Digitization and Blockchain in Finance, The Netherlands in 2020 and 2021

Jan Veuger

Professor Blockchain Saxion | University of Applied Sciences School of Finance and Accounting-School of Creative Technology - School of Governance, Law and Urban Development - Hospitality Business School - School of Commerce and Entrepeneurship - School of People and Society, The Netherlands. |

AbstractThe exploratory research in 2020 received a lot of attention in trade journals in the Netherlands and in the international context of academic journals, webinars and conferences. This led to this research in 2021, including a reorientation on the structure of the research. Due to the further development of the faculty in 2020 and 2021, the questions from the research were further professionalized, peer reviewed by experts and supplemented. In addition, it is interesting and scientifically important to place the research more in both a national and international perspective, both with regard to professional groups and with regard to other studies, such as that of Controllers Magazine, After various inventorying discussions at the end of 2020, whether or not at the request of the stakeholders, this led to a reorientation on the conducting of the research. At the beginning of 2021, the study was therefore extended almost simultaneously to: (a) all members of the Working field commission (Werkveldcommissie; WVC) of the Accountancy (AC), Finance, Tax and Advice (FTA, formerly Fiscal Law and Economics) and Finance & Control (FC) programmes of the Academy of Finance, Economics and Management (FEM) at Saxion University of Applied Sciences, (b) all members of the foundation of collaborating chartered accountants and accounting and bookkeeping firms (SRA), a network organization of 375 independent audit firms with 900 branches in the Netherlands, and (c) international sister universities of Saxion University of Applied Sciences. |

Licensed: |

|

Keywords: JEL Classification |

|

Received: 18 August 2021 |

|

Funding: This study received no specific financial support. |

Competing Interests:The author declares that there are no conflicts of interests regarding the publication of this paper. |

1. Introduction

Nakamato (2008) states that one must have faith in the current financial system and that institutions must not devalue the money. History teaches that this could not always be realized. There must be confidence in sufficient reserves and no creation of credit bubbles. However: The reserves of banks are limited to very limited, even after the economic crisis of 2008, and the question is whether the conviction of the International Monetary Fund (IMF) (Adrian & Mancini-Griffolii, 2019) that crypto coins such as Bitcoin, Ethereum and Libra should be linked to the central banks, given their reputation in recent decades, is justified. Nakamato (2008) asserts the following statement in this regard:

The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to ebase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.

This sentiment was also shared by Friedrich Hayek, Nobel Prize winner in Economics in 1974. In his essay (Hayek, 1976) he argues for the abolition of:

A free market competition in the currency industry, a means of combating inflation and adverse economic consequences through the exclusive right for institutions to be allowed to produce money and the exclusive right for governments to force people to accept the money (Hayek, 1976).

Blockchain is therefore a social, political and economic revolution and stems from Libertarian Anarchism, Crypto-Anarchism and Cyperpunk. This is a philosophy that seeks to protect privacy and political freedom through the use of cryptography. Where the internet is about information transfer, Blockchain is about value transfer and can therefore be interpreted as the fourth technical revolution (Veuger, 2020).

1.1. Currencies and Payment Systems

When we look at global developments in the area of the use of currencies, China is at the forefront. In China, many people pay via WeChat, a social media app released by the Chinese company Tencent in 2011, comparable to a combination of Twitter, Facebook and WhatsApp. This makes it possible to arrange financial changes or, for example, to order a taxi. They are years ahead with digital payment systems (NRC, 2019) and in the Netherlands, for example, the question is asked of whether banks still have a future. ABN AMRO, ING and Rabobank are increasingly disappearing from the streets (Elsevier, 2021) the number of bank branches has decreased from approximately 3,500 in 2015 to approximately 1,000 in September 2020 (Elsevier, 2021) and the number of ATMs has decreased from almost 10,000 in 2015 to approximately 4,000 in September 2020 (Elsevier, 2021).

Alipay is a comparable digital payment system to a mobile and online payment platform of third parties, founded in 2004 by the Alibaba Group and its founder Jack Ma. Payments are made with the national currency yuan and within WhatsApp now with Libras. Facebook’s Libra (Laan, 2019) is linked to a basket of different safe currencies, moves with those rates and is used for worldwide payments. The Libra does not look like the Bitcoin because it is not a cryptocoin (Veuger, 2019). With a cryptocoin, anyone can contribute to the processing of transactions by mining. The first block of the Bitcoin blockchain (Lim & Janse, 2019) was mined on January 3, 2009. It includes a reference to The Times’ article entitled ‘Chancellor Alistair Darling on brink of second bailout for banks’, which was published on the same day. The article reminds us of the uncertain times of the economic crisis in which governments and central banks tried to save the financial system. The then Chancellor of England, Alistair Darling, faced the difficult choice of spending billions of extra money buying toxic assets from banks and providing banks with cheaper state-guaranteed loans at low interest rates. With Libra, mining is done by the Libra association based in Switzerland, which initially included Visa, Vodafone, eBay, MasterCard, Spotify and Uber, but from which, for example, MasterCard, Visa and eBay already withdrew in 2019. The Libra is intended as a form of banking in line with Bill Gates’s 1994 statement that ‘Banking is necessary. Banks are not’. Supervisors view these developments with suspicion (Elsevier, 2019; Het Financieele Dagblad, 2019b). The criticism of Libra also has an effect on the value of other crypto currencies (Het Financieele Dagblad, 2019a, 2019h) but the real value of the Bitcoin, for example, in the current norms and standards of the institutionalized economy, is difficult to determine because it is traded on different exchanges. The established order – including the American and British central banks – therefore have a great deal of criticism of Libra, with the G7 in 2019 also considering a vision of cryptocurrencies and digital security. There is no global body that can control the Libra, and it is questionable whether an AFM or Financial Stability Board in England can coordinate policy on this (Het Financieele Dagblad, 2019b). The Libra experienced a restart in January 2021 with Diem.

The Diem Association has lost several participants almost two years after its launch. Visa, Mastercard and Stripe were some of the first companies to pull out of Libra, followed by PayPal, eBay and Vodafone. Meanwhile, the project has also suffered some notable departures, from Kevin Weil, the head of Facebook’s planned digital wallet Novi, to Dante Disparte, Diem’s head of public affairs (CNBC, 2020). Diem entered talks with Swiss financial regulators in 2021 to secure a payments licence. ‘A key step in our dialogue with the regulators was a phased approach to launch’, Christian Catalini, Diem’s chief economist, told (CNBC, 2020), ‘We are going to phase in different functionalities and usage scenarios, applications in different areas’. The aim would be to ensure that the technology and the reserve system work as expected. Nevertheless, Diem has reached a global race among central banks to figure out their own strategy for digital money. The People’s Bank of China is leading the way, testing a digital version of the yuan in a number of cities, while the British central bank is considering whether or not to issue its own digital currency. We should not exclude Diem either, given its developments and impact, but also relate it to other currencies.

1.2. Parliamentary Bill 2018

In the Netherlands in 2018, only one parliamentary bill (Tweede, 2019) reached the Chamber of Ministries of Finance and Justice, whereby companies are subject to a licence according to the standards of the Dutch Bank regarding digital currencies. In addition, the Minister of Justice and Security has set out a research assignment, which is the result of the ‘Blockchain en Recht’ (‘Blockchain and Law’) report (Schellekens, Tjong, Kaufmann, Schemkes, & Leenes, 2019). The Blockchain faculty (Maten, Barkel, & Veuger, 2019) subsequently issued unsolicited advice to the minister and a reflection to the authors to ensure that the right discussion took place in the Lower House. It can be concluded that (Maten et al., 2019) the authors of the report demonstrably do not understand the technology and have a limited scope. Their focus is mainly on permissionless Blockchains, while it can be argued that innovation is coming mainly from the permissioned Blockchains. In this context, it is important to recognize the entire ecosystem and the transformation thereof. The privacy legislation and the discussions in this report are a non-problem. The report only looks at the Blockchain system, while it should be viewed in the combination of Machine Learning (ML) and Artificial Intelligence (AI) (Veuger, 2020). These are important developments that will eliminate a great deal of work in society in the near future. This is without prejudice to the need to look for the legal context in which the new technologies can develop. The same applies to the development of the governance and its models around Blockchain, ML and AI. Both are essential points for further research: we do not know what we have not seen.

1.3. International Monetary Fund

The International Monetary Fund (IMF) indicates that central banks play an important role in controlling the risks of virtual currencies such as Bitcoin, Ethereum and Libra (Adrian & Mancini-Griffolii, 2019). The IMF, which strives for financial stability, expects new rules for digital monetary transactions to have a major impact on the future of commercial banks. In addition to the positive consequences of cryptocurrency, they also expect substantial risks that can be reduced by central banks. The critical comment that can be made here is: ‘How risky are the current banks if they do not keep pace with the rapidly changing social developments and digitization?’. Cooperation between central banks and providers of money is already taking place in India, Hong Kong and Switzerland, with the national central bank in China already collaborating in national reserves with Alipay and WeChat. Ant Financial is also affiliated with the Chinese Alibaba Group, the highest-rated TechFin company in the world with a value of 150 billion US dollars in 2019. In November 2020, the possibly largest IPO ever, of the Chinese Ant Group, was cancelled. Founder Jack Ma and his empire of webshops and payment services would have become too powerful. The Chinese government therefore launched a financial investigation after Jack Ma gave a controversial speech on October 24, 2020 (Apple Daily, 2020). He is alleged to have made statements critical of the Chinese financial system and the state banks and advocating reforms in the regulatory system to promote innovation. Jack Ma’s critical speech was a few days before Ant Group’s major IPO. On the Shanghai and Hong Kong stock exchanges, the company was expected to raise over $30 billion, but that ultimately did not happen. The IMF is therefore clear in its view that the role of retail banks could change completely and that they should prepare for disruption in the banking sector. The IMF is considering three scenarios for the future: (1) the coexistence of bank money and cryptocurrency, (2) both forms of money complementing each other and (3) commercial banks losing control of deposits. A debate about the necessity of a public digital currency is therefore desirable in this exploration (NRC, 2019).

