade balance of countries that are considered new members of the EU. Despite receiving more investment than nations in the Western Balkans, the effects of that investment have been skewed towards imports (Demertzis & Pontuch, 2013; Mencinger, 2008).

Imports changed significantly as a percentage of GDP over the study period in both the fixed and random effect models. This confirmed the theory that in these countries the increase in GDP is linked to the increase in imports. Analyzing the table for the changes in GDP of the nations with which the countries have trade links reveals a positive link with imports, although this finding is only significant in the fixed effect model. The economic crisis of 2008–2012 did not have a significant impact on imports. Lastly, inflation had a positive impact on imports; however, this finding is only significant in the fixed effect model.

Considering the final part of the table, FDI had a negative and statistically significant influence on the balance of trade. This finding is in line with research on the relationship between FDI and developing countries' trade balances, such as that of Tabassum et al. (2012), which found that FDI had a significant positive impact on Pakistan's imports but had no significant impact on the country's exports, and thus had a negative impact on the country's trade balance. Khan and Kim (1999) also conducted a study in Pakistan and found that FDI had a negative impact on the trade balance, with imports suffering more than exports. They concluded that developing countries should encourage FDI in their export sector as well as in domestic markets (Khan & Kim, 1999).

FDI is argued to have a negative influence on developing countries' trade balance because of increased aggregate demand, which is covered in the short term by imports because it takes more time to increase domestic production capacity. This means that the short-term trade balance impact of FDI is expected to be negative; however, this could change in the long run.

Although FDI has a short-term negative impact on the trade balance of some new EU member countries, this impact decreases over time, according to Mencinger (2008). His results show that foreign investors invested in these countries, intending to lower the cost of living; however, the beneficial effect may not be sufficient to overcome potential structural deficits (Mencinger, 2008).

Data reporting for Western Balkan countries is limited, and there is no information available from before 2000, so we can only assess FDI's short-term impact on the trade balance. FDI has impacted both exports and imports in the short term, but the impact on imports has been greater and more significant, resulting in a negative net effect on the trade balance. To fully understand this occurrence, a more in-depth structural analysis would be beneficial, as the impact of FDI is highly dependent on the sectors in which it is implemented and the economic structure of the host country. For instance, FDI has an impact on imports and exports, but the trade balance effect is unclear when investments are made in the manufacturing sector, where there is more use of technology, leading to a greater increase in exports (Herrmann & Jochem, 2005).

Also, some argue that FDI increases competition within a country and, as a result, improves domestic firms’ quality of production, making them more competitive in foreign markets (Van Den Berghe, 2003). However, this cannot be substantiated based on the currently available data or the context of this study.

In the current study, FDI was found to have a negative and significant impact on the trade balance of the studied countries. To fully understand this result, additional research should examine the structural, economic, and social factors that may have contributed. Some of the factors that have contributed to FDI worsening the trade balance may include the short-term impact of FDI on demand growth and the structure of FDI in these countries (focused on services). An examination of the result table shows that all the coefficients, except Inf in the fixed effect model, have a negative impact on the trade balance, and these findings are all significant, except for FGDP in the random effect model.

6. Conclusion

This study used a model similar to that of Mencinger (2008) to assess the impact of FDI on the exports, imports, and trade balances of six Western Balkan nations (Kosovo, Albania, Northern Macedonia, Montenegro, Bosnia and Herzegovina, and Serbia). To examine this influence, panel data for these nations from 2000 to 2018 were utilized, and the data were summarized in a database containing 114 observations. Empirical research on developing nations is often connected with a lack of data for various time periods or with inconsistent and difficult-to-compare data. This will improve with time, therefore comparable future analyses employing more extensive datasets would be desirable.

To assess the effect of FDI on the trade balances of the studied countries, we developed three simple models to capture the marginal effect of FDI. We accomplished this by including several variables, the absence of which might have caused overestimation or underestimation of the FDI coefficient and negatively affected the parameters that assess the structure of the econometric model.

Our findings indicate that, in general, FDI has had a positive impact on the level of exports and imports in Western Balkan countries, expressed as a percentage of GDP. Both variables have a significant impact at the 95 percent confidence level, but the coefficient of FDI’s impact on imports is greater than the coefficient of its impact on exports (0.581 and 0.254, respectively). Both models are well specified, according to econometric analyses, and changes in the independent variables explain a large portion of the changes in the dependent variable.

