Empirical and Evidence-Based Investigation: External Debt, Poverty and Economic Growth Nexus

Emmanuel Okokondem Okon1

Onoja Israel Monday2

1,2Department of Economics, Kogi State University, Anyigba, Kogi State, Nigeria. |

AbstractThis study analyses the relationship among external debt, poverty and economic growth in Nigeria using annual time series data for the period 1986 through 2016 and employing a multivariate regression approach to estimate the augmented growth model specified. It was revealed that external debt is negatively and significantly related to economic growth. Also, positive and insignificant relationship between external debt service and economic growth was observed. There posit a positive significant relationship between exchange rate and economic growth. Finally, the empirical findings of this study shows positive significant relationship between per capita income (a measure of poverty level) and economic growth. However, an evidence-based survey conducted shows that the target beneficiaries did not actually benefit from the various poverty alleviation programmes set up in the country. In that light, government must build on already existing civil society groups, community-based organisations and their activities where possible when delivery services and resources to rural areas and communities in poverty and adequate financial markets access and strong bond market must be ensured by government to fortify the mechanism for efficient management of its debts. |

Licensed: |

|

Keywords: |

|

| (* Corresponding Author) |

1. Introduction

Most empirical studies have delved into the relationship between debt and growth, debt and/or poverty and growth. Notable studies on the relationship between debt and growth include those by Chowdhury (1994); Sawada (1994); Elbadawi, Ndulu, and Ndung'u (1996); Pattilo, Helen, and Luca (2004); Atique and Malik (2012) and Kasidi and Said (2013). Malik, Hayat, and Hayat (2010) explored the relationship between external debt and economic growth in Pakistan for the period between 1972 – 2005 using time series econometric technique. Their result shows that external debt is negatively and significantly related to economic growth. The evidence suggests that increase in external debt will lead to decline in economic growth. Previous study by Hameed, Ashraf, and Chaudhary (2008) on Pakistan analysed the long run and short run relationships between external debt and economic growth. Annual time series data from 1970 to 2003 was obtained to examine the dynamic effect of GDP, debt service, capital stock and labour force on her economic growth. The study concludes that debt servicing burden has a negative effect on the productivity of labour and capital, thereby adversely affecting economic growth. Rabia and Kamran (2012) explain that the impact of external borrowing on economic growth has been studied by many Economists. In conclusion some researchers found that there is a positive relationship between foreign debt and economic growth, while others found that there is a negative impact of foreign debt on economic growth, due to the inefficient distribution of the resources, they also stated that economic theories suggest that external debt might add value to the country’s economic growth if its employed effectively and efficiently.

Notable studies on the relationship between poverty and growth include those by De Janvry and Sadoulet (2000); Ravallion and Chen (2003); Basu and Mallick (2008); Odhiambo (2011); Sala-i-Martin and Pinhovskiy (2010); Arif and Farooq (2011); Young (2012) and McKay (2013). De Janvry and Sadoulet (2000) analysed the determinants of change in poverty and inequality in 12 Latin American countries for the period 1970–1994. They found evidence suggesting that per capita aggregate income growth leads to a reduction in the incidence of urban and rural poverty.

In Nigeria, Adepoju, Salau, and Obayelu (2007) analysed the time series data for over a period from 1962 to 2006. Exploring time to time behaviour of donor agencies as an outcome of various bilateral and multilateral arrangements, they concluded that accumulation of external debt hampered economic growth in Nigeria. Tomori and Adebiyi (2002) demonstrated that the increases in government expenditure on debt service obligations tend to adversely affect development from the distribution perspective, as the poor are likely to receive the short and of the stick in expenditure reduction measures. Sulaiman and Azeez (2012) carried out a study on the effect of external debt on the economic growth of Nigeria. Annual time series data covering the period 1970 to 2010 was employed. The empirical analysis was carried out using econometric techniques of Ordinary Least Squares (OLS), Augmented Dickey-Fuller (ADF) unit root test, Johansen Co-integration test and Error Correction Method (ECM). The co-integration test revealed a long-run relationship amongst the variables and findings from the error correction model revealed that external debt has contribute positively to the growth of the Nigerian economy.

Many studies were conducted to verify the theoretical postulation relating to poverty and growth nexus in Nigeria. For instance, Aigbokhan (2000); Osinubi (2006); Akanbi and Toit (2011); Adigun, Awoyemi, and Omonona (2011); Okoroafor and Chinweoke (2013); Stephen and Simoen (2013) and Nuruddeen and Ibrahim (2014). From the above peruse literature review, it could be seen most of the previous studies analysed either the effect of external debt on economic growth or the effect of poverty reduction on economic growth in Nigeria. None of these studies incorporated the idea of studying side by side the effect of external debt and poverty on economic growth. This relationship is important especially for economic policies. However, some of the research work was carried out a long time ago, and there have been a number of structural changes in the economy between the time these studies were carried out and the current situation in Nigeria. This study also attempts to provide evidence –based effect of poverty reduction programmes on the poor (beneficiaries) through field survey.

The paper is broadly divided into five sections. Following this introduction, Section 2 provides an overview of external debt, poverty level and programmes in Nigeria. Section 3 indicates the methodology including the data Sources, model and method of analysis. Section 4 presents results and discussion. Section 5 gives summary, conclusion and recommendations.