2. Central Banks

Central banks (World Economic Forum, 2019) from dozens of countries around the world are actively investigating how Blockchain and distributed ledger technology can be applied to solve long-term challenges. However, their activities are not always known or communicated, whether or not for competitive reasons. The purpose of the report Central banks and distributed ledger technology: How are central banks today exploring the Blockchain of central banks (World Economic Forum, 2019) is to introduce and to illuminate key issues and areas of research, experimentation and implementation for central banks with respect to Blockchain technology. It provides an overview of the most important literature in this area at that time. It is important that DLT is an active research and exploration area and that many central banks have not yet drawn definitive conclusions about the possibilities this offers for weighing risks. GitHun (2019) already gives an idea of scientific research in this area.

The President of the European Central Bank, Christine Lagarde, prompted the global regulation of Bitcoin in January 2021. She indicated that in some cases the digital currency has been used for money laundering and that any loopholes in the law should be closed. This in itself represents unusual reasoning because money laundering practices are possible with every (digital) currency. The largely anonymous nature of Bitcoin has led to an institutional concern. Lagarde said about this (Reuters, 2021): ‘(Bitcoin) is a very speculative asset, which has done a number of funny things and some interesting and totally reprehensible money laundering activities.’ What is unique is that she did not give specific examples of money laundering practices but said that she understood that there had been criminal investigations into illegal activities. That is remarkable, because such investigations also take place routinely for flows of money from, for example, the USD or Euro.

3. Developments in Perspective and Blockchain in Particulair

To put the above issues in perspective, it is important to look at market capitalization and the total growth of money since 2015. The question that can be asked is whether current physical money has been a decades-long or age-old hype and whether crypto currencies are the legitimate substitute.

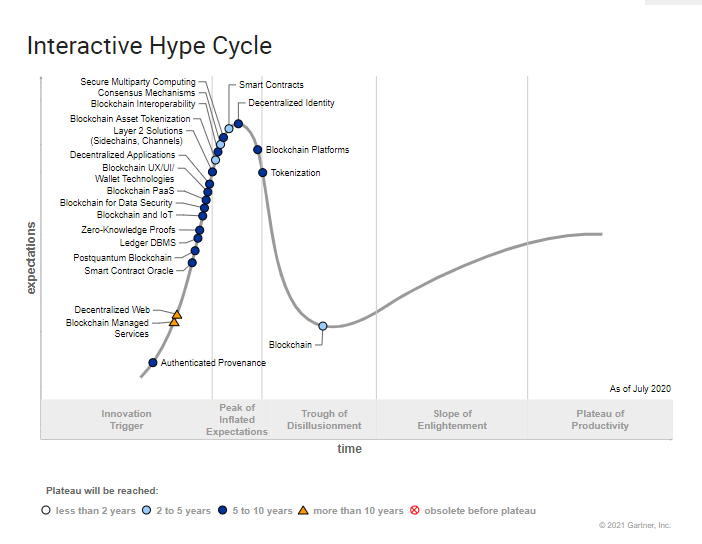

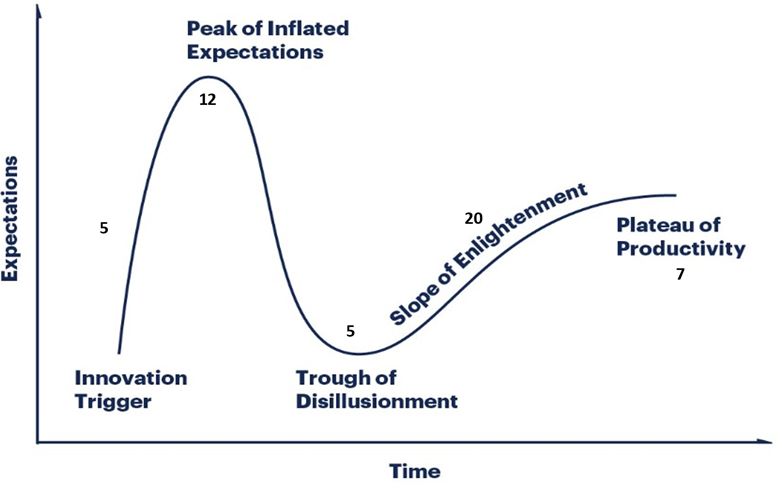

Blockchain technology is hardly a priority on the agenda of Chief Information Officers (CIO). To help CIOs understand the current Blockchain and future evolution, David Furlonger, Vice President, Distinguished Analyst and Research Fellow Gartner Inc. outlined how the Blockchain could develop through 2030. Furlonger noted that in the Gartner 2019 CIO survey, only 5% of the CIOs assessed Blockchain in the Gartner 2019 as a game changer for their organizations, far below the themes of artificial intelligence, cloud, data and analytics. In the top, typical and lagging categories of CIO respondents, 11% of the CIO respondents used Blockchain or were planning to do so in 2020. Although Blockchain offers a range of options, private ledgers will have difficulty reaching a positive Total Cost of Ownership (TCO) within four years. There is therefore a need according to Furlonger for a good cost/benefit analysis in this area. The Blockchain perspective alongside technology offers new paradigms for the way in which organizations (Bessems & Bril, 2017) can interact, act or how assets are represented in practice (Pomp, 2019; Pomp & Verhaert, 2018). It is quite possible that current business and technology will be unable to make optimal use of the possibilities of Blockchain technologies. Gartner’s Blockchain Spectrum offers a model for investigating the evolution of Blockchain solutions and indicates how their phases are consistent with the value that companies can derive from them (Gartner, 2018). The ‘hype cycle’ concept was formalised by Gartner to model the different phases characterising the appearance and development of a new technology. This model begins with the premise that, from its discovery until its mass adoption, every innovation is supposed to go through similar stages, marked in particular by significant fluctuations in interest.

Time Table |

Phase | Explanation |

2009-2020 |

Accessibility technologies for the Blockchain | This early phase of Blockchain experiments is being built on top of existing systems to reduce costs and friction in private activities. They only have limited distribution options to a small number of nodes within or between companies. |

2016-2023 |

Blockchain-inspired solutions | The current phase of Blockchain-inspired solutions is primarily designed to address a specific operational problem - usually in terms of inter-organizational processes or inefficiency of administration. These solutions have symbolization or decentralized decision making. |

2020 |

Blockchain complete solutions | Blockchain Complete offer, starting in the 2020s, will implement smart contracts and deliver the full value proposition of the Blockchain, including decentralization and tokenization. |

After 2025 |

Improved solutions with Blockchain | In this future situation, smart contracts will be truly autonomous, and advanced technologies will allow exchanges and transactions that are not yet possible. At that time, we will see Decentralized Autonomous Organizations (DAO) and micro-transactions by machines. |

3.1. Blockchain and Crypto coin Developments in 2020

Whereas in 2015 the Gartner Hype Cycle indicated that Blockchain was in the first phase of development and was mainly seen as a hype, the picture looks significantly different in 2020. Based on her research in 2020 (Gartner, 2020) Gartner states the following about Blockchain developments in 2020: Blockchain technology has developed slowly, with most business projects remaining in experimental mode, without clear targets and measurements. Organizations are reluctant to transfer authority to consortia of multiple parties. Most Blockchains, in which stakeholders have given permission, are hardly distributed and work on only a few nodes that are managed by a single party. Unlike public Blockchains, Blockchains with permissions do not eliminate centralized authority.

Nevertheless, they uniquely support a single version of unchangeable data, which is shared and trusted by network participants. Many central banks are currently investigating or testing digital currencies on Blockchains. Together with a number of other central banks, the European Central Bank (ECB) will study the possibility of setting up its own cryptocurrencies. To this end, they have set up a research team and are cooperating in this initiative with the Bank of England, the Swedish Riksbank, the Swiss National Bank SNB, the Bank of Canada and the Bank of Japan.

The Bank for International Settlements (BIS), which is also described as the central bank for central banks, is also participating in the initiative. Notable absences are the People’s Bank of China, which is already working on its own cryptocurrency, and the US Federal Reserve. The latter has so far stayed far away from digital coins. The research group will examine in which situations crypto coins offer an advantage. It also examines which functional and technical design choices can be made and how the different digital currencies can work together. The banks involved also want to share knowledge about emerging technologies. The research team coordinates its work with supervisors. China has already launched its digital currency and is testing consumer payments. At the start of the COVID-19 pandemic, the need for transparent, reliable, end-to-end supply chain data pointed for many to Blockchains. Necessary standards for tokenized processes and supply chain information (GS1, EPCIS) are evolving further. These events will place Blockchain’s progress in the fourth phase of the Gartner Hype Cycle.

Gartner (2020) indicates that innovative solutions supported by Blockchain are mainly in an experimental phase or in production on a limited scale. Nevertheless, early adopters and application leaders use Blockchain to transform their digital businesses in a unique way, especially with supply-chain-related and payment-related use cases.

More than 50 central banks are investigating or testing digital currencies on Blockchains with permissions. China has already launched its digital currency and is testing consumer payments. At the start of the COVID-19 pandemic, the need for transparent, reliable, end-to-end supply chain data clearly pointed for many to Blockchains. Necessary standards for tokenized processes (e.g. of InterWork Alliance) and supply chain information (GS1, EPCIS) are evolving further. These events will bring Blockchain’s progress to the slope of enlightenment.