There is a clear difference observable between FDI's influence on imports and exports when modeling the trade balance as a proportion of GDP. Overall, FDI had a negative influence on the Western Balkan nations' trade balances, calculated as a percentage of GDP, and this finding is significant at a significance level of 90%. However, despite its lesser importance for FDI's influence on the trade balance, the coefficient of -0.319 shows how FDI affects the Western Balkan nations' economic structure.

These findings are consistent with the empirical literature that has investigated the causal relationship between FDI and trade balance. Given the small amount of data and the limitations of this analysis, particularly the lack of structural investment information and the short period for which information was available, these findings provide an unsatisfactory picture of the impact of FDI on the trade balances of the studied countries.

We conclude that policymakers in the examined countries should exercise caution when implementing measures to attract FDI to reduce the short-term negative trade balance. As FDI stops flowing, demand rises in nations with less developed economies, which is largely met by increasing imports. Due to a lack of data, it is impossible to assess the medium- and long-term impacts of FDI on companies’ competitiveness in the countries where it has been implemented; however, research that has examined this long-term correlation estimates that FDI helps companies in host countries grow their export potential, which helps improve the country's trade balance.

Furthermore, the research suggests that the effect of FDI on the trade balance is highly influenced by the economic sector in which these investments are concentrated. Due to the constraints of our study, we have not been able to go into depth on this point, but an investigation into how foreign investment is spread across sectors within Western Balkan nations might reveal structural reasons for the effect of FDI on the balance sheet, trade, and economy of these countries.

References

Aaby, N.-E., & Slater, S. F. (1989). Management influences on export performance: A review of the empirical literature 1978-1988. International Marketing Review, 6(4).Available at: https://doi.org/10.1108/eum0000000001516.

Al-Hazaimeh, A., Al-Hyari, K., & Marwan, A.-N. (2011). Determinants of aggregate imports in Jordan: Empirical evidence (1976-2008). Journal of Economic Development, Management, IT, Finance, and Marketing, 3(1), 18-38.

Alexander, S. S. (1959). Effects of a devaluation: A simplified synthesis of elasticities and absorption approaches. The American Economic Review, 49(1), 22-42.

Bahmani-Oskooee, M. (1992). What are the long-run determinants of the US trade balance? Journal of Post Keynesian Economics, 15(1), 85-97.Available at: https://doi.org/10.1080/01603477.1992.11489927.

Bajo-Rubio, O. B. B., & Esteve, V. (2016). The effects of competitiveness on trade balance: The case of southern Europe. Economics, 10(1), 1-27.Available at: https://doi.org/10.5018/economics-ejournal.ja.2016-30.

Bickerdike, C. F. (1920). The instability of foreign exchange. The Economic Journal, 30(117), 118-122.Available at: https://doi.org/10.2307/2223208.

Botrić, V. (2013). Determinants of intra-industry trade between Western Balkans and EU-15: Evidence from bilateral data. International Journal of Economic Sciences and Applied Research, 6(2), 7-23.

Braga, H., & Willmore, L. (1991). Technological imports and technological effort: An analysis of their determinants in Brazilian firms. The Journal of Industrial Economics, 39(4), 421-432.Available at: https://doi.org/10.2307/2098441.

Cavusgil, S. T., & Naor, J. (1987). Firm and management characteristics as discriminators of export marketing activity. Journal of Business Research, 15(3), 221-235.Available at: https://doi.org/10.1016/0148-2963(87)90025-7.

Christensen, C. H., Da Rocha, A., & Gertner, R. K. (1987). An empirical investigation of the factors influencing exporting success of Brazilian firms. Journal of International Business Studies, 18(3), 61-77.Available at: https://doi.org/10.1057/palgrave.jibs.8490412.

Collier, P. (2002). Primary commodity dependence and Africa’s future (pp. 1–24): World Bank.

Demertzis, M., & Pontuch, P. (2013). The role of FDI in preventing imbalances in the euro area. Quarterly Report on the Euro Area (QREA), 12(2), 17-25.

Diamantopoulos, A., & Inglis, K. (1988). Identifying differences between high-and low-involvement exporters. International Marketing Review, 5(2), 52-60.Available at: https://doi.org/10.1108/eb008352.

Dominguez, L. V., & Sequeira, C. G. (1993). Determinants of LDC exporters' performance: A cross-national study. Journal of International Business Studies, 24(1), 19-40.Available at: https://doi.org/10.1057/palgrave.jibs.8490223.

Duasa, J. (2007). Determinants of Malaysian trade balance: An ARDL bound testing approach. Global Economic Review, 36(1), 89-102.Available at: https://doi.org/10.1080/12265080701217405.

Dwyer, J., & Kent, C. (1993). Estimation of demand for imports| RDP 9312: A re-examination of the determinants of Australia's imports. Reserve Bank of Australia Research Discussion Papers, (December).

Egwaikhide, F. O. (1999). Determinants of imports in Nigeria: A dynamic specification. AERC Research Paper 91, African Economic Research Consortium, Nairobi, IDS 019757, pp 1-32.

Falk, M. (2008). Determinants of the trade balance in industrialized countries (No. 013). FIW-Research Reports.

Funke, M., & Holly, S. (1992). The determinants of West German exports of manufactures: An integrated demand and supply approach. Weltwirtschaftliches Archiv, 128(3), 498-512.Available at: https://doi.org/10.1007/bf02707364.

GAP. (2011). Kosovo in CEFTA: In or out? Retrieved from from: http://www.institutigap.org/documents/72590_CEFTAEng.pdf.

Gashi, P. (2019). Trade and industrial development in Kosovo. In Western Balkan Economies in Transition (pp. 99-121). Cham: Springer.

Herrmann, S., & Jochem, A. (2005). Trade balances of the central and east European EU member states and the role of foreign direct investment (No. 2005, 41). Discussion Paper Series 1.

Horton, T., & Wilkinson, J. (1981). An analysis of the determinants of occupational upgrading. Economics of Education Review, 1(2), 273–1755.

Jongwanich, J. (2010). Determinants of export performance in East and Southeast Asia. World Economy, 33(1), 20-41.Available at: https://doi.org/10.1111/j.1467-9701.2009.01184.x.

Kakar, R., Waliullah, W., Khan, K. M., & Khan, W. (2010). The determinants of Pakistan’s trade balance: An ARDL cointegration approach. Lahore Journal of Economics, 15(1), 1–26.

Khan, A. H., & Kim, Y.-H. (1999). Foreign direct investment in Pakistan: Policy issues and operational implications. © Asian Development Bank. Retrieved from: http://hdl.handle.net/11540/2483.

Loewendahl, H. (2001). A framework for FDI promotion. Transnational Corporations, 10(1), 1-42.

Madsen, T. K. (1989). Successful export marketing management: Some empirical evidence. International Marketing Review, 6(4).Available at: https://doi.org/10.1108/eum0000000001518.

Mayer, J., Butkevicius, A., Kadri, A., & Pizarro, J. (2003). Dynamic products in world exports. Review of World Economics, 139(4), 762-795.Available at: https://doi.org/10.1007/bf02653112.

Mencinger, J. (2008). The 'Addiction' with FDI and current account balance. ICER Working Paper No.16/2008. International Center for Economic Research.

Montanari, M. (2005). EU trade with the Balkans: Large room for growth? Eastern European Economics, 43(1), 59-81.Available at: https://doi.org/10.1080/00128775.2005.11041096.

Panitchpakdi, S. (2005). Reflections on the last three years of the WTO. World Trade Review, 4(3), 367-378.

Reid, S. D. (1983). Managerial and firm influences on export behavior. Journal of the Academy of Marketing Science, 11(3), 323-332.Available at: https://doi.org/10.1007/bf02725228.

Rogers, A. (2000). An analysis of the determinants of Fiji's imports. Economics Department, Reserve Bank of Fiji, 13(4), 12-14.

Shawa, M. J., & Shen, Y. (2013). Analysis of the determinants of trade balance: Case study of Tanzania. International Journal of Business and Economics Research, 2(6), 134-141.

Tabassum, U., Nazeer, M., & Siddiqui, A. A. (2012). Impact of FDI on import demand and export supply functions of Pakistan: An econometric approach. Journal of Basic & Applied Sciences, 8(1), 151-159.Available at: https://doi.org/10.6000/1927-5129.2012.08.01.16.

Thursby, J., & Thursby, M. (1984). How reliable are simple, single equation specifications of import demand? The Review of Economics and Statistics, 66(1), 120-128.Available at: https://doi.org/10.2307/1924703.

Trivić, J., & Klimczak, Ł. (2015). The determinants of intra-regional trade in the Western Balkans. Proceedings of the Faculty of Economics in Rijeka: Journal of Economics and Business, 33(1), 37-66.

Van Den Berghe, D. (2003). UNCTAD world investment report 2002: Transnational corporations and export competitiveness. International Business Review, 3(12), 387-390.