2. External Debt, Poverty Level and Programmes in Nigeria: Overview

Nigeria like most highly indebted poor countries has low economic growth and low per capita income, with domestic savings insufficient to meet developmental and other national goals. Nigerian exports were primarily primary commodities with export earnings too small to finance imports which are mostly capital intensive (Manufactured) goods which are comparably more expensive (Siddique, Selvanathan, & Selvanathan, 2015). Compounding the problem is Nigeria’s drift to mono economy with the discovery of oil. The oil sector generates about 95% of foreign exchange earnings and about 80 per cent of budgetary revenue. The inability to diversify her revenue sources coupled with corruption and mismanagement compels Nigeria to have inadequate fund for growth and developmental projects such as roads, electricity pipe borne water and so on.

The quest for economic growth and development compelled Nigeria to acquire external debt. The first major external loan of US$28 million by Nigeria was acquired from World Bank in 1958 to finance railway construction. Ever since then, there has been accumulation of loans aimed at various development projects. As the amount of loans increased, Debt Management Office (DMO) was established in October, 2000. Prior to the establishment of DMO, Central Bank of Nigeria (CBN) was saddled with the responsibility of management of national debts. At moment, DMO in collaboration with CBN and Federal Ministry of Finance manage Nigeria’s debts (Nwannebuike, Ike, & Onuka, 2016).

There are large resources (human and physical) endowed in Nigeria. However, the country has increasing rate of poverty both at the regions and at the national level, high unemployment rate, high income inequality, low quality human capital, high percentage of population on welfare and high out migration in the face of high economic growth measured by GDP. Information from the National Bureau of Statistics – NBS (2012); UNDP (2009) showed that about 15% of Nigeria’s population was poor in 1960. Poverty rates in Nigeria increased from 27.2 per cent in 1980 to 42.7 per cent in 2004 and further to 65.6 per cent in 2010.While the27.2 per cent for 1980 equals‟ 17.7 million persons, in 2010, 112.5million persons were found poor in absolute terms.

In Nigeria, various efforts were made by the government, non-governmental organizations and individuals to reduce poverty in the country. According to Ogwumike (2001) poverty reduction measures implemented so far in Nigeria focuses more attention on economic growth, basic needs and rural development strategies. The economic growth approach focuses attention on rapid economic growth as measured by the rate of growth in real per capita GDP or per capita national income, price stability and declining unemployment among others, which are attained through proper harmonization of monetary and fiscal policies. The basic need approach focuses attention on the basic necessities of life such as food, health care, education, shelter, clothing, transport, water and sanitation, which could enable the poor live a decent life. The rural development approach focuses attention on the total emancipation and empowerment of the rural sector.

Furthermore, Ogwumike (2001) grouped the strategies for poverty reduction in Nigeria into three eras – the pre–SAP era, the SAP era and the democratic era. In the pre-SAP era, the measures that were predominant were the Operation Feed the Nation, the River Basin Development Authorities, the Agricultural Development Programmes, the Agricultural Credit Guarantee Scheme, the Rural Electrification Scheme and the Green Revolution. In the SAP era the following poverty reduction measures were introduced; the Directorate for Food, Roads and Rural Infrastructures, the National Directorate of Employment, the Better Life Programme, the Peoples‘ Bank, the Community Banks, the Family Support Programme and the Family Economic Advancement Programme. The democratic era witnessed the introduction of the Poverty Alleviation Programme (PAP) designed to provide employment to 200,000 people all over the country. It was also aimed at inculcating and improving better attitudes towards a maintenance culture in highways, urban and rural roads and public buildings. By 2001 PAP was phased out and fused into the newly created National Poverty Eradication Programme (NAPEP) which was an integral part of the National Economic Empowerment and Development Strategy (NEEDS).3. Methodology

3.1. Data Sources and Method of Analysis

In examining the relationship between external debt, poverty and growth in Nigeria, the study employed data that are secondary in nature. The annual time series data from 1986-2016 were obtained from institutional and academic publications. They include CBN Statistical Bulletin of various years, Nigerian Bureau of Statistics annual publications, Debt Management Office, World Bank, CIA fact book, various academic journals. The estimation technique was Ordinary Least Square (OLS). The computational device was the E-view software (version 7.0). Among the tests conducted ware t- test, to ascertain the significance of regression coefficients (Gujarati, 2003) F-test, for the overall significance of our model (a test of goodness of fit of the model) (Patterson & Okafor, 2007); (R2) Coefficient of determination (Gujarati, 2003) which gives the proportion of the variation in the dependent variable explained by the independent variables. Also, stationarity test was conducted to ascertain the stationarity conditions of the series. As such, Augmented (Dickey & Fuller, 1979) test was employed.

In examining the effect of poverty reduction programmes on the poor, primary data were obtained from a survey conducted with a well-constructed 7-item questionnaire developed by the researchers based on the objective of the study. A total of 150 questionnaires were distributed randomly among residents of Anyigba town comprising students, traders, farmers, civil servants and business men and women. Illiterate respondents were interviewed and the questionnaire filled by the researcher. However, a total of 112 questionnaires were retrieved which indicate a response rate of about 74.7% proportion of the sample size. Tables, graphs, percentage and other simple statistical tools were used in the analysis of the data collated.