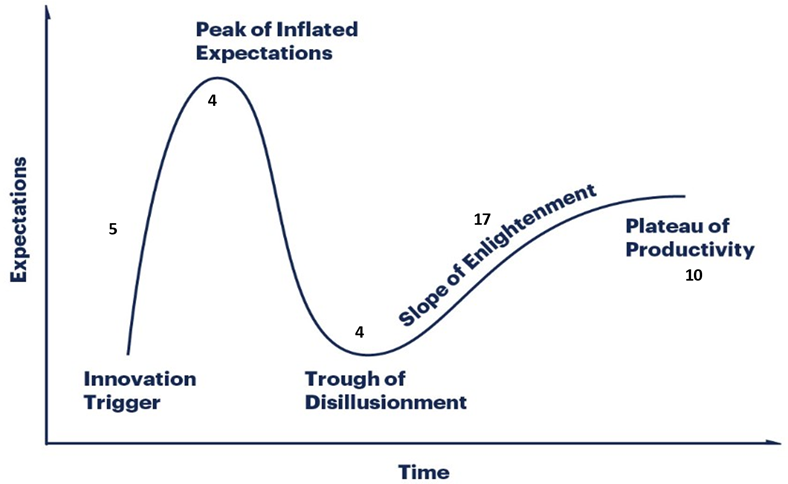

Figure-1. Interactive hype cycle blockchain (Gartner, 2020). The Gartner Technology Hype Cycle is a cycle for new tech innovations that was first published in 1995 by Gartner Inc, an enterprise research firm. The hype cycle proposes a standard model created by David Furlonger and can be used as a monitor as new inventions strive to journey onto mainstream adoption. This model was also used when we explained what is blockchain technology and what is a distributed ledger. The Hype Cycle typically features the Gartner Curve in which the project life cycle is drawn based on expectations over time. There are four key stages in the Gartner curve including the innovation trigger, the Peak of Inflated Expectations, the Trough of Disillusionment, the Slope of Enlightenment, and the Plateau of Productivity.

4. Technological Developments for Financial

When we look at technological developments that influence the financial professional, we arrive at the following developments based on discussions with the participating organizations. A number of technological developments, which are included in the survey, are explained in alphabetical order below. This is to further clarify their specific impact on the financial professional, assuming that the other elements of the survey such as accounting software, big data, currency, cybersecurity, data analytics, Regtech and ethics are generally known.

4.1. Artificial Intelligence

Creativity is a fundamental feature of human intelligence, and a challenge for Artificial Intelligence (AI) (Boden, 1998). AI technology can be used in three ways to create new ideas: by producing new combinations of known ideas; by exploring the potential of conceptual spaces; and by carrying out transformations that enable the generation of previously impossible ideas.

AI will have less difficulty modelling the generation of new ideas than automating their evaluation. Technical progress in the field of artificial intelligence (AI) leads to the development of human-like machines, which are able to work autonomously and mimic our cognitive behaviour. The progress and interest of managers, academics and the public has created an interest in AI in many industries. Many companies are therefore investing heavily to take advantage of AI through business model innovation. However, managers receive little support from the academic world when they want to implement AI in their company’s activities, which leads to an increased risk of project failure and undesirable results.

Reim, Åström, and Eriksson (2020) aim to provide a deeper insight into AI and how it can be used as a catalyst for business model innovation. Due to the increasing range and variety of available published material, a literature study has been conducted to collect the current knowledge within AI business model innovation. The results are presented in a step-by-step plan to guide the implementation of AI in business operations. Our findings suggest four steps in implementing AI: (1) understand AI and the organizational capabilities needed for digital transformation; (2) understand current BMI, potential for BMI, and the role of the business ecosystem; (3) develop and refine capabilities needed to implement AI; and (4) reach organizational acceptance and develop internal competencies.

4.2. Bitcoin

Bitcoin has essentially become successful. The most interesting thing about the Bitcoin is that it encourages people to participate through a positive feedback loop curve of economic incentives (Lim & Janse, 2019). In a post on the P2PFoundation forum on February 18, 2019, Satoshi Nakamoto states that Bitcoin also resembles precious metals such as gold and silver.

Instead of there being a central institute that changes the offer in order to keep the value somewhat equal, the offer has already been determined in advance in the Bitcoin software, and the value of Bitcoin thus changes. The limited offer creates potential for a positive feedback loop where the greater use of Bitcoin leads to a higher value, and this higher value in turn attracts more users wishing to benefit from an increasing price (Lim & Janse, 2019). This loop ensures that the Bitcoin network has become an organic system that sustains itself without a party enforcing participation. It looks like this: (a) there is greater confidence in the Bitcoin network, causing a greater demand for Bitcoin; (b) this increases the Bitcoin price; (c) Bitcoin’s higher price makes it more cost-effective to mine Bitcoin. Because of this, more people will try to mine Bitcoin; (d) because more is mined, the total computer power supplied to the network increases; and (e) this leads to the Bitcoin network becoming more secure. Performing a 51% attack on the network becomes more difficult. In addition, the difficulty of mining is also increased when more total computer power is used to mine. Due to the higher level of difficulty, a block will still be created on average every 10 minutes, with an additional 12.5 Bitcoin currently in circulation.

Bitcoin inflation also remains limited because Bitcoin is halved every four years; so there cannot be more than about 21 million Bitcoin in total. Better security and the limited inflation of Bitcoin lead to more confidence in the Bitcoin network (Lim & Janse, 2019).

4.3. Bitcoin SV

Bitcoin SV (BSV) is the result of a vision interpretation within Bitcoin. In 2017, Bitcoin implemented a fork, or split, which created Bitcoin Cash. A year later, Bitcoin Cash has developed a new vision interpretation, and a new division has emerged, namely Bitcoin SV. The SV stands for ‘Satoshi Vision’, and they call themselves the Bitcoin as it was originally intended. The team behind Bitcoin SV is developing plenty of new innovations, which is very positive for the future.

The Bitcoin SV future price will further depend on how the developments within Bitcoin SV and in the market will proceed. In any case, the plans and expectations for 2021 – 2025 look good.

Many are therefore already choosing to step up to the expectations for 2021. Following this, Bitcoin SV has developed a Bitcoin SC Massive Open Online Course in four parts (https://mooc.saxion.nl/courses/course-v1:SAXION+BC1), which was launched on February 5, 2021 (Veuger & Bitcoin, 2021) in the Closing Ceremony of Blockchain Week 2021 (Veuger, Kos, & Nguyen, 2021).

Making a forecast of Bitcoin SV’s price expectation (Figure 2 for example) is comparable to the equity market, as it is largely influenceable by the market. However, by looking at developments that have already been realized over the past two years, new plans, new partnerships and other important issues that have an impact on the price, an indication can be given.

An exact Bitcoin SV forecast in terms of price cannot be indicated, but it is certain that a price increase of 100% – 300% is realistic within a period of 1 to 2 years. Investors also look at a longer timeframe of around 5 years when investing. This is a consideration for a longer term than, for example, the price expectation in 2025. The following graph shows what the highest price has been in the past two years.

4.4. Decentralized Finance

Decentralized Finance (DeFi) dissolves outdated financial services, combining the resulting components into applications that operate transparently without intermediaries. The rapid expansion of DeFi has led many application leaders to wonder whether it justifies the hype. Gartner (2020) has investigated this count and arrived at three findings: (1) DeFi applications include digital assets, smart contracts and open-source protocols that are used to exchange value in a reliable, trustworthy manner between anonymous parties, (2) DeFi implements Packaged Business Capabilities (PBCs) in an architectural manner, building blocks that can be dynamically assembled into applications, using various pre-built components and functions, and (3) the DeFi market is embryonic and the technology immature. Ethereum 2.0 is still not ready for deployment, and user interfaces are complex and difficult to navigate. Nevertheless, innovation in this area is very fast, and developments follow each other quickly. For example, DeFi-supported stablecoins grew from $2 billion in 2019 to well above $10 billion in July 2020. Stakeholders interested in benefiting from decentralized Blockchain applications should think about the following Gartner (2020): Prepare to integrate DeFi into application portfolios if there are PBCs that uniquely solve an existing problem or create a new business opportunity. By the end of 2021, DeFi technology will be ready for early corporate adoption, provided that the regulations are clear. Integrate DeFi PBCs with existing centralized financial (CeFi) operations to support efficient, transparent, peer-to-peer versions of traditional financial products and all-new products that support new media of exchange and value. By 2022, DeFi technology will be ready for early business adoption as long as regulatory guidelines are clear (Gartner, 2020a).

4.5. Anti-Money Laundering

Anti-money laundering (AML) (Kenton & Anderson, 2020) refers to laws, regulations and procedures designed to prevent criminals from concealing illegally obtained money as legitimate income. Although the anti-money laundering laws cover a limited number of transactions and criminal conduct, their implications are far-reaching. For example, banks and other financial institutions that lend or accept deposits from customers must comply with rules under the AML regulation that ensure that they do not cooperate in money laundering. Kenton and Anderson (2020) draw three conclusions: (1) anti-money laundering (AML) practices should deter criminals by making it harder for them to hide illegally obtained money, (2) criminals use money laundering to hide their crimes and the money they earn from them, and (3) the AML regulation requires financial institutions to monitor their customers’ transactions and to report suspicious financial activities.

4.6. Enterprise Resource Planning

Enterprise Resource Planning (ERP) refers to a type of software that organizations use to manage day-to-day business activities such as accounting, purchasing, project and risk management, compliance and supply chain activities. A complete ERP system also includes Enterprise Performance Management (EPM) software to support planning, budgeting and reporting on the financial results of the organization. ERP systems connect business processes through data exchange. By collecting the organization’s shared transaction data from multiple sources, ERP systems eliminate data duplication and provide data integrity with one source of truth. Often, ERP systems are critical for the organization. Blockchain pushes the existing benefits of an ERP system to a different level: centralized business processes become accessible across multiple organizations. Integration enables optimization of all operations of multiple, different organizations, as well as trusted sharing of data. This is particularly beneficial when we think of financial transactions. Financial institutions and banks can enjoy more control over internal data processing, giving them a stronger grip on security. Given how financial institutions handle sensitive information, they can be sure with Blockchain that they provide their services with a minimum of risk.

4.7. Initial Coin Offering

Initial Coin Offering (ICO) is a form of crowdfunding to raise capital with crypto coins. In recent years, ICOs have become attractive. The purpose of an ICO is to raise capital to get the project of a starting company (a start-up) off the ground. With an ICO, a quantity of the crowdfunded crypto coins is sold to investors in the form of tokens – series of numbers or characters – in exchange for legal tender or other crypto coins. These tokens will be promoted as future functional currency units if the ICO financing objective is met and the project is launched.

4.8. Internet of Things

Can financial services benefit from Internet of Things (IoT) technology? Yes, and not only from more and better data about the customers’ assets. IoT applications are intended to transform finances and data along with every other sector. But according to the Deloitte (2021) there are short-term and long-term opportunities for the financial services sector to see the benefits of IoT. Deloitte (2015) already issued in 2015 an overview of where IoT works well, bottlenecks that companies may encounter when using IoT data and possible use cases for future adoption. Within the Saxion minor ‘Digital Business Models and Blockchain’, students regularly conduct surveys in collaboration with the professional field and offer solutions (Haaker & Veuger, 2021).

4.9. Payment Services Directive 2

Payment Services Directive 2 (PSD2) was implemented in Europe with the aim of creating safer payments and offering better financial services to customers. The Directive entered into force on January 13, 2018 and simplified the rules and regulations for payment services across the European Union. Since then, numerous articles and e-books on PSD2 have been published explaining the concept to the general public. The Payment Services Directive is an EU directive managed by the European Commission to regulate payment services. The objective of PSD2 is to increase pan-European participation in the payment industry and to harmonize the rights and protection of consumers. PSD2 aims for (a) simplifying banking rules to regulate payment services across the European Union, (b) enhancing customer safety and providing them with a better banking experience, and (c) promoting competition and innovation in financial services.

4.10. Purchase to Pay

Purchase-to-pay (P2P), i.e. the Purchase-to-Pay process, is understood to mean the entire process of ordering, purchasing and purchasing up to and including automatic payment of the invoice. A synonym for this concept is also ‘procure to pay’ or ‘procurement’.

4.11. Robot Process Automation

Robotic Process Automation (RPA) occurs when basic tasks are automated via software or hardware systems operating in different applications. The software or robot can be taught a workflow with multiple steps and applications, such as accepting received forms, sending a receipt message, checking the form for completeness, submitting the form in a folder and updating a spreadsheet with the name of the form, the date submitted, and so on. RPA software is designed to reduce the burden on employees in the area of repetitive, simple tasks.

5. Financial Professional

The financial professional of the future fulfils various roles in the acquisition, operation and disposition process(es) (NBA (Nederlandse Beroepsorganisatie voor Accountants), 2016, 2019) whereby certain specific and general competencies are more or less relevant. A competence is the ability to perform adequate tasks that are an important component of a function, role or responsibility. Four professional-specific competencies apply for the real estate manager: financial management and financial operation, financial mediation and financial services, financial innovation and redevelopment, financial investment and financial consulting. Two general competencies apply for the financial professional of the future: (1) Social and communicative competence and (2) Self-management competence. The following roles will be fulfilled by the financial professional of the future as a service provider, contract manager, representative of interests, mediator, network hub and as a consultant to the organization. A follow-up study (NBA (Nederlandse Beroepsorganisatie voor Accountants), 2019) took place at the beginning of 2019. This 2019 study does not follow up on the conclusions of the 2018 report, which means it can be asserted that the developments of Blockchain are identified but not (yet) recognized. A worrying observation. In 2018, the new NBA knowledge group mapped the technology landscape for the auditing profession based on McKinsey’s ‘3 horizons of innovation’ model. The result reveals that several large offices are already working extensively on technologies from horizon two (analytics and process mining) and that a number of digital developments are already common, while the SME auditor does not (yet) notice this to any great degree.

6. First Exploratory Study 2020

The first exploratory study on technological developments of the financial professional took place in 2020 (Veuger, 2020a, 2020b, 2020c, 2020d, 2020e) among all members of the Werkveldcommissie (‘Work Field Committee’; WVC) of the Accountancy (AC), Finance, Tax and Advice (FTA, formerly Fiscal Law and Economics) and Finance & Control (FC) programmes of the Academy of Finance, Economics and Management (FEM) at Saxion University of Applied Sciences. In the study, the WVCs consisted of 31 regional and nationally represented offices according to the overview below in Table 2.

| Training | Offices |

| Accountancy (AC) | Jong & Laan, BDO, KroeseWevers, Mazars, De Kok, EY, A&L, Koers!, Eshuis, KPMG, Baker Tilly and 2assure. |

| Finance, Tax and Advice (FTA) | Mazars, Jong & Laan, Saxion, KPMG, PWC, EY, Verhoeven Ruesink Daniel, Jongbloed and the Tax Department. |

| Finance & Control (FC) | Sutfene, Ten Hag, Aebi Schmidt, Municipality of Lochem, Achmea, Municipality of Hengelo, Theaterhotel Almelo and the Municipality of Enschede. |

In total from the three programmes, the 31 WVC members were enrolled with a response of 41.9% (n = 13 31), although it should be noted that the response varied per programme: AC 50.0% (n = 6 12), FTA 18.1% (n = 2 11) and FC 62.5% (n = 5 8). All responses received at that time were 100% usable.

When we look at the size of the respondents’ organizations, the number of branches and the number of full-time equivalents (FTEs) represented in the 2020 survey, the following picture is created in Table 3. There are differences to note in the number of branches of the represented degree programmes. In conclusion, it can be said that a good general but also a specific comparison is possible. Large offices provide a relatively strong picture of the number of FTEs for Finance, Tax and Advice.

| Training | Number of branches respondents |

FTEs |

| Accountancy (AC) | 61 |

9,432 |

| Finance, Tax and Advice (FTA) | 4 |

5,000 |

| Finance & Control (FC) | 9 |

2,607 |

| Total | 74 |

17,039 |

At the time of response, the respondents had different functions as can be seen in Table 4. This shows that professionals are represented at both operational, tactical and strategic levels and thus give a completely typical view of the represented functions respondents of financial organizations.

| Training | Represented functions respondents |

| Accountancy (AC) | Accountant, senior manager Audit & Assurance, junior IT auditor, register accountant, partner and professional accountant director. |

| Finance, Tax and Advice (FTA) | Partner TAX-BTA and Senior Manager Tax. |

| Finance & Control (FC) | Manager Financial Administration & Financial Control Investments, Project Manager Planning and Control & Planning and Physical Control, Controller (2x) and Group Manager. |

A number of conclusions can be drawn from this exploratory study in 2020 (Veuger, 2020a, 2021): (1) We have encountered a positive attitude of the financial professional with regard to the state of digitization and Blockchain, (2) Attention to soft skills was, is and remains a point of attention for both organizations and education, (3) The working environment slows down the evolution towards digitization and Blockchain, and (4) The sector runs the risk of resembling the proverbial ostrich that sticks its head in the sand when it sees danger.

In 2020, a similar study was published relative to the study described above. For the fifth consecutive year, Controllers Magazine and Executive Finance (Executive Finance CM, 2020) together with their supporters, investigated what concerns them as finance professionals when it comes to technology in their work. Corona has accelerated some new controls and reports, while projects have been postponed and investments frozen.More and more companies are seeing the possibilities of automation and other technological developments. Five years ago, 60 percent of financial professional found that their employer had little or no focus on new technological developments. There really has already been a shift in that. The more than 300 respondents see developments as financial professionals fully as an opportunity and think such developments will make them a better business partner.

7. First Exploratory Study 2020

The exploratory research in 2020 received a lot of attention in trade journals in the Netherlands and in the international context of academic journals, webinars and conferences (Veuger, 2020a, 2020b, 2020c, 2020d, 2020e, 2021) . This led to this research in 2021, including a reorientation on the structure of the research. Due to the further development of the faculty in 2020 and 2021, the questions from the research were further professionalized, peer reviewed by experts and supplemented. In addition, it is interesting and scientifically important to place the research more in both a national and international perspective, both with regard to professional groups and with regard to other studies, such as that of Controllers Magazine (Executive Finance CM, 2020) . After various inventorying discussions at the end of 2020, whether or not at the request of the stakeholders, this led to a reorientation on the conducting of the research. At the beginning of 2021, the study was therefore extended almost simultaneously to: (a) all members of the Werkveldcommissie (Werkveldcommissie; WVC) of the Accountancy (AC), Finance, Tax and Advice (FTA, formerly Fiscal Law and Economics) and Finance & Control (FC) programmes of the Academy of Finance, Economics and Management (FEM) at Saxion University of Applied Sciences, (b) all members of the (SRA), a network organization of 375 independent audit firms with 900 branches in the Netherlands, and (c) international sister universities of Saxion University of Applied Sciences.

Invitees have been asked to respond to the Gartner Hype Cycles (Gartner, 2020b) model, which is a graphical representation of the maturity and adoption of technologies and applications, showing how they are potentially relevant to solving real business problems and seizing new opportunities. The Gartner Hype Cycle methodology gives a picture of how a technology or application will evolve over time. In addition, the model provides a good source of insight to manage its deployment within the context of specific business objectives.

8. First Exploratory Study 2020

8.1. Response

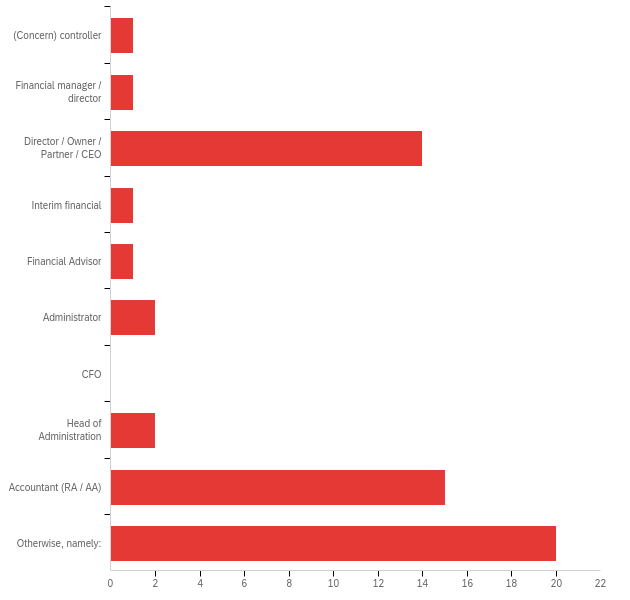

The survey took place in February to March 2021 among all members of the Werkveldcommissie (WVC) of the Accountancy (AC), Finance, Tax and Advice (FTA, formerly Fiscal Law and Economics) and Finance & Control (FC) programmes of the Academy of Finance, Economics and Management (FEM) at Saxion University of Applied Sciences, 15 involved strategic international universities of Saxion Finance & Control and the SRA, a network organization of 375 independent audit firms with 900 branches in the Netherlands. A reminder was sent once. The response (n=54) and represented offices and universities is included in Table 5. This overall response of n=541 is 74% higher than in the study in 2020 with n=31.2 In total, the response in 2021 is 12.8% of a total number of potential responses: 31 WVC, 375 SRA and 15 strategically involved universities, a total of 421. All the responses received were 100% usable. 3 When we look at the respondents’ functions in Figure 3, the following picture is created in Table 2. The group of Director/Owner/Partner/CEO and Accountant (RA/AA) represents 50.1% (n=2954) of the total number of respondents. In addition, the Otherwise group represents 35.1% (n=2054) as a third large group consisting of, among others, tax advisor, lecturer researcher, international coordinator, international office partner management, officer, tax advisor, teacher, lecture in finance, coordinator EU, head of international office, full professor, IT management assistant-accountant (AA), partner and system administrator. A representative group.

| Organizations | Universities |

| SRA | BINUS UNIVERSITY |

| Q accountants and tax consultants | University of Rijeka |

| Boonzaaijer & Merkus Accountants & Advisors | UCLL |

| Company Steens & Partners Accountants en Adviseurs | Pusan National University |

| Vermetten Accountants | Bern University of Applied Sciences, BFH |

| Accountants voor de Gezondheidszorg BV | National Economics University |

| Louer Accountancy | Sheridan College - Pilon School of Business |

| Steens IT Audit & Consultancy | IUT GEA Fontainebleau (PARIS 12) |

| FAIRnumbers | Henallux University College |

| Hols de Man accountants | tax & business consultants | National Economics University |

| Van der Laan Groep | UAS Upper Austria, School of Business and Management |

| Alfa Accountants | Thomas More University of Applied Sciences |

| De Jong & Laan | Petra Christian University |

| BDO Accountants & Adviseurs | Università Politecnica delle Marche |

| Baker Tilly | Banking Academy of Vietnam |

| Jongbloed Fiscaal Juristen NV | |

| Eshuis Accountants en Adviseurs | |

| Linden Accountants BV | |

| JAN© Accountants en Adviseurs BV | |

| Numlock | |

| ANB Accountants | |

| Crowe Peak | |

| Qwintess NV | |

| de Jong & Laan | |

| AccountXperts | |

| Smink Kok Lentink accountants en belastingadviseurs | |

| Boesveld van der Burg Accountancy en Belastingadviezen | |

| Westerveld en Vossers | |

| SRL accountants | |

| Van Velzen accountants & adviseurs | |

| Ozlo Accountants | |

| TweeDee accountants & belastingadviseurs | |

| SNP Adviseurs | |

| Cooster | |

| Mazars Enschede | |

| Municipality of Lochem | |

| Stichting Sensire | |

| Mazars | |

| EY Belastingadviseurs |

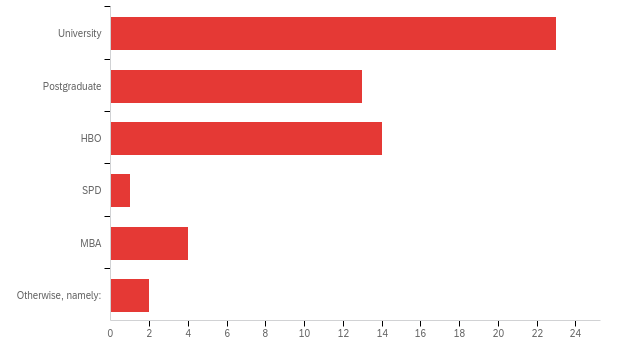

At the time of response, the respondents had different training levels according to Table 3. This shows that the level is high: university, postgraduate, higher professional education and MBA with 94.7% (n=5457) in Figure 4.

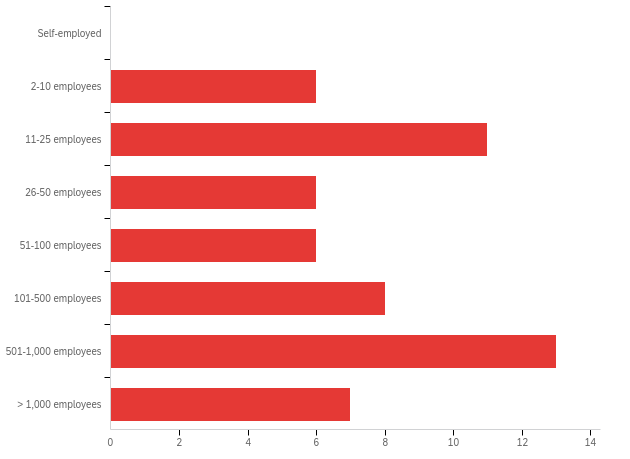

The size of the respondents’ organizations are evenly distributed over the 2-10 employees up to and including more than 1,000 employees, with the group of 11-25 and 501-1,000 employees being relatively more represented. This does not in itself produce any particular conclusions other than that there is a balanced representation in terms of the size of organizations (Figure 5).

Figure-3. Functions of respondents.

Figure-4. Educational level of respondents.

Figure-5. Size of organizations.

Looking further at which industry the organizations represent, this is for the vast majority Business Services 66.7% (n=3854) followed by Education 26.3% (n=1557).

8.2. Current Situation

Respondents have been asked – as in the comparable study in 2020 – to respond to the Gartner Hype Cycles 4 model, which is a graphical representation of the maturity and adoption of technologies and applications, how they are potentially relevant to solving real business problems and utilization of new opportunities. The Gartner Hype Cycle methodology gives a picture of how a technology or application will evolve over time. In addition, the model provides a good source of insight to manage its deployment within the context of specific business objectives. The model taps into the five most important phases of a technology’s life cycle.

8.2.1. Innovation Trigger

A potential breakthrough in technology begins. Early proof-of-concept stories and the interest of the media lead to considerable publicity. Often, there are no usable products and commercial viability has not been proven.

8.2.2. Peak of Inflated Expectations

Early publicity yields a number of success stories - often accompanied by dozens of failures. Some companies take action; many companies do not.

8.2.3. Trough of Disillusion

Interest decreases as the experiments and implementations do not lead to results. Producers of the technology shake up or fail. Investments will only continue if the surviving providers improve their products to the satisfaction of the early adopters.

8.2.4. Slope of Enlightenment

More examples of how the technology can benefit the company are beginning to crystallize and are more commonly understood. The second- and third-generation products appear from technology providers. More companies finance pilots; conservative companies remain cautious.

8.2.5. Plateau of Productivity

Mainstream adoption gets underway. The criteria for assessing the viability of suppliers are more clearly defined. The broad applicability and relevance of the technology on the market is clearly bearing fruit.

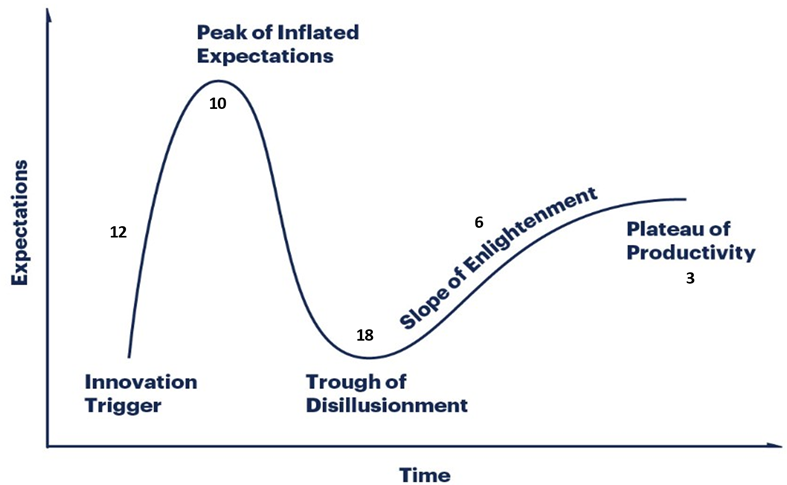

8.2.6. Current Situation in Society with Digitization and Blockchain

Respondents were asked to indicate where they think society stands in 2021 with regard to digitization. The following figure represents all responses from all respondents. The majority of 55.1% (n=2749) indicate that digital developments in society are mainly in the last two phases: Slope of Enlightenment and Plateau of Productivity. A not-insignificant proportion of respondents still see a considerable proportion of 24.5% in the Peak of Inflated Expectations (n=1249), which may indicate media attention with or without clear source references and/or general expectations. If we compare this conclusion with the research from 2020, we see a significant shift to the last two phases, which indicates a more adoption of technological developments (Figure 6).

Figure-6. Hype Cycle maturity, adoption of digital technologies and applications in society with the number of respondents per phase.

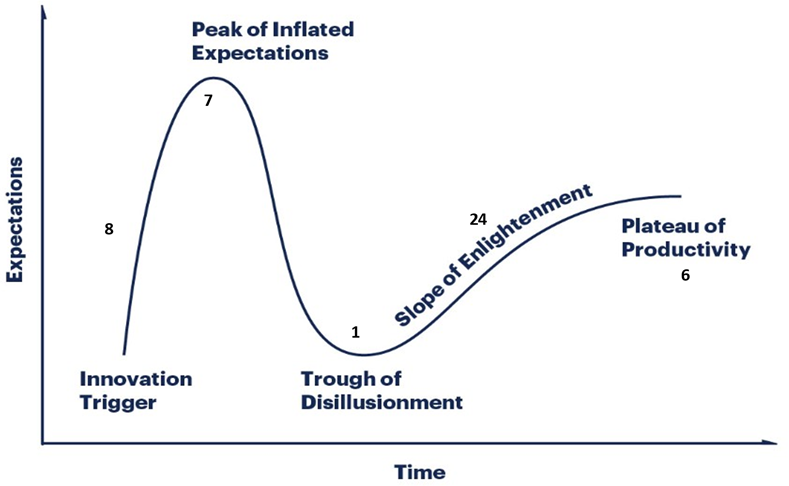

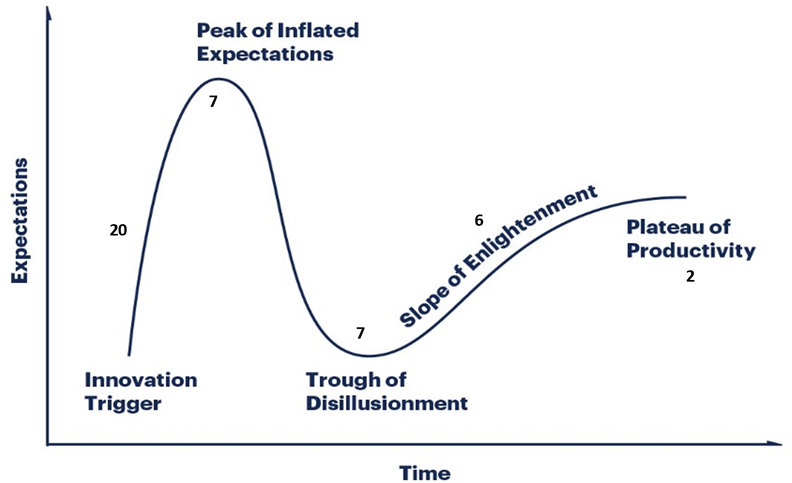

Specifically looking at the maturity and adoption of Blockchain technologies and applications in society with the number of respondents per phase, compared to the general developments of technologies and applications in society, we see that Blockchain is predominantly in the first three phases of developments: 48.6% (n=4049). Compared to the same research in 2020 (Veuger, 2020) we see in 2021 a clear shift to phases 2, 3 and 4 instead of primarily an interpretation in phase 1, which indicates a greater adoption of Blockchain in society (Figure 7).

Figure-7. Hype Cycle maturity, adoption of Blockchain technologies and applications in society with the number of respondents per phase.

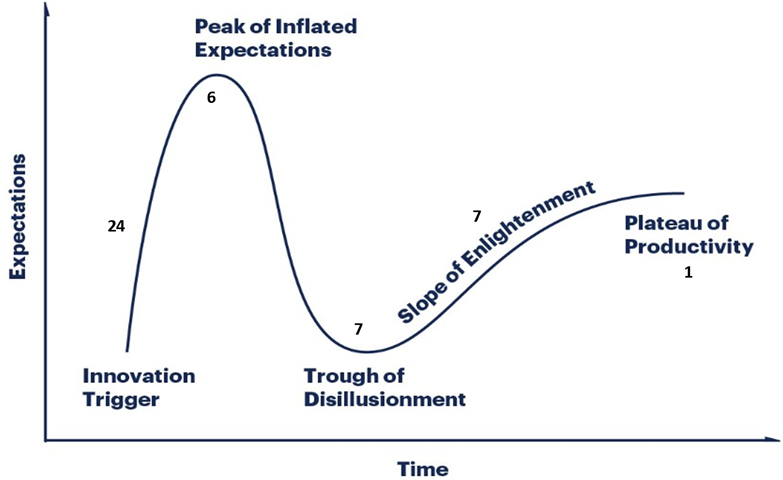

8.2.7. Current Situation in the Organization with Digitization and Blockchain

Respondents were asked to indicate where they think their organization stands in 2021 with regard to digitization. The following figure represents all responses from all respondents. This picture shows that the majority of respondents (n=2446) finance more company pilot projects and that conservative companies remain cautious. Compared to the same research in 2020 (Veuger, 2020) we see a much heavier emphasis on the fourth phase (Figure 8). A considerable shift in 2021.

Figure-8. Hype Cycle maturity, adoption of digital technologies and applications in the organization with the number of respondents per phase.

Specifically looking at the maturity and adoption of Blockchain technologies and applications in the organization with the number of respondents per phase, compared to the general developments of technologies and applications in the organization, we see that Blockchain is predominantly in the first three phases of developments: 53.3% (n=2445). Compared to the same research in 2020 (Veuger, 2020) we see a comparable picture in which a clear shift to phases 3 and 4 can now be seen (Figure 9). This indicates more adoption of Blockchain in the organization compared to the research in 2021.

8.2.8. Current Situation as a Professional with Digitization and Blockchain

Respondents were asked to indicate where they stand as a professional in 2021 with regard to digitization. The following figure represents all responses from all respondents. This picture shows that the majority of respondents (n=2740) finance more company pilot projects and that conservative companies remain cautious and that the broad applicability and relevance of the technology on the market is clearly bearing fruit (phases 4 and 5). Based on their position, respondents were particularly positive about where they stand compared to digital developments. Compared to the same research in 2020 (Veuger, 2020) we see an image in which now more is a clear shift to phases 4 and 5 (Figure 10). This indicates clear adoption of digital technologies compared to the research in 2021.

Figure-9. Hype Cycle maturity, adoption of Blockchain technologies and applications in the organization with the number of respondents per phase.

Figure-10. Hype Cycle maturity, adoption of digital technologies and applications as a professional with the number of respondents per phase.

Looking more specifically at the maturity and adoption of Blockchain technologies and applications of the professional with the number of respondents per phase, we see that this is balanced over phases 2, 3, 4 and 5 with a striking response in phase 1. Compared to the same research in 2020 (Veuger, 2020) a shifting picture to phases 2, 3 and 4 can be seen (Figure 11). This indicates more adoption of Blockchain in the organization compared to the research in 2020.

8.3. Terms Affecting the Financial Professional and Opportunities

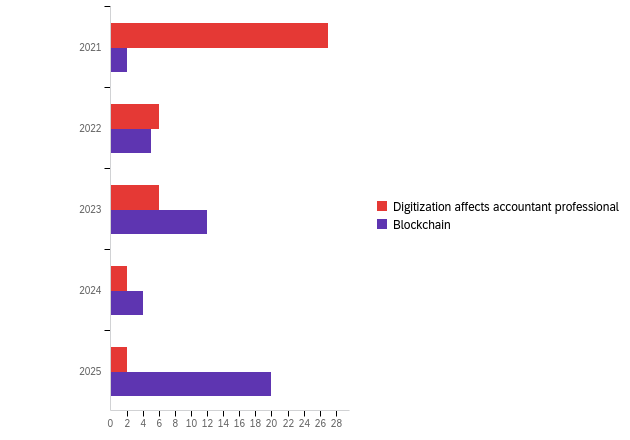

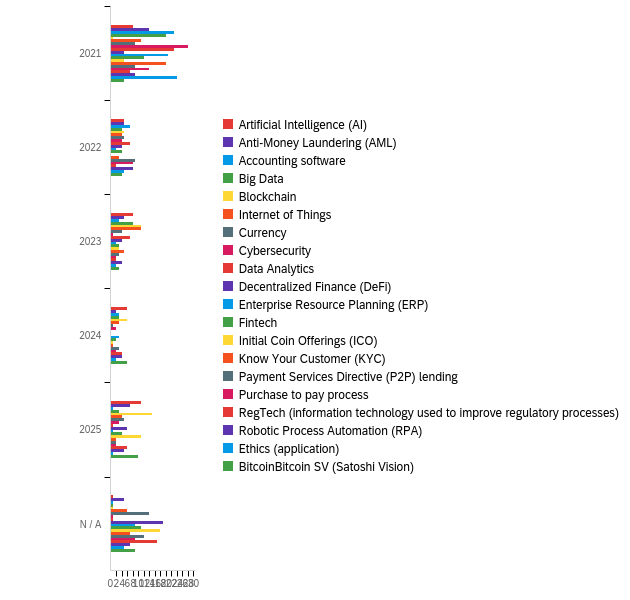

Also investigated is when people expect that digitization will have an effect on the new professional, i.e. the recent graduate from a university of applied sciences (HBO) and in particular Blockchain. Clear developments can be seen mainly in 2021 on the broad scope of digitization in general and to a lesser extent in the years thereafter, which may indicate that the trends are expected to be deployed in 2021 (Figure 12). Blockchain developments are expected especially in the next four years.

Figure-11. Hype Cycle maturity, adoption of Blockchain technologies and applications as a professional with the number of respondents per phase.

# |

Question | 2021 |

2022 |

2023 |

2024 |

2025 |

N/A |

Total |

||||||

1 |

Artificial Intelligence (AI) | 20.51% |

8 |

12.82% |

5 |

20.51% |

8 |

15.38% |

6 |

28.21% |

11 |

2.56% |

1 |

39 |

2 |

Anti-money laundering (AML) | 36.84% |

14 |

13.16% |

5 |

13.16% |

5 |

5.26% |

2 |

18.42% |

7 |

13.16% |

5 |

38 |

3 |

Accounting software | 60.53% |

23 |

18.42% |

7 |

7.89% |

3 |

7.89% |

3 |

2.63% |

1 |

2.63% |

1 |

38 |

4 |

Big Data | 51.28% |

20 |

10.26% |

4 |

20.51% |

8 |

7.69% |

3 |

7.69% |

3 |

2.56% |

1 |

39 |

5 |

Blockchain | 2.56% |

1 |

12.82% |

5 |

28.21% |

11 |

15.38% |

6 |

38.46% |

15 |

2.56% |

1 |

39 |

6 |

Internet of Things | 28.21% |

11 |

10.26% |

4 |

28.21% |

11 |

7.69% |

3 |

10.26% |

4 |

15.38% |

6 |

39 |

7 |

Currency | 23.68% |

9 |

13.16% |

5 |

10.53% |

4 |

2.63% |

1 |

13.16% |

5 |

36.84% |

14 |

38 |

8 |

Cybersecurity | 71.79% |

28 |

10.26% |

4 |

2.56% |

1 |

5.13% |

2 |

7.69% |

3 |

2.56% |

1 |

39 |

9 |

Data Analytics | 58.97% |

23 |

17.95% |

7 |

17.95% |

7 |

0.00% |

0 |

2.56% |

1 |

2.56% |

1 |

39 |

10 |

Decentralized Finance (DeFi) | 13.16% |

5 |

10.53% |

4 |

10.53% |

4 |

0.00% |

0 |

15.79% |

6 |

50.00% |

19 |

38 |

11 |

Enterprise Resource Planning (ERP) | 55.26% |

21 |

5.26% |

2 |

5.26% |

2 |

7.89% |

3 |

2.63% |

1 |

23.68% |

9 |

38 |

12 |

Fintech | 33.33% |

12 |

11.11% |

4 |

8.33% |

3 |

5.56% |

2 |

11.11% |

4 |

30.56% |

11 |

36 |

13 |

Initial Coin Offerings (ICO) | 13.16% |

5 |

0.00% |

0 |

7.89% |

3 |

2.63% |

1 |

28.95% |

11 |

47.37% |

18 |

38 |

14 |

Know Your Customer (KYC) | 52.63% |

20 |

7.89% |

3 |

13.16% |

5 |

2.63% |

1 |

5.26% |

2 |

18.42% |

7 |

38 |

15 |

Payment Services Directive (P2P) lending | 23.68% |

9 |

23.68% |

9 |

7.89% |

3 |

7.89% |

3 |

5.26% |

2 |

31.58% |

12 |

38 |

16 |

Purchase to pay process | 37.84% |

14 |

21.62% |

8 |

5.41% |

2 |

5.41% |

2 |

5.41% |

2 |

24.32% |

9 |

37 |

17 |

RegTech (information technology used to improve regulatory processes) | 18.42% |

7 |

5.26% |

2 |

5.26% |

2 |

10.53% |

4 |

15.79% |

6 |

44.74% |

17 |

38 |

18 |

Robotic Process Automation (RPA) | 24.32% |

9 |

21.62% |

8 |

10.81% |

4 |

10.81% |

4 |

13.51% |

5 |

18.92% |

7 |

37 |

19 |

Ethics (application) | 61.54% |

24 |

12.82% |

5 |

5.13% |

2 |

5.13% |

2 |

2.56% |

1 |

12.82% |

5 |

39 |

20 |

Bitcoin SV (Satoshi Vision) | 13.51% |

5 |

10.81% |

4 |

8.11% |

3 |

16.22% |

6 |

27.03% |

10 |

24.32% |

9 |

37 |

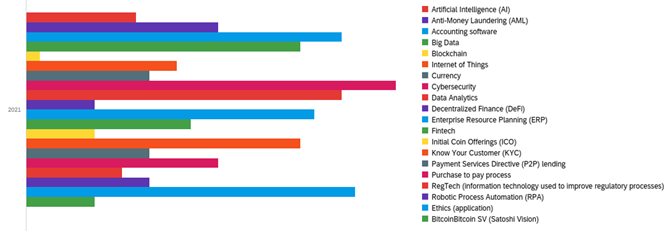

Also investigated in further detail is which different forms of digitization will have an impact on the new and existing financial professional and in what time frame. A time horizon for the next five years has been maintained for this. For each item, the number of responses for when one would expect what in a particular year is shown in the figure below. Cybersecurity (28), ethics (24), data analytics (23), accounting software (23), ERP (21) and big data (20) are expected to play a major role for 2021. For 2021, this is mainly Payment Services Directive (P2P) (9), Purchase to pay process (8) and Robot Process Automation (8) and in 2022 Blockchain (11) and the Internet of Things (11). Looking at Blockchain, we see that expectations in 2021, 2022 and 2023 affect the financial professional faster than all other digital developments on all fronts. The scores for 2021 are shown in detail in the overview below (Figure 13, 14 and Table 6), as well as in detail over the coming years.

Figure-13. Scores for 2021 in detail.

Figure-14. Influence of different digitizations on the new and existing financial professional for the next five years.

8.4. Investments in Digitization

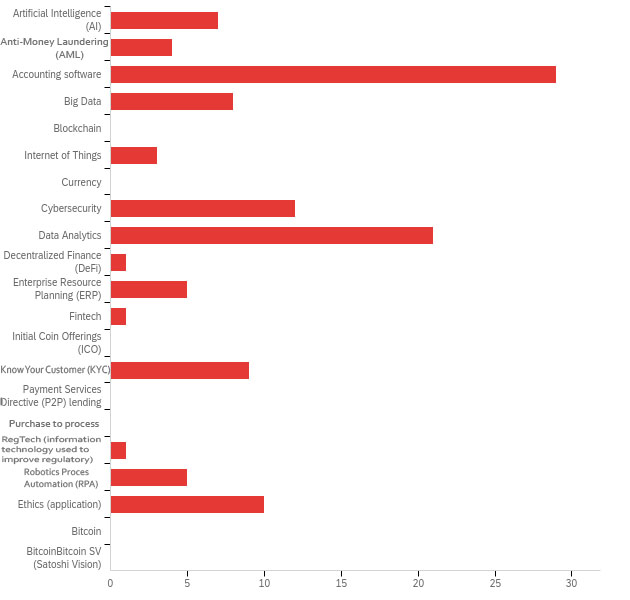

Based on the many different digitization’s as shown in the previous table, the question has been asked of what the respondents’ organization invests most in. It is noteworthy that most investments take place in accounting software (25%, n =2957) followed by data analytics (18.1%, n = 2157) and cybersecurity (10.3%, n =1257). The current attention to ethics and the lack of attention to investments in Blockchain, currency, Initial Coin Offerings (ICO), Payment Services Directive (P2P), Bitcoin and Bitcoin SV are also striking (Figure 15). This non-investment, which is mainly related to digital currencies, may indicate that the organizations surveyed do not deal with this as an organization or as a professional.

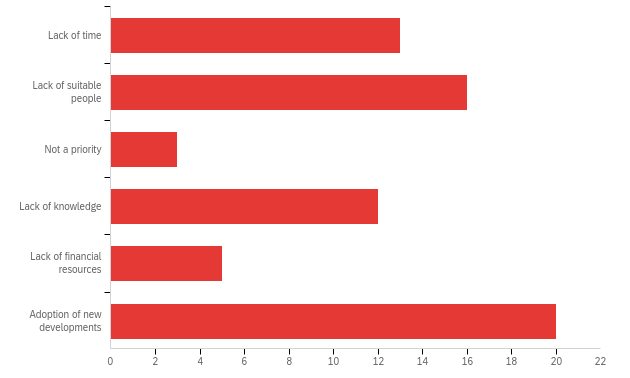

It is also interesting to see what obstacles (Figure 16) there are for professionals in relation to automation. In particular, adoption of digital technologies (29.0%, n =2057) followed by insufficiently equipped staff (23.2%, n =1657), insufficient time (18.8%, n =1357) and insufficient knowledge (17.4%, 1257). In conclusion, it can be stated that in particular the combination of capacity and insufficient knowledge and equipped personnel (49.3%) is more decisive than adoption (29.0%).

Figure-15. Most investments in digitization.

Figure-16. Obstacles in automation.

When investing in new technological developments, it is mainly the management team (42.0%, n =2169), the CEO (28%, n =1469) and the CFO (12.0%, n =669) who decide. When the implementations of the new technologies are mainly done jointly (69.2%, n =2750) or by the ICT department (28.2%, n =1150).

8.5. Conclusions

Five conclusions can be drawn from the study from the current situation in (1) society, (2) organizations, (3) as a professional with digitization and in particular Blockchain, (4) terms affecting the financial professional and (5) investments in digitization.

1. Current Situation in Society with Digitization and Blockchain: Relevance of the Technology on the Market is Clearly Bearing Fruit

Majority indicate that digital developments in society are mainly in the last two phases of the Gartner Hype Cycle: Slope of Enlightenment and Plateau of Productivity. A not-insignificant proportion of respondents still see a considerable proportion in the Peak of Inflated Expectations, which may indicate media attention with or without clear source references and/or general expectations. If we compare this conclusion with the research from 2020, we see a significant shift to the last two phases, which indicates a more adoption of technological developments. Blockchain is predominantly in the first three phases of developments. Compared to the same research in 2020 (Veuger, 2020) we see a clear shift to phases 2, 3 and 4 instead of primarily an interpretation in phase 1 in 2021. This indicates greater adoption of Blockchain in society.

2. Current Situation in the Organization with Digitization and Blockchain: Heavier Emphasis on Phases 3 and 4

The majority of respondents see more company pilot financing and that conservative companies remain cautious. Compared to the same research in 2020, we see a much heavier emphasis on the fourth phase. A considerable shift in 2021. Blockchain is predominantly in the first phase of developments. Compared to the same research in 2020, we see a comparable picture in which a clear shift to phases 3 and 4 can now be seen. This indicates more adoption of Blockchain in the organization compared to the research in 2021.

3. Current Situation as a Professional with Digitization and Blockchain: More Adoption.

Respondents mainly see that more companies finance pilot projects and that conservative companies remain cautious and that the broad applicability and relevance of the technology on the market is clearly bearing fruit (phases 4 and 5). Based on their position, respondents were particularly positive about where they stand compared to digital developments. Compared to the same research in 2020, we see an image in which now more is a clear shift to phases 4 and 5. This indicates clear adoption of digital technologies compared to the research in 2021. Looking more specifically at the maturity and adoption of Blockchain technologies and applications of the professional with the number of respondents per phase, we see that this is balanced over phases 2, 3, 4 and 5 with a striking response in phase 1. Compared to the same research in 2020, a shifting picture to phases 2, 3 and 4 can be seen. This indicates more adoption of Blockchain in the organization compared to the research in 2020.

4. Terms Affecting the Financial Professional and Opportunities: Already Very Large

Clear developments can be seen mainly in 2021 on the broad scope of digitization in general and to a lesser extent in the years thereafter, which may indicate that the trends are expected to be deployed in 2021. Blockchain developments are expected especially in the next four years. Cybersecurity, ethics, data analytics, accounting software, ERP and big data are expected to play a major role for 2021. For 2021, this is mainly Payment Services Directive (P2P), Purchase to pay process and Robot Process Automation. For 2022, this will mainly be Blockchain and the Internet of Things. Looking at Blockchain, we see that expectations in 2021, 2022 and 2023 affect the financial professional faster than all other digital developments on all fronts.

5. Investments in Digitization: Insufficient Knowledge, Capacity and Qualified Personnel.

In conclusion, it can be stated that in particular the combination of capacity and insufficient knowledge and equipped personnel (49.3%) is more decisive than adoption (29.0%). It is noteworthy that most investments take place in accounting software followed by data analytics and cybersecurity. The current attention to ethics and the lack of attention to investments in Blockchain, currency, Initial Coin Offerings (ICO), Payment Services Directive (P2P), Bitcoin and Bitcoin SV are also striking. These non-investments, mainly related to digital currencies, may indicate that the organizations surveyed do not deal with this as an organization or as a professional. When investing in new technological developments, it is mainly the management team, CEO and CFO who decide, while the implementations of the new technologies are mainly done jointly or by the ICT department.References

Adrian, T., & Mancini-Griffolii, T. (2019). The rise of digital money. USA: Fintech Notes, IMF.

Apple Daily. (2020). Jack Ma’s speech at the bund summit 2020 in Shanghai.

Bessems, P., & Bril, W. (2017). Blockchain organiseren. Germany: Paul Bessems en Walter Bril.

Boden, M. A. (1998). Creativity and artificial intelligence. Artificial Intelligence, 103(1-2), 347-356. Available at: https://doi.org/10.1016/s0004-3702(98)00055-1.

CNBC. (2020). Facebook-backed Diem aims to launch digital currency pilot later this year. Retrieved from: https://www.cnbc.com/2021/04/20/facebook-backed-diem-aims-to-launch-digital-currency-pilot-in-2021.html .

Deloitte. (2015). The derivative effect: How financial services can make IoT technology pay off. The Internet of Things in the financial services industry. The internet of things in the financial services industry | Deloitte Insights.

Deloitte. (2021). The derivative effect. How financial services can make IoT technology pay off: The Internet of Things and Financial Services | Deloitte US.

Elsevier. (2019). Facebook wordt bank (pp. 22). Amsterdam: Elsevier.

Elsevier. (2021). Do banks still have a future? Diemen: Elsevier Weekblad.

Executive Finance CM. (2020). IT-vision 2020. Exclusive research CM: Controllers magazine and executive finance. Research into the influence of technological developments on financials. Alphen Aan De Rijn: CM.

Gartner. (2018). The reality of blockchain. USA: Gartner.

Gartner. (2020). Hype cycle for blockchain technologies 2020. Hype Cycle for Blockchain Technologies, 2020 (gartner.com).

Gartner. (2020a). What you need to know about blockchain DeFi. What you need to know About blockchain DeFi (gartner.com).

Gartner. (2020b). Gartner hype cycle. Hype cycle research methodology (gartner.com).

GitHun. (2019). Blockchain papers. GitHub - decrypto-org/blockchain-papers: A curated list of academic blockchain-related papers.

Haaker, T., & Veuger, J. (2021). Minors 2021: A fresh look from Saxion students on the digital and sustainable challenges of companies. Saxion University of Applied Sciences The Netherlands.

Hayek, F. (1976). Choice in currency. A way to stop inflation. London: The Institute of Economic Affairs.

Het Financieele Dagblad. (2019a). ING stapt in blockchainbedrijf. Amsterdam: Het Financieele Dagblad.

Het Financieele Dagblad. (2019b). The difficult relationship between bureaucrat and crypto. Amsterdam: Het Financieele Dagblad.

Het Financieele Dagblad. (2019h). Facebook partners distance themselves from the controversial libramunt. Amsterdam: Het Financieele Dagblad.

Kenton, & Anderson. (2020). Must be (Anderson 2021). Retrieved from: https://www.whitecase.com/publications/article/international-comparative-legal-guide-anti-money-laundering-laws-regulations .

Laan, S. V. D. L. (2019). Pay soon with the libra? Diemen: Elsevier Weekblad.

Lim, C. L., & Janse, A. (2019). Blockchain basic book. Enschede: Saxion Hogeschool.

Maten, J. T., Barkel, C., & Veuger, J. (2019). Blockchain viewed too solitary. Essay: Saxion University of Applied Sciences The Netherlands.

Nakamato, S. (2008). Bitcoin: A peer-to-peer electronic cash system. White Paper.

NBA (Nederlandse Beroepsorganisatie voor Accountants). (2016). A profession with a future. Amsterdam: NBA.

NBA (Nederlandse Beroepsorganisatie voor Accountants). (2019). NBA: 'Sector is characterized by major change dynamics. Amsterdam: NBA.

NRC. (2019). The Libra? That's nothing special for the Chinese. Amsterdam: NRC Handelsblad.

Pomp, M. (2019). Entrepreneurship in the age of digital Darwinism. Appendix to Elsevier. Amsterdam: Elsevier.

Pomp, M., & Verhaert, R. (2018). Blockchain in practice. The Hague: Sdu Uitgevers.

Reim, W., Åström, J., & Eriksson, O. (2020). Implementation of Artificial Intelligence (AI): A roadmap for business model innovation. AI, 1(2), 180-191. Available at: https://doi.org/10.3390/ai1020011.

Reuters. (2021). ECB’s Lagarde calls for regulating Bitcoin’s "funny business". ECB’s lagarde calls for regulating Bitcoin’s "funny business" | Reuters.

Schellekens, M. E., Tjong, T. T., Kaufmann, W., Schemkes, F., & Leenes, R. (2019). Blockchain and the law. An exploration of the regulatory need. The Netherlands: Tilburg University.

Tweede, K. (2019). Mini symposium the house of representatives & blockchain. The Hague: Dienst Analyse en Onderzoek Tweede Kamer der Staten-Generaal.

Veuger, J. (2019). Libra and anxiety rhetoric: Fear to be eaten. Research & development in material science peer-reviewed. Impactfactor 3.153. RDMS (pp. 1252-1255). NY USA: Crimson Publishers.

Veuger, J. (2020). Added value of blockchain for financial professionals in the Netherlands. Series: Advances in economics, business and management research. Paper presented at the Proceedings of the Fifth International Conference on Economic and Business Management (FEBM 2020). Atlantic Press.

Veuger, J. (2020a). Added value of blockchain for financial professionals in the Netherlands. Series: Advances in economics, business and management research. Paper presented at the Proceedings of the Fifth International Conference on Economic and Business Management (FEBM 2020). Atlantic Press.

Veuger, J. (2020b). Added value of blockchain for financial professionals in the Netherlands. speaker at. Paper presented at the The Fifth International Conference on Economics and Business Management (FEBM2020). October 18th 2020, Sanya, China.

Veuger, J. (2020c). Blockchain convergence. Paper presented at the The Third International Research Conference on Business and Economics. Big Data for Social, Economic and Business Improvement: An Effort to Achieve Sustainable Development Goals in the Midst Global Turbulence. October 14th-15th 2020, Univeristas Diponegoro Fakultas Ekonomika Dan Busnis, Semarang, Indonesia.

Veuger, J. (2020d). Blockchain convergence. Paper presented at the Summer Short Course Program 2020. Achieving Sustainable Development Goