Effects of Knowledge, Time Pressure and Personality on Professional Skepticism among Government Auditors

Erlane K Ghani1*

Zurialinda Abdul Jabal2

Gholamreza Zandi3

Qazi Muhammad Adnan Hye4

1Faculty of Accountancy, University Technology MARA Selangor, Malaysia. |

AbstractThis study aimed to examine the effects of knowledge, time pressure, and personality characteristics on professional skepticism among auditors. This study conducted a questionnaire survey of 258 auditors in a Malaysian government audit department. The results showed that of the three factors examined in this study, time pressure and personality characteristics influence the professional skepticism of auditors. However, the results showed that knowledge does not influence auditors’ professional skepticism. The findings in this study provide a greater understanding of the factors that lead to audit deficiencies caused by a lack of professional skepticism. These threats should be systematically assessed by regulators to determine the actions required to enhance and encourage professional skepticism in audit work. The findings in this study could help the auditors themselves to take preventive measures and adopt a more proactive approach in improving audit independence through professional skepticism. In addition, this study contributes to the existing literature by providing further evidence of the factors that may influence professional skepticism among auditors. |

Licensed: |

|

Keywords: |

|

Received: 22 November 2021 |

|

| (* Corresponding Author) |

Funding: This research is supported by Faculty of Accountancy, Universiti Teknologi MARA, Malaysia. |

Competing Interests: The authors declare that they have no competing interests. |

1. Introduction

In recent years, government audit departments have been troubled by many problems relating to integrity, credibility, and efficiency (Kozakov et al., 2021). One of the issues in Malaysia has been the appointment of the Auditor General, who is said to be closely related to the higher-ups in the government and have political influence. The appointment has raised concerns among people who question the transparency and independence of the auditors (Zul, Mohamed, & Ghani, 2020). Additionally, fraud and corruption scandals involving civil servants have increased the skepticism about auditors' competence when conducting audits. Professional skepticism is important, especially when audits are conducted in areas associated with significant judgments or transactions outside the ordinary scope of business, such as related party transactions that may be motivated by a desired outcome (Hurtt, 2010; Pringgabayu & Ramdlany, 2017). Besides that, skepticism may assist auditors in discovering fraud while auditing or help them in situations where perpetrators seek to hide their misstatements by deceiving the auditors. Moreover, the current global financial crisis and public outcry about the quality of audits have highlighted a need for professional skepticism to be more clearly demonstrated. Consequently, audit regulators are advised to examine professional skepticism and explain why auditors have at times seemed to lack the required professional skepticism (PCAOB, 2012).

Quadackers, Groot, and Wright (2014) emphasized that professional skepticism has a significant and positive relationship with auditors’ judgments and decisions because auditors make numerous judgments throughout the audit process before coming to decisions. They also found that the presumptive doubt perspective associated with professional skepticism is more effective in predicting material misstatement than the neutrality of auditors when dealing with higher-risk situations. This finding shows that auditors need to maintain some degree of uncertainty until the evidence indicates otherwise. According to Nelson (2009), an auditor’s judgment combined with their knowledge, traits, and incentives indicates their level of professional skepticism. Sayed Hussin, Iskandar, Saleh, and Jaffar (2017), in their study on the relationship between professional skepticism and auditors’ assessment of the risk of misstatement in financial statements, concluded that a lack of professional skepticism affected an auditor’s independence and audit quality. This finding is supported by Chiang (2016), who revealed that auditor independence is a fundamental antecedent of professional skepticism as it may enhance auditor’s integrity and objectivity in making professional judgments. However, auditor independence could be affected by conscious and unconscious bias, such as powerful incentives that reduce professional skepticism.

This study examines the influence of auditors’ knowledge, time pressures, and personal characteristics on their professional skepticism. In doing so, this study provides an understanding of the factors that lead to audit deficiencies caused by a lack of professional skepticism, based on the theoretical framework of Nolder and Kadous (2018). These threats should be brought to the regulators’ attention to determine the relevant actions to take to enhance and encourage professional skepticism in audit work. The remainder of this paper is organized as follows. The following section reviews the related literature and develops the hypotheses. It is followed by a description of the research method and subsequently the results and discussion. The final section includes suggestions for future research.

2. Literature Review

There is no general agreement on the definition of professional skepticism (Hurtt, 2010). The word skepticism originated from the Greek word ‘sceptikos,’ meaning ‘inquiring or reflective’ (Glover & Prawitt, 2014). Being skeptical is often associated with questioning, careful observation, probing reflection, and suspension of belief. It can also be related to an attitude that includes a questioning mind and the critical evaluation of audit evidence, which auditors should possess and apply throughout the audit process to maintain audit quality and auditors’ independence (PCAOB, 2012). Auditors’ professional skepticism comprises two components. The first is a skeptical mindset, which is a way of thinking or processing information. The second is a skeptical attitude, which is the way auditors cognitively and affectively evaluate the audit evidence obtained (Nolder & Kadous, 2018).

Nelson (2009) distinguished between two perspectives on professional skepticism: neutrality and presumptive doubt. Neutrality represents an auditor’s mindset in which no bias or dishonesty in financial statements is assumed, whereas the presumptive doubt mindset assumes the reverse. The study also indicated that in certain areas there is excessive audit evidence due to the implementation of the presumptive doubt perspective by regulators in their inspections. However, several studies have argued against the selection of a single perspective (either neutrality or presumptive doubt) for the entire audit. To achieve the optimal balance between effectiveness and efficiency, auditors may make use of the entire continuum of professional skepticism, depending on the particular situation during the audit (Glover & Prawitt, 2014). This continuum includes a behavioral range from complete trust to complete doubt, in which there is a level of audit evidence for each stage/level of the continuum, except complete trust. This stage includes no application of professional skepticism. Most studies on professional skepticism have investigated how skepticism influences audit judgments, for instance, in evaluating material misstatements in financial statements (Sayed Hussin et al., 2017) and audit engagement planning (Rodgers, Mubako, & Hall, 2017).

Furthermore, there are difficulties with the application of professional skepticism in auditing due to several factors. Hurtt, Brown-Liburd, Earley, and Krishnamoorthy (2013) outlined four antecedents of skeptical judgment, which comprise auditor characteristics (e.g., traits, experience, and training), evidential characteristics or lack of evidence, client characteristics (e.g., tendencies to get in with the auditors), and environmental influences (e.g., regulations and standards). In addition, incentives, traits, knowledge, and audit experience and training affect the auditors’ skeptical judgment and skeptical actions (Nelson, 2009). Auditors’ skepticism is influenced by both individual and social factors (Nolder & Kadous, 2018). Individual factors include auditors’ personality traits, knowledge, abilities, and motivations. Meanwhile, social factors include firm culture, client pressures, auditing standards, and firm methodology. For the purpose of this study, three key factors were selected: knowledge, time pressure, and personality traits. Personality traits include personal characteristics that may affect professional skepticism practices among auditors.

Knowledge comprises the information and skills gained through experience or education (Asadnezhad, Hejazi, Akbari, & Hadizadeh, 2017; Tanha, Salamzadeh, Allahian, & Salamzadeh, 2011). As an auditor, the need to have extensive knowledge is important (Cheng, Chelliah, & Teoh, 2021) because auditors must be a step ahead of the person they are auditing to avoid being manipulated by perpetrators. In addition, adequate knowledge offers advantages to the engagement team when interacting with clients about disputed accounting issues (Nelson, 2009). Knowledge also makes it easier for auditors to understand accounting and auditing standards, jargon, and audit procedures, which could affect their appropriate exercise of professional skepticism (Glover & Prawitt, 2014). Another group of studies, however, has found a negative relationship between knowledge and professional skepticism. Kaplan and Norton (1992) indicated that knowledge might not increase professional skepticism, arguing that as auditors become more experienced, their belief in free errors that offer relatively more probable explanations for the audit findings increases. This outcome is supported by Earley (2002). When she tested the use of information by experienced and new auditors, Earley found that experienced auditors tend not to look too deeply when the initial evidence meets their expectations, especially if the result shows problem-free financial statements. Based on this review of the ample literature on the relationship between knowledge and professional skepticism, this study proposed the following hypothesis:

H1: There is a significant relationship between auditor knowledge and professional skepticism.

Skeptical behavior might be influenced by the pressures auditors face to stay within the budgeted time (Nelson, 2009). Time budget pressure occurs when the amount of time budgeted to complete an audit is less than the actual time required (Sayed Hussin et al., 2017). Previous studies have shown that time budgets have a high probability of creating pressure because firms currently seem to use these budgets as a performance measurement tool instead of a control mechanism (Zul et al., 2020). Other studies have found a significant negative relationship between the variables. Individuals under high levels of time pressure demonstrate a low level of skepticism, are unable to detect contradictions in the audit case, and are more likely to collect and examine less evidence than individuals under moderate and tolerable levels of time pressure (Robinson, 2011). Time pressure also has a negative impact on auditors’ assessment of risk, whereby high time pressure keeps auditors’ from exerting appropriate and sufficient judgment towards the risk assessment of material misstatements, which may affect audit quality (Sayed Hussin et al., 2017). More experienced auditors have argued that pressure to meet the budget deadlines hinders their professional skepticism (Parlee, 2015). Time budget pressure also interacts with professional commitments that affect the underreporting of time (Andreas, 2016) decreasing auditors’ ability to identify material misstatement and negatively impacting audit quality (Bowrin & King, 2010). Based on the extensive literature review on the association between time budget pressure and professional skepticism, the proposed hypothesis was developed as follows:

H2: There is a significant relationship between time pressure and professional skepticism.

Personality is the combination of personal characteristics, attributes, and properties. Different people respond differently to issues based on their personalities. Thus, to better understand auditors’ personality characteristics, it is important to identify characteristics that may reduce audit quality (Gundry & Liyanarachchi, 2007; Ndinguri, Prieto, & Machtmes, 2012). Personality characteristics can be divided into two behavior types: Type A and Type B. Type A consists of characteristics such as aggressive, ambitious, competitive, impatient, experiencing higher levels of stress, having a greater sense of time urgency, and high commitment to occupational goals. These characteristics are opposite to the characteristics of people with Type B behavior (Fisher, 2001). These characteristics may have implications for audit quality. For example, if Type A auditors experience a higher level of stress due to time pressure or other factors, they might be prone to more dysfunctional behaviors. However, since they are committed to their occupational goals, they might be more cautious in their actions, and this caution would be reflected in the audit quality (Gundry & Liyanarachchi, 2007). Previous studies have suggested that there is a significant relationship between personality and audit quality, whereby audit quality is defined in terms of incomplete audit steps and procedures (premature sign-off) and the acceptance of weak explanations from clients (Gundry & Liyanarachchi, 2007). However, other studies, such as Fisher (2001), found no significant direct or moderated effect of personality characteristics on audit quality. Based on a comprehensive review of the literature on the relationship between personality characteristics and professional skepticism, the following hypothesis was proposed:

H3: There is a significant relationship between personality characteristics and professional skepticism.

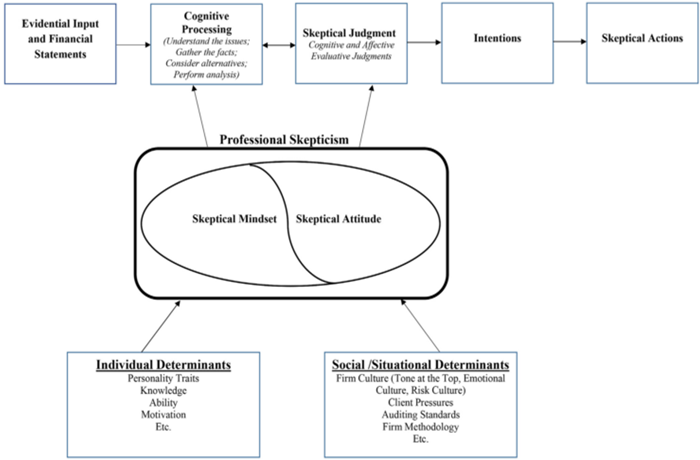

This study utilized the theoretical framework on professional skepticism designed by Nolder and Kadous (2018) as shown in Figure 1. This framework divides auditors’ professional skepticism into two components: skeptical mindset and skeptical attitude. The way the auditors think or process information about audit evidence or any related matters is called the skeptical mindset, whereas the skeptical attitude involves the auditors’ method of evaluating the evidence and managements’ assertions. The development of this framework was the study’s theoretical contribution to the auditing literature (Salamzadeh, 2020).

In terms of measuring the two concepts, mindsets are measured based on cognitive processing, while attitude is measured based on judgments. The influence of the auditors’ cognitive processing on their attitude leads to the subsequent events. For instance, more objective and critical processing of evidence would lead to more accurate ideas about risk. Furthermore, Figure 1 shows that professional skepticism is influenced by individual and social factors. Individual factors include auditors’ personality traits, knowledge, abilities, and more. Meanwhile, social factors include firm culture, client pressure, auditing standards, and more. Conceptualizing professional skepticism as both mindset and attitude allows for a complete view of skepticism and implies that both process measures (cognitive processing) and output measures (cognitive and affective measures) are relevant to measuring skepticism.

Figure 1. Antecedents and consequences of an auditor's professional skepticism (Nolder & Kadous, 2018).

3. Research Design

3.1. Sample Selection

The targeted sample for this study was the auditors of a Malaysian government audit department. Aside from its management, the department has three main sectors: the financial audit sector, performance audit sector, and governance audit sector. This structure applies not only at the headquarters’ level but also in each of the states. Each sector carries out its own type of audit. For instance, the financial audit sector is mainly involved with auditing the financial statements of federal government accounts, statutory bodies, and government-owned companies. Meanwhile, the performance audit sector focuses on evaluating the performance of government procurements, activities, and projects based on the three factors of economy, efficiency, and effectiveness. In total, there are 460 auditors in the government audit department.

This study applied a probability sampling method, specifically simple random sampling, where the sample in the population has a known zero chance of being chosen or equal chance of being selected. This study focused on the auditors working at the headquarters due to time constraints and the higher volume of audit work expected there. The targeted respondents occupied various positions, including professional and management levels and the support level. These respondents were selected to gain a clearer picture of which level the results have the most impact on. Normally, the support level focuses more on work in the field, which requires them to use their abilities and knowledge to determine the risk areas and use their professional judgment to make the right choices. Meanwhile, the professional and managerial levels act as superiors who are required to use their professional judgment to make decisions and guide the audit work appropriately so that the audit quality is not called into question. Professional skepticism is the antecedent of professional judgment and determines the efficiency and appropriateness of that particular judgment.

3.2. Research Instrument and Data Collection

In this study, primary data were collected by using a questionnaire. One advantage of using a questionnaire is the facilitation of data processing. The standardized questionnaire that was distributed to respondents made it easier to understand the data and guaranteed the data quality (Akbayrak, 2000). The questionnaire comprised four parts. The first part contained the respondent’s demographic information, including gender, age, years of work experience, education level, and professional membership. The remaining parts required the respondents to give their opinion of or reaction to each variable investigated in this study, i.e., professional skepticism, time pressure, and personality characteristics, aside from knowledge, which was measured based on the respondent’s years of work experience. A 5-point Likert scale, ranging from 1 (strongly disagree) to 5 (strongly agree), was used to measure the responses in parts two and three.

The second part of the questionnaire tested the respondents’ level of professional skepticism. This part consisted of 13 items derived from six identified characteristics of professional skepticism: a questioning mind, suspension of judgment, search for knowledge, interpersonal understanding, self-esteem, and autonomy.

In the third part of the questionnaire, the respondents were asked to give their thoughts on time pressure to measure the level of pressure on their current job or cultural style. This part of the questionnaire consisted of nine items.

The fourth and final part required the respondents to evaluate their personalities. A 5-point Likert scale ranging from 1 (never or almost never true) to 5 (always or almost always true) was used to measure the responses.

The questionnaire was developed using Google Forms. The link to the questionnaire was circulated using the WhatsApp application and email. These mechanisms were chosen to facilitate the process of completing the questionnaire for the respondents. A cover letter explaining the purpose and objective of the research and assuring the confidentiality of the information provided was attached to the questionnaire. A total of 259 responses were obtained.

4. Results

4.1. Descriptive Statistics

Table 1 presents the descriptive statistics for the items relating to professional skepticism. The overall mean score for the dependent variable is relatively low at 3.29. This score indicates that the respondents have a low level of discernment regarding professional skepticism. ‘The acceptance of other people’s explanations without further thought’ was the item that received the lowest mean score (mean = 2.13). Most respondents also disagreed that they do not feel sure of themselves, with a mean score of 2.14. On the other hand, the item ‘searching for knowledge,’ which measured professional skepticism, obtained the highest mean score of 4.03. It also received a maximum scale of 5 by the respondents.

| List of constructs and measures | Mean |

SD |

|

1 |

I often accept other people’s explanations without further thought. | 2.13 |

0.823 |

2 |

I am confident of my abilities. | 3.74 |

0.770 |

3 |

I often reject statements unless I have proof that they are true. | 3.45 |

1.036 |

4 |

Discovering new information is fun. | 3.91 |

0.916 |

5 |

Other people’s behavior does not interest me. | 2.72 |

0.863 |

6 |

My friends tell me that I usually question things that I see or hear. | 3.17 |

0.884 |

7 |

I like to understand the reason for other people’s behavior. | 3.71 |

0.780 |

8 |

I do not feel sure of myself. | 2.14 |

0.722 |

9 |

I dislike having to make decisions quickly. | 3.58 |

0.874 |

10 |

I like searching for knowledge. | 4.03 |

0.774 |

11 |

I frequently question things that I see or hear. | 3.76 |

0.796 |

12 |

It is easy for other people to convince me. | 2.60 |

0.830 |

13 |

I like to ensure that I’ve considered most available information before making a decision. | 3.86 |

0.910 |

The descriptive statistics of the variable knowledge are presented in Table 2. The mean for knowledge is a low score of 2.62. This score indicates that most of the respondents have between six to ten years’ work experience.

| List of Constructs and Measures | Mean |

SD |

| Years of Work Experience | 2.62 |

0.897 |

Table 3 presents the descriptive statistics for the items relating to time pressure. The overall mean for this independent variable is a moderate score of 3.68. This score indicates that the respondents have some discernment of time pressure. ‘Sign-off required audit step without completing it’ was the item with the lowest mean score of 2.85. On the other hand, the item ‘tightening of time allocation in recent years,’ which measured time pressure, obtained the highest mean score of 3.98, with a full scale of 5 chosen by many respondents. This outcome indicates that in recent years the auditors have been experiencing time pressure that influences their audit work.

Table 4 presents the descriptive statistics for the variable personality characteristics. The overall mean for this independent variable is a low score of 2.97. This score indicates that most respondents do not meet the criteria for Type A characteristics. The ‘peaceable’ characteristic received the lowest mean score of 2.28. In contrast, the ‘enthusiastic’ attitude obtained the highest mean score of 3.60 among the personality characteristics.

4.2. Preliminary Analyses

Table 5 presents the result of the preliminary tests, and it shows values for skewness of between -0.321 and 0.443. The values for kurtosis are between -1.010 and 1.801.

| List of constructs and measures | Mean |

SD |

|

1 |

Time allocation has become tighter in recent years. | 3.98 |

0.920 |

2 |

The time allocation interferes with the proper conduct of an audit. | 3.94 |

0.845 |

3 |

Time allocation attainment is a major factor in the performance evaluation process. | 3.94 |

0.859 |

4 |

The inclusion of specific audit steps in the audit program facilitates the proper overall conduct of an audit. | 3.84 |

0.866 |

5 |

The auditor’s professional judgment is always sufficient to overrule the performance of a specific audit step. | 3.17 |

0.972 |

6 |

In my opinion, some auditors in my department sign-off the required audit step without actually completing it. | 2.85 |

0.914 |

7 |

The time allocation has a significant influence on the auditor’s job performance. | 3.95 |

0.839 |

8 |

When the time allocation had exceeded in one phase of an audit, the auditor feels the need to save time elsewhere. | 3.71 |

0.838 |

| List of Constructs and Measures | Mean |

SD |

|

1 |

Energetic | 3.51 |

0.715 |

2 |

Quite | 3.10 |

0.767 |

3 |

Outspoken | 2.79 |

0.883 |

4 |

Self-Confident | 3.56 |

0.761 |

5 |

Peaceable | 2.28 |

0.662 |

6 |

Aggressive | 2.86 |

0.948 |

7 |

Quick | 3.48 |

0.763 |

8 |

Calm | 2.51 |

0.904 |

9 |

Forceful | 2.58 |

0.833 |

10 |

Enterprising | 3.40 |

0.740 |

11 |

Relaxed | 2.64 |

0.810 |

12 |

Headstrong | 3.05 |

0.866 |

13 |

Tense | 2.88 |

0.846 |

14 |

Enthusiastic | 3.60 |

0.786 |

15 |

Irritable | 2.58 |

0.804 |

16 |

Ambitious | 3.44 |

0.729 |

17 |

Dominant | 2.69 |

0.801 |

18 |

Assertive | 3.58 |

0.804 |

19 |

Argumentative | 2.93 |

0.892 |

20 |

Excitable | 3.29 |

0.749 |

21 |

Mild | 2.64 |

0.750 |

22 |

Loud | 2.71 |

0.824 |

23 |

Individualistic | 2.35 |

0.808 |

24 |

Easy-Going | 2.41 |

0.709 |

25 |

Talkative | 3.00 |

0.826 |

26 |

Outgoing | 3.19 |

0.660 |

27 |

Cautious | 2.69 |

0.619 |

28 |

Strong | 3.38 |

0.754 |

| Variables | Normality Test |

||

Skewness |

Kurtosis |

Mean |

|

| Professional Skepticism | -0.321 |

1.801 |

3.29 |

| Knowledge | 0.443 |

-1.010 |

2.62 |

| Time Pressure | -0.356 |

1.224 |

3.68 |

| Personality Characteristics | 0.255 |

-0.685 |

2.97 |

Table 6 presents the results of the correlation coefficient matrix and the level of significance of the variables. The range of the Pearson’s correlation coefficient r values is between -0.577 and 0.703. Therefore, there is no multicollinearity since all the independent variables have correlation coefficient values under the -0.8 to 0.8 range.

| Variable | DV |

IV11 |

IV12 |

IV13 |

IV2 |

IV3 |

|

| DV | Pearson Correlation | 1 |

-0.206 |

0.075 |

1.62 |

0.703 |

0.231 |

| Sig. (2-tailed) | 0.028 |

0.247 |

0.068 |

0.000 |

0.016 |

||

| IV11 | Pearson Correlation | 1 |

-0.520 |

-0.577 |

-0.161 |

-0.038 |

|

| Sig. (2-tailed) | 0.000 |

0.000 |

0.069 |

0.363 |

|||

| IV12 | Pearson Correlation | 1 |

-0.273 |

0.041 |

-0.057 |

||

| Sig. (2-tailed) | 0.000 |

0.005 |

0.354 |

0.300 |

|||

| IV13 | Pearson Correlation | 1 |

0.086 |

0.151 |

|||

| Sig. (2-tailed) | 0.216 |

0.082 |

|||||

| IV2 | Pearson Correlation | 1 |

0.085 |

||||

| Sig. (2-tailed) | 0.220 |

||||||

| IV3 | Pearson Correlation | 1 |

|||||

| Sig. (2-tailed) | |||||||

| Key: DV = Professional Skepticism; IV11 = Knowledge (Exp2 – 6 to 10 years); IV12 = Knowledge (Exp3 – 11 to 15 years); IV13 = Knowledge (Exp3 – > 16 years); IV2 = Time Pressure; IV3 = Personality Characteristics. |

4.3. Factors Influencing Professional Skepticism

The results of the multiple regression and overall statistics are summarized in Table 7. The R2 value indicates that 53.8% of the variation in professional skepticism is explained by the variation of knowledge, time pressure, and personality characteristics. In addition, the F-value shows that this set of variables is deemed significant [F (5,80) = 18.600, p < 0.001], in that one of the predictors (independent variables) has a significant linear relationship with professional skepticism (dependent variable). This outcome is proven since the p-values of time pressure (p-value = 0.000) and personality characteristics (p-value = 0.042) are less than 0.05, indicating that time pressure and personality characteristics affect professional skepticism at the 5% significance level (a=0.05). As such, H2 and H3 are supported. Meanwhile, the different knowledge categories have p-values of 0.711, 0.394, and 0.350, respectively, which are higher than 0.05 at the 5% significance level (a=.05), providing evidence that knowledge does not significantly affect professional skepticism. Therefore, H1 is not supported.

The multiple regression equation for this study is as follows:

Yi = β0 + β1D1i+ β2iD2i+ β3iD3i+ β4X4 + β5X5 + Ei

Where:

Professional Skepticism = β0 + β1D1iKnowledge [Years of work 6–10 years) + β2iD2iKnowledge [Years of work 11–15 years) + β3iD3iKnowledge [Years of work >16 years) + β4Time Pressure + β5Personality Characteristics + Ei

| Variables | Unstandardized coefficient beta |

t-Value |

Significance |

|

| Constant | -0.262 |

-0.43 |

0.966 |

|

| Knowledge (Exp2 6 to 10yrs) | 0.813 |

0.372 |

0.711 |

|

| Knowledge (Exp3 10 to 15yrs) | 1.978 |

0.857 |

0.394 |

|

| Knowledge (Exp4 >16 yrs) | 2.155 |

0.940 |

0.350 |

|

| Time Pressure | 1.133 |

8.773 |

0.000 |

|

| Personality Characteristics | 0.108 |

2.063 |

0.042 |

|

| R square (R2) = 0.538 F value = 18.600 Significance = 0.000 |

||||

Based on the conducted multiple regression analysis, it can be concluded that of the three hypotheses developed in this study, two are supported by the evidence. These hypotheses are H2: Time Pressure has a significant relationship with professional skepticism and H3: Personality characteristics have a significant relationship with professional skepticism. Further analysis of the role of time pressure showed a significant linear relationship between time pressure and professional skepticism, in which the significant value is equal to 0.000 (p-value <0.05) at the 95% confidence level. Therefore, H2 is supported. The result is consistent with Robinson (2011), who found that individuals under high time pressure exhibit a lower degree of skepticism than individuals under moderate time pressure.

The findings for H3 showed a significant relationship between personality characteristics and professional skepticism, in which the p-value is 0.042 (less than 0.05). This outcome is consistent with Gundry and Liyanarachchi (2007), who found a significant relationship between personality and audit quality in terms of premature sign-off and accepting weak explanations from clients.

However, the test of H1 did not support the hypothesis. H1 states that knowledge has a significant relationship with professional skepticism. The results indicate that there is no significant relationship between knowledge and professional skepticism since the significant value is more than 0.05 (p-value = 0.711, 0.394, and 0.350 for Exp2, Exp3, and Exp4, respectively). Therefore, regardless of the length of the auditor’s work experience, their level of knowledge does not determine their level of professional skepticism.

5. Conclusion

This study examined the factors that might influence professional skepticism among auditors. To achieve its objective, this study conducted a multiple regression analysis on three independent variables (auditor’s knowledge, time pressure, and personality characteristics) and professional skepticism, the dependent variable. The results showed that of the three hypotheses developed, two hypotheses, H2 [Time Pressure has a significant relationship with professional skepticism] and H3 [Personality characteristics have a significant relationship with professional skepticism], were supported by the data. However, H1 [Knowledge has a significant relationship with professional skepticism] was not supported. These results provide a greater understanding of the factors leading to audit deficiencies caused by a lack of professional skepticism.

It is advisable for regulators to assess similar threats to determine the actions required to enhance and encourage professional skepticism in audit work. In addition, this study might assist the government’s audit departments or the auditors themselves in taking preventive measures and assuming more proactive approaches to improving audit independence in a way that reflects professional skepticism. Such approaches would include comprehensive audit planning with proper schedules to avoid time pressure, which could cause audits to be signed off prematurely, and implementing a positive workplace culture to motivate the auditors. The audit departments should also provide sufficient and effective training, especially to new recruits and junior staff, to ensure that they are all equipped with the appropriate knowledge. Last but not least, the departments should be adequately monitored by superiors/seniors to ensure that audits are conducted properly.

This study is not without limitations. First, this study only examined three variables: knowledge, time pressure, and personality characteristics. There are other variables that were not included in this study. Perhaps, future studies could extend this study by including other variables. Secondly, the number of respondents in this study could be considered low. Increasing the number of respondents might provide more robust findings. Future results could provide an in-depth understanding of the factors that lead to audit deficiencies caused by a lack of professional skepticism.

References

Akbayrak, B. (2000). A comparison of two data collecting methods: Interviews and questionnaires. Journal of Hacettepe University Faculty of Education, 18(18), 1-8.

Andreas. (2016). Interaction between time budget pressure and professional commitment towards underreporting of time behaviour. Procedia - Social and Behavioural Sciences, 219, 91–98.

Asadnezhad, M., Hejazi, R., Akbari, M., & Hadizadeh, E. (2017). Designing the business model of herbal pharmaceutical knowledge based companies. Journal of Entrepreneurship, Business and Economics, 5(2), 47-63.

Bowrin, A. R., & King, J. (2010). Time pressure, task complexity, and audit effectiveness. Managerial Auditing Journal, 25(2), 160–181. .

Cheng, J., Chelliah, S., & Teoh, A. P. (2021). The effect of subsidiary characteristics on efficiency in knowledge transfer between multinational companies. Journal of Entrepreneurship, Business and Economics, 9(1), 230-274.

Chiang, C. (2016). Conceptualising the linkage between professional scepticism and auditor independence. Pacific Accounting Review, 28(2), 180-200.

Earley, P. C. (2002). Redefining interactions across cultures and organizations: Moving forward with cultural intelligence. In B. M. Staw & R. I Sutton (Eds.), Research in organizational behaviour (pp. 271- 299). New York: JAI Press.

Fisher, R. T. (2001). Role stress, the type a behavior pattern, and external auditor job satisfaction and performance. Behavioral Research in Accounting, 13(1), 143-170.

Glover, S. M., & Prawitt, D. F. (2014). Enhancing auditor professional skepticism: The professional skepticism continuum. Current Issues in Auditing, 8(2), P1-P10.

Gundry, L. C., & Liyanarachchi, G. A. (2007). Time budget pressure, auditors' personality type, and the incidence of reduced audit quality practices. Pacific Accounting Review, 19(2), 125–152.

Hurtt, R. K. (2010). Development of a scale to measure professional skepticism. Auditing: A Journal of Practice & Theory, 29(1), 149-171.

Hurtt, R. K., Brown-Liburd, H., Earley, C. E., & Krishnamoorthy, G. (2013). Research on auditor professional skepticism: Literature synthesis and opportunities for future research. Auditing: A Journal of Practice & Theory, 32(Supplement 1), 45-97.Available at: https://doi.org/10.2308/ajpt-50361 .

Kaplan, R., & Norton, D. (1992). The balanced scorecard: measures that drive performance. Harvard business review: On measuring corporate performance. Boston, MA: Harvard Business School Press.

Kozakov, V., Kovalenko, N., Golub, V., Kozyrieva, N., Shchur, N., & Shoiko, V. (2021). Adapatation of the public administration system to global risks. Journal of Management Information and Decision Sciences, 24(2), 1-8.

Ndinguri, E., Prieto, L., & Machtmes, K. (2012). Human capital development dynamics: The knowledge based approach. Academy of Strategic Management Journal, 11(2), 121-136.

Nelson, M. W. (2009). A model and literature review of professional skepticism in auditing. Auditing: A Journal of Practice & Theory, 28(2), 1-34.Available at: https://doi.org/10.2308/aud.2009.28.2.1 .

Nolder, C. J., & Kadous, K. (2018). Grounding the professional skepticism construct in mindset and attitude theory: A way forward. Accounting, Organizations and Society, 67, 1-14.Available at: https://doi.org/10.1016/j.aos.2018.03.010 .

Parlee, M. C. (2015). Promoting professional skepticism in the audit environment (Order No. 10190461). ProQuest Dissertations & Theses Global. (1854137551).

PCAOB. (2012). Staff audit practice alert SAPA No. 10 Maintaining and applying professional skepticism in audits. PCAOB, 35(2), 1–10.

Pringgabayu, D., & Ramdlany, D. M. A. (2017). Creating knowledge management with the role of leadership and organizational culture. Journal of Entrepreneurship, Business and Economics, 5(2), 147-171.

Quadackers, L., Groot, T., & Wright, A. (2014). Auditors’ professional skepticism: Neutrality versus presumptive doubt. Contemporary Accounting Research, 31(3), 639-657.

Robinson, S. N. (2011). An experimental examination of the effects of goal framing and time pressure on auditors' professional skepticism (Order No. 3529253). ProQuest Dissertations & Theses Global. (1041248324).

Rodgers, W., Mubako, G. N., & Hall, L. (2017). Knowledge management: The effect of knowledge transfer on professional skepticism in audit engagement planning. Computers in Human Behavior, 70, 564-574.

Salamzadeh, A. (2020). What constitutes a theoretical contribution? Journal of Organizational Culture, Communications and Conflict, 24(1), 1-2.

Sayed Hussin, S. A. H., Iskandar, T. M., Saleh, N. M., & Jaffar, R. (2017). Professional skepticism and auditors’ assessment of misstatement risks: The moderating effect of experience and time budget pressure. Economics & Sociology, 10(4), 225–250.Available at: https://doi.org/10.14254/2071-789x.2017/10-4/17 .

Tanha, D., Salamzadeh, A., Allahian, Z., & Salamzadeh, Y. (2011). Commercialization of university research and innovations in Iran: Obstacles and solutions. Journal of Knowledge Management, Economics and Information Technology, 1(7), 126-146.

Zul, N., Mohamed, N., & Ghani, E. K. (2020). The effect of first line defence officers on money laundering risks prevention in financial institutions in Malaysia. Solid State Technology, 63(6), 9374-9393.