3.2. Model I

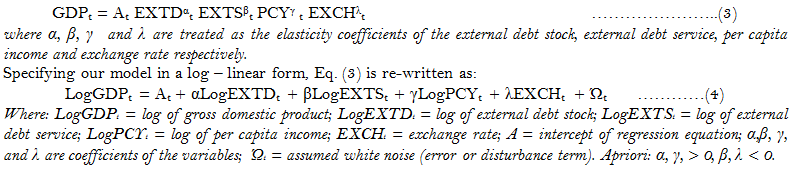

To capture the relationship between external debt, poverty, and economic growth a neoclassical production function is assumed. The production function is of the form given below:

Y = F (L, K, T) ……………….. (1)

Where: Y = Output; K = Capital; L = Labour; and T = Technical Progress.

Equation 1 states that output growth can be enhanced by promoting be physical and human capital.

Capital goods are mainly imported and some inputs are domestically produced through the investment process. The labour input is either skilled or unskilled labour. The supply of unskilled labour is not constraint in LDCs, given the huge unemployment pool. Foreign borrowings allowed a country to maintain domestic investment and economic growth and poverty reduction at levels beyond those that could be financed through domestic savings. Thus, external debt helps to finance development of both physical and human capital. Therefore, a debt augmented neoclassical production function is put thus:

Y = F (L, K,T,E, Ӂ) ……………….. (2)

Where: E = External debt stock; and Ӂ = Variables that determines growth

Following this line of reasoning, the model employs in this study closely follows the one employed by James (2003) and Oyedele, Emerah, and Ogege (2013). The model allows for the inclusion of variables that are of great importance to Nigerian economy and this study.

Y = ƒ(External debt, External debt service, Per capita income, Exchange rate).

The Linear specification is given as:

3.3. Model II

In an attempt to examine the effect of poverty reduction programme on the poor, the chi-square test was employed to analyse the discrepancies between observed and expected frequency. The chi-square was calculated by the summation of the observed value minus the expected value divided by the expected value.Thus:

4. Result and Discussion

4.1. Model I Result

| Variables | ADF statistics |

5% critical value |

Order of Integration | Lag length |

Probability |

Remarks |

| LNGDP | -5.048743 |

-2.981038 |

First Difference I(1) | 1 |

0.0004 |

Stationary |

| LNEXTD | -3.716204 |

-2.976263 |

First Difference I(1) | 0 |

0.0096 |

Stationary |

| LNPCY | -5.566069 |

-2.998064 |

First Difference I(1) | 4 |

0.0002 |

Stationary |

| LNEXTS | -4.528150 |

-2.976263 |

First Difference I(1) | 0 |

0.0013 |

Stationary |

| EXCH | -4.409014 |

-2.976263 |

First Difference I(1) | 0 |

0.0018 |

Stationary` |

| Source: Computation from Eviews 7.0 software |

To avoid the problem of spurious regression (Granger & Newbold, 1974) we tested for unit root. The Augmented Dickey-Fuller (ADF) Unit Root Test result in Table 1 shows that all the variables were stationary at first difference given the 5% critical value.

| Variables | Coefficient |

Standard Error |

T-Values |

P-Values |

| CONSTANT | 15.83714 |

1.854984 |

8.537617 |

0.0000 |

| LNEXTD | -0.315629 |

0.158784 |

-1.987787 |

0.0584 |

| LNEXTS | 0.003664 |

0.128357 |

0.028545 |

0.9775 |

| LNPCY | 0.283478 |

0.109093 |

2.598494 |

0.0158 |

| EXCH | 0.016719 |

0.003630 |

4.605291 |

0.0001 |

| R2 = 0.878495; R2* = 0.858244; F* = 43.38059; DW Statistics = 1.97966 | ||||

| Source: Computation from Eviews 7.0 software |

As revealed in the static regression result in Table 2 above, the constant has no significant meaning in the model other than reflecting the value of the dependent variable when other explanatory variables are held constant. The value of the constant term shows that when all other variables are held constant, LNGDP will increase by 15.83714units all things being equal. The result shows that external debt (LNEXTD) is negatively and significantly related to economic growth. The evidence suggests that a unit increase in external debt leads to decline in economic growth by 0.315629 units. The inverse relationship observed in this study between external debt and economic growth is contrary to apriori expectation but aligns with Malik et al. (2010) that explored the relationship between external debt and economic growth in Pakistan for the period 1972 - 2009, using time series econometric technique. A plausible reason for the result obtained in this study is that external debt may have negative impact on investment through debt overhang and credit-rationing problem (Eduardo, 1989). Debt overhang phenomenon is where substantial resources are used for debt servicing such that it stifles economic growth. It becomes a tax on domestic production such that the amount spent hampers meaningful economic growth activities as it reduces resources available to government to implement growth oriented economic policies. Credit rationing effect results when a country is unable to pay her debts. The authorities increase interest rates to narrow savings investment gap, thus affecting new investment, generating greater surplus for debt servicing and repayment. However, this may subsequently depress future growth prospects (Nwannebuike et al., 2016).

According to the Director General of the Debt Management Office (DMO), Dr Abraham Nwankwo, Nigeria’s debt to GDP remains sustainable even as Nigerians have continued to express worries the spike in the country’s debt profile could be another time bomb for future generation.

He said that the external debt stock was currently about 23 per cent of the export earnings, compared to the applicable threshold is 150 per cent, adding that this is seven times stronger than it needs to be (Anumihe, 2016). Nwankwo also argued that Nigeria’s external debt is uniquely of top investment grade and this is the reason that in spite of global economic and financial tribulations, Nigeria’s Eurobonds have continued to trade creditably at stable low yields relative to the weight of the challenges and compared to other countries’ Eurobonds. For instance, as at June 30, 2016 the nation’s total debt was $61 billion (N16 trillion) made up of outstanding external debt stock for states and federal Government is $11 billion (N3 trillion), domestic debt for federal Government is $37 billion (N11 trillion) and

domestic debt for states is $12 billion (N3 trillion) (Anumihe, 2016).

Also, emanated results in Table 2 exert a positive relationship between external debt service (LNEXTS) and economic growth. The positive sign exhibited by the coefficient of LNEXTS is against economic theory and contrary to the empirical study by Hameed et al. (2008) which concludes that debt servicing burden has a negative effect on the productivity of labour and capital, thereby adversely affecting economic growth. According to the Director General of the Debt Management Office (DMO), Dr Abraham Nwankwo, the external debt service is currently about 0.74 per cent of total export earnings, compared to the applicable threshold of 20 per cent: this means that this liquidity indicator is 27 times stronger than what is required to guarantee that the external debt can be serviced as and when due. In addition, there is an administrative safeguard: since 2005, Nigeria’s prudential public debt management practice has been that debt service charge is the topmost item in the sequence of the line of expenditures in the budget. Only very few other developing economies could boast of such a healthy and attractiveexternal debt condition” the DG, explained (Anumihe, 2016). Nonetheless, a closer examination of Table 2 shows that LNEXTS (external debt service) is statistically insignificant at any conventional level.

As depicted in Table 2, the empirical findings of this study shows positive relationship between LNPCY (per capita income – a measure of poverty level) and economic growth and consistent with apriori expectation. This result is statistically significant at 5% level. A rise in per capita income signals growth in the economy and tends to reflect an increase in productivity. As reported by Trading Economics (2017) the GDP per capita in Nigeria is equivalent to 20 percent of the world's average. GDP per capita in Nigeria averaged 1627.58 USD from 1960 until 2015, reaching an all-time high of 2548.40 USD in 2014 and a record low of 1086.40 USD in 1968. The positive relation report in this study between per capita income (a measure of poverty level) and economic growth should be taken with caution because despite the impressive record of per capital income, the rising profile of poverty in Nigeria is assuming a worrisome dimension every passing day. According to Ojo (2008) Nigeria has at least half of its population living in abject poverty. In like manner the Federal Office of Statistics (1996) reported that poverty has been massive, pervasive, and engulfs a large proportion of the Nigerian society. It is in this same spirit that Abiola and Olaopa (2008) enunciated that the scourge of poverty in Nigeria is an incontrovertible fact, which results in hunger, ignorance, malnutrition, disease, unemployment, poor access to credit facilities, and low life expectancy as well as a general level of human hopelessness. It was against this backdrop that this study conducted an evidence-based survey in sub-section 4.1.2 to ascertain the effect of poverty alleviation programs on the beneficiaries (poor) given the various poverty alleviation measures implemented in Nigeria. The use of survey research result provides a snapshot of the attitudes and behaviors – including thoughts, opinions, and comments about the respondents. The valuable feedback from the respondents will aid policy making.

Table 2 posits a significant relationship between exchange rate (EXCH) and economic growth. The significance of this relationship is statistically at 1% level. This result aligns with numerous studies that have assessed the relationship between exchange rate movements and economic growth (Connolly, 1983; Gylfason & Schmid, 1983; Krueger, 1978) and tend to provide support for expansionary effects of devaluations of a country’s currency. In Nigeria, the exchange rate policy has undergone substantial transformation from the immediate post-independence period when the country maintained a fixed parity with the British pound, through the oil boom of the 1970s, to the floating of the currency in 1986 till present day. The exchange rate devaluation or depreciation has boost domestic production through stimulating the net export component. This is evident through the increase in international competitiveness of some domestic industries in the country leading to the diversion of spending from foreign goods whose prices become high, to domestic goods. As illustrated by Guitan (1976) and Dornbusch (1988) the success of currency depreciation in promoting trade balance largely depends on switching demand in proper direction and amount as well as on the capacity of the home economy to meet the additional demand by supplying more goods. On the whole, exchange rate fluctuations have in turn determined economic performance in Nigeria. However, there is need to check the degree of fluctuations in the exchange rate in the face of internal and external shocks so that it would not exerted a contractionary effect.

The value of R2 (0.878495) is a measure of model goodness of fit and stand at 87% even when adjusted for. By implication, the explanatory prowess of the model is undoubtedly substantial to have explained growth to the tune of about 87% while the disturbance term can be held liable for the remaining per cent. The Durbin Watson (DW) statistics (1.97966) obtained suggests that there is an absence of serial correlation or autocorrelation problem of regression in the model. This is because it approximately conforms to the benchmark of 2.0 for the absence of autocorrelation problem of regression. The F-statistics falls within the acceptance region with a value of 43.38059 showing the level of joint significance of the explanatory variables.

4.2. Model II Result

Given the various poverty reduction measures implemented in Nigeria, the responses to the 7-item questionnaire administered randomly among residents of Anyigba town concerning the effect of poverty reduction programmes on the beneficiaries (poor) are presented below based on the issues raised:

| Programmes | Frequency |

Percentage |

| NAPEP | 56 |

50% |

| FEAP | 15 |

13.39% |

| YOUWIN | 36 |

32.14% |

| Undecided | 5 |

4.46% |

| TOTAL | 112 |

100% |

| Source: Field Survey |

On the question of familiar poverty alleviation programmes, Table 3 above shows that 56 persons representing 50% of the respondents were familiar with the NAPEP initiative, 15 were familiar with FEAP and 36 with YOUWIN representing 13.39% and 32.14% of the total respondents respectively. 5 respondents were undecided. They represent a paltry sum of 4.46%.

| Responses | Frequency |

Percentage |

| Yes | 69 |

61.61% |

| No | 41 |

36.61% |

| Undecided | 2 |

1.79% |

| Total | 112 |

100% |

| Source: Field Survey |

From Table 4 above, majority of the people were aware of the objectives of these poverty eradication programmes. This is evident in the number of people attesting to the knowledge of the objectives (69). They also represented a large percentage of 61.61%. 41 respondents claim not to be aware of the objectives while 2 persons are undecided. They represent 36.61% and 1.79% respectively of the entire respondents. Thus it can be deduced that a large percentage of people were actually aware of the purpose these poverty alleviation programmes serve.

| Responses | Frequency |

Percentage |

| Yes | 17 |

15.18% |

| No | 95 |

84.82% |

| Undecided | 0 |

0% |

| Total | 112 |

100% |

| Source: Field Survey |

In Table 5 above, 15.18% of the respondents claim to have received some form of training and educational empowerment from the poverty alleviation programmes. 84.82% of the respondents, however, had never received any training or educational empowerment. It can be inferred from the foregoing that majority of the people had never received any form of training or educational empowerment from the various poverty alleviation programmes. This is ironic given the fact most people are actually aware of these programmes cum their objectives.

| Responses | Frequency |

Percentage |

| Yes | 14 |

12.5% |

| No | 98 |

87.5% |

| Undecided | 0 |

0% |

| Total | 112 |

100% |

| Source: Field Survey |

Table 6 above shows the response of the respondents to the question of receiving any credit facility from any of these programmes. While 14 respondents representing 12.5% attested to had received various forms of credit facilities from the various programmes, a major chunk of the respondents responded otherwise. They represented 87.5% of the overall respondents. This is also baffling given the fact that these numbers of people are large and they are also a significant lot. Thus, it can be deduced from the table that majority of the people actually had never received any form of credit facility from any of these programmes.

| Responses | Frequency |

Percentage |

| Yes | 20 |

17.86% |

| No | 92 |

82.14% |

| Total | 112 |

100% |

| Source: Field Survey |

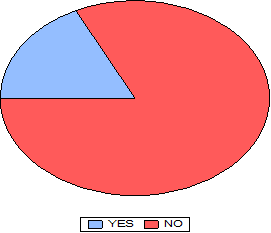

Table 7 shows that 20 persons (17.86%) agreed to have benefitted positively from these programmes while 92 persons (82.14%) disagreed as show by the large portion of the pie chart below.

This is expected since majority of the respondents claimed not to have received any trainings or educational empowerment from these programmes. The same large numbers of people also had never had access to any form of credit facility.

| Responses | Frequency |

Percentage |

| Yes | 19 |

16.96% |

| No | 88 |

78.57% |

| Undecided | 5 |

4.46% |

| Total | 112 |

100% |

| Source: Field Survey |

Table 8 shows that 19 persons(16.96%) are believed to have witnessed a significant improvement in their living standard while 88 persons(78.57%) disagreed. 5 persons(4.46%) were however undecided. Majority of the respondents did not witness an increase in living standard attributed to benefit accrued from any of the poverty alleviation programmes. This also aligns with the analysis of the previous table see Table 5 which showed that majority of the respondents had never received any training or educational empowerment from these programmes. The same large numbers of people also had never had access to any form of credit facility see Table 6.

| Responses | Frequency |

Percentage |

| Yes | 19 |

16.96% |

| No | 91 |

81.25% |

| Undecided | 2 |

1.79% |

| Total | 112 |

100% |

| Source: Field Survey |

As revealed in Table 9, majority of the respondents given by 81.25% (91 persons) do not believe that poverty alleviation programmes have yielded much impact despite the various human and material resources deployed to it. A small percentage of the respondents however believe that these various programmes have yielded much impact. This group represents 16.96% of the total respondents. The implication of this is that the majority opinion of the impact of these programmes is a negative one and much confidence is not placed on them.

Thereafter, the study tested the null hypothesis![]() : poverty reduction programmes does not benefit the target beneficiaries. The Hypothesis was tested using question from Table 7. In testing this hypothesis, the statistical method of chi-square (c2) was used. The entire hypothesis was tested at 5% or 0.05 level of significance. The data is analysed using the Excel 2010 Software Package and the result is depicted below. The decision rule is that if the chi-square calculated is greater than the critical value, the null hypothesis is rejected and alternative hypothesis is accepted

: poverty reduction programmes does not benefit the target beneficiaries. The Hypothesis was tested using question from Table 7. In testing this hypothesis, the statistical method of chi-square (c2) was used. The entire hypothesis was tested at 5% or 0.05 level of significance. The data is analysed using the Excel 2010 Software Package and the result is depicted below. The decision rule is that if the chi-square calculated is greater than the critical value, the null hypothesis is rejected and alternative hypothesis is accepted

| A | B | C | |

1 |

Have you Benefitted Positively from this programme? Observed |

||

2 |

Description | ||

3 |

20 | Yes | |

4 |

|||

5 |

92 | No | |

6 |

Expected | Description | |

7 |

56 | Yes | |

8 |

|||

9 |

56 | No | |

| Formula | Description (Result) | ||

10 |

=CHISQ.TEST(A3:A5, A7:A9) | The χ2 statistic for the data above is1.02206 with degrees of freedom (3.841) |

| Source: Computation using excel 2010. |

As can be seen in Table 10 above, c2 calculated is 1.02206 while X2 tabulated value at (2-1) (2-1) degree of freedom is 3.841. The value of c2 tabulated is clearly greater than the value of c2 calculated. From the calculation, the chi-square calculated value (1.02206) is less than the tabulated value (3.841), as such, the null hypothesis is accepted and the alternative hypothesis rejected. It is therefore concluded that the target beneficiaries did not actually benefit from the various programmes set up to alleviate poverty in the country. This finding is in line with the work of Yakubu and Abbass (2010) in their study on national poverty eradication programme (NAPEP) and poverty alleviation in rural Nigeria: A case study of Giwa Local Government Area of Kaduna. The study revealed that majority of the population agreed that there was no mobilization about NAPEP programmes in their localities and as such they never had access or privileged to benefit from any of their programmes.

5. Summary, Conclusion and Recommendation

This study basically examines external debt, poverty and economic growth relationship in Nigeria between the years 1986-2016. This period covers the various efforts made by the government, non-governmental organizations and individuals to reduce poverty in the country. The quest for economic growth and development compelled Nigeria to acquire external debt during this period. Secondary data were culled from CBN Statistical Bulletin of various years, Nigerian Bureau of Statistics annual publications, Debt Management Office, World Bank, CIA fact book, and various academic journals. In order to align this work with scientific paraphernalia, Augmented Dickey and Fuller (1979) test was employed to ascertain the stationarity conditions of the series; the ordinary least square multiple regression analytical technique was also used and the Econometric Views (E-views 7.0 version) software was employed to facilitate the accuracy and reliability of our estimates obtained all through the analysis.

The result shows that external debt (LNEXTD) is negatively and significantly related to economic growth. The evidence suggests that a unit increase in external debt leads to decline in economic growth by 0.315629 units. Also, there exert a positive relationship between external debt service (LNEXTS) and economic growth. The positive sign exhibited by the coefficient of LNEXTS is against economic theory and contrary to the empirical study by Hameed et al. (2008) which concludes that debt servicing burden has a negative effect on the productivity of labour and capital, thereby adversely affecting economic growth. Also, this study reports that there posit a significant relationship between exchange rate (EXCH) and economic growth. The significance of this relationship is statistically at 1% level. Furthermore, the empirical findings of this study shows positive relationship between LNPCY (per capita income – a measure of poverty level) and economic growth and consistent with apriori expectation. However, according to Ojo (2008) Nigeria has at least half of its population living in abject poverty. In like manner the FOS (1996) reported that poverty has been massive, pervasive, and engulfs a large proportion of the Nigerian society. It is in this same spirit that Abiola and Olaopa (2008) enunciated that the scourge of poverty in Nigeria is an incontrovertible fact, which results in hunger, ignorance, malnutrition, disease, unemployment, poor access to credit facilities, and low life expectancy as well as a general level of human hopelessness. It was against this backdrop that this study conducted an evidence-based survey to ascertain the effect of poverty alleviation programmes on the beneficiaries (poor) given the various poverty alleviation measures implemented in Nigeria. Primary data were obtained from the field and chi-square test was employed to analyse the discrepancies between observed and expected frequency. The value of c2 tabulated was clearly greater than the value of c2 calculated, as such, the null hypothesis was accepted that the target beneficiaries did not actually benefit from the various poverty alleviation programmes set up in the country.

Conclusively, external debt is negatively and significantly related to economic growth. Also, positive and insignificant relationship between external debt service and economic growth was revealed. There posit a positive significant relationship between exchange rate and economic growth. Finally, there exist a positive significant relationship between per capita income (a measure of poverty level) and economic growth. However, an evidence-based survey conducted shows that the target beneficiaries did not actually benefit from the various poverty alleviation programmes set up in the country. Therefore, the government needs to invest in infrastructure, public goods and capital projects to stimulate economic growth. In that capacity, the government needs more income to execute these projects. However, the important thing is that government should ensure adequate utilisation of these resources to maximise outputs in the economy. Also, government needs to put a mechanism in place to ensure efficient management of its debts, thus, the need for adequate financial markets access and strong bond market. In the same vein, government should invest tangibly in agriculture in order to generate more revenue to manage the economy instead of external indebtedness.

Government policy on poverty alleviation must follow a multi-sectoral approach where all the stakeholders are given specific roles to play after undergoing capacity building and ethical orientation training (Oloyede, 2014). In that light, government must take into cognizance the activities of already existing civil society groups, community-based organisations when delivery services and resources to rural areas and communities in poverty.

5.1. Limitations and Further Research

Although the research has reached its aim, there were some unavoidable limitations. Economic growth was measured by gross domestic product and poverty level was measured by per capita income. The choice of measures may have affected the estimates. Secondly, our model specification was not subjected to robustness tests which could have confirmed the validity of our results. The variables of interest may not represent the full picture of the Nigerian economy, therefore it is suggested that other variables should be considered during future studies. Also, further testing of external debt, poverty and growth relationship in Nigeria with a non-linear function will increase our knowledge.

5.2. Competing Interests

There are no competing interests whatsoever in respect of this paper.

Authors’ Contributions

Author 1wrote the introduction and contributed to the review of empirical studies and stylized facts which were included in the introductory section. Author 2 contributed to sourcing and extracting the data sets used for analysis in section four. The methodology, analysis and discussion of the results were done by authors 1and 2. Author 1 summarized the paper, drew conclusion and suggested the recommendations.

6. Acknowledgements

The authors are grateful to their colleagues and friend for useful advice and suggestions received in the process of generating data and preparing the manuscript for publication.

References

Abiola, A. G., & Olaopa, O. R. (2008). Economic development and democratic sustenance in Nigeria. In E. O. Ojo (Ed), Challenges of Sustainable Democracy in Nigeria (pp. 25-34). Ibadan: John Archers Publishers Limited.

Adepoju, A. A., Salau, A. S., & Obayelu, A. E. (2007). The effects of external debt management on sustainable economic growth and development: Lessons from Nigeria: University Library of Munich, Germany.

Adigun, G. T., Awoyemi, T. T., & Omonona, B. T. (2011). Estimating economic growth and inequality elasticities of poverty in rural Nigeria. International Journal of Agricultural Economics and Rural Development, 4(1), 25 – 35.

Aigbokhan, B. E. (2000). Poverty, growth and inequality in Nigeria: A case study. African Economic Research Consortium Research Report.

Akanbi, O. A., & Toit, D. C. B. (2011). Macro-econometric modelling for the Nigerian economy: A growth–poverty gap analysis. Economic Modelling, 28(1-2), 335-350. Available at: https://doi.org/10.1016/j.econmod.2010.08.015 .

Anumihe, I. (2016). Nigeria’s $64bn debt overhang raises fresh concerns. Retrieved from http://www.nigeriatoday.ng/2016/10/nigerias-64bn-debt-overhang-raises-fresh-concerns/ .

Arif, G. M., & Farooq, S. (2011). Poverty, inequality and unemployment in Pakistan. Background Paper, Pakistan Institute of Development Economics, Karachi.

Atique, R., & Malik, K. (2012). Impact of domestic and external debts on economic growth of Pakistan. World Applied Science Journal, 20(1), 120-129.

Basu, S., & Mallick, S. (2008). When does growth trickle down to the poor? The Indian case. Cambridge Journal of Economics, 32(3), 461–477.

Chowdhury, K. (1994). A structural analysis of external debt and economic growth: Some evidence from selected countries in Asia and the pacific. Applied Economics, 26(1), 1121-1131.

Connolly, M. (1983). Exchange rates, real economic activity and the balance of payments: Evidence from the 1960s. In E. Classesn, and P. Salin (Eds.), Recent Issues in the Theory of Flexible Exchange Rates. Amsterdam: North Holland.

De Janvry, A., & Sadoulet, E. (2000). Growth, poverty, and inequality in Latin America: A causal analysis, 1970–1994. Review of Income and Wealth, 46(3), 267–287.

Dickey, D. A., & Fuller, W. A. (1979). Distributions of the estimators for autoregressive time series with a unit root. Journal of American Statistical Association, 74(366), 427-481.

Dornbusch, R. (1988). Open macroeconomics (2nd ed.). New York: Basic Books.

Eduardo, B. (1989). The effect of external debt on investment. Finanace and Development, 26(3), 17-19.

Elbadawi, A. I., Ndulu, J. B., & Ndung'u, N. (1996). Debt overhang and economic growth in Sub-Saharan Africa. Paper presented at the Paper Presented at the IMF/World Bank Conference on External Financing for Low-income Countries, December. Washington, DC: IMF/World Bank.

Federal Office of Statistics. (1996). The social and economic profile of Nigeria. Abuja: Federal Office of Statistics.

Granger, C., & Newbold, P. (1974). Spurious regressions in econometrics. Journal of Econometrica, 2(1), 111–120.

Guitan, M. (1976). The effects of changes in exchange rate on output, prices and the balance of payments. Journal of International Economics, 6(1), 65-74.

Gujarati, D. N. (2003). Basic econometrics (4th ed.). New Delhi: Tata McGraw- Hill Publishing Company Ltd.

Gylfason, T., & Schmid, M. (1983). Does devaluation cause stagflation? Canadian Journal of Economics, 1(1), 641-654.

Hameed, A., Ashraf, H., & Chaudhary, M. A. (2008). External debt and its impact on economic and business growth in Pakistan. International Research Journal of Finance and Economics, 20(1), 132-140.

James, A. (2003). Sub-Saharan Africa: External debt, economic growth and poverty reduction. American Journal of Environmental Protection, 19(1), 1-20.

Kasidi, F., & Said, A. M. (2013). Impact of external debt on economic growth: A of Tanzania. Advances in Management and Applied Economics, 3(4), 59 – 82.

Krueger, A. O. (1978). Foreign trade regimes and economic development: Liberalization attempts and consequences. Cambridge, MA: Ballinger.

Malik, S., Hayat, M. K., & Hayat, M. U. (2010). External debt and economic growth: Empirical evidence from Pakistan. International Research Journal of Finance and Economics, 44(44), 1450-2887.

McKay, A. (2013). Growth and poverty reduction in Africa in the last two decades: Evidence from an AERC growth-poverty project and beyond. Journal of African Economies, 22(1), 149–176.

National Bureau of Statistics – NBS. (2012). Annual abstract of statistics. Abuja: NBS Press.

Nuruddeen, T., & Ibrahim, S. S. (2014). An empirical study on the relationship between poverty, inequality and economic growth in Nigeria. Journal of Economics and Sustainable Development, 5(26), 20- 24.

Nwannebuike, U. S., Ike, U. J., & Onuka, O. I. (2016). External debt and economic growth: The Nigeria experience. European Journal of Accounting Auditing and Finance Research, 4(2), 33-48.

Odhiambo, N. M. (2011). Growth, employment and poverty in South Africa: In search of a trickle-down effect. Journal of Income Distribution, 20(1), 49-62.

Ogwumike, F. O. (2001). Appraisal of poverty and poverty reduction strategies in Nigeria. CBN Economic and Financial Review, 39(4), 45-71.

Ojo, E. O. (2008). Imperatives of sustaining democratic values. In Ojo, E. O (Ed), Challenges of Sustainable Democracy in Nigeria. Ibadan: John Archers Publishers Limited.

Okoroafor, M. O., & Chinweoke, N. (2013). Poverty and economic growth in Nigereia, 1990-2011. The Macrotheme Review, 2(6), 105- 115.

Oloyede, B. B. (2014). Effectof poverty reduction programmes on economic development: Evidence from Nigeria. Arabian Journal of Business and Management Review, 4(1), 26-37.

Osinubi, T. S. (2006). Macro econometric analysis of growth, unemployment and poverty in Nigeria. Pakistan Economic and Social Review, 43(2), 249-269.

Oyedele, S. O., Emerah, A. A., & Ogege, S. (2013). External debt, debt servicing and poverty reduction in Nigeria: An empirical analysis. Journal of Economics and Sustainable Development, 4(19), 174-179.

Patterson, C. E., & Okafor, E. W. (2007). Globalisation and employment generation: Evaluating the impact of trade on aggregate employment in Nigeria’s industrial sector. Employment Generation in Nigeria. Ibadan: The Nigerian Economic Society.

Pattilo, C., Helen, P., & Luca, R. (2004). What are the channels through which external debt affects growth. International Monetary Fund (IMF) Working Paper, Africa. Asia and Pacific Department. No. W.P/04/15.

Rabia, A., & Kamran, M. (2012). Impact of domestic and external debt on the economic growth of Pakistan. World Applied Sciences Journal, 20(1), 120-129.

Ravallion, M., & Chen, S. (2003). Measuring pro-poor growth. Economics Letters, 78(1), 93–99.

Sala-i-Martin, X., & Pinhovskiy, M. (2010). Africa poverty is falling Much faster than you think. NBER Working Paper No. 15775, National Bureau of Economic Research, Cambridge, MA.

Sawada, Y. (1994). Are the heavily indebted countries solvent? Tests of inter temporal borrowing constraints. Journal of Development Economics, 45(1), 325-337.

Siddique, A., Selvanathan, E., & Selvanathan, S. (2015). The impact of external debt on economic growth: Empirical evidence from highly indepted poor countries (No. 15-10).

Stephen, B. A., & Simoen, I. A. (2013). Does economic growth reduce poverty in Nigeria? Developing Country Studies, 3(9), 62 – 68.

Sulaiman, L. A., & Azeez, B. A. (2012). Effect of external debt on economic growth of Nigeria. Journal of Economic and Sustainable Development, 3(8), 66-77.

Tomori, S., & Adebiyi, M. A. (2002). External debt burden and health expenditure in Nigeria: An empirical investigation. Nigerian Journal of Health and Biomedical Sciences, 1(1), 1-5.

Trading Economics. (2017). Nigeria GDP per capita. Retrieved from http://www.tradingeconomics.com/nigeria/gdp-per-capita .

UNDP. (2009). Human development report 2009. Retrieved from http://hdr.undp.org/en/reports/global/hdr2009/ .

Yakubu, R., & Abbass, I. M. (2010). National poverty eradication programme (NAPEP) and poverty alleviation in rural Nigeria: A case study of Giwa local government area of Kaduna State. European Scientific Journal, 8(18), 90-103.

Young, A. (2012). The African growth miracle. Journal of Political Economy, 120(4), 696–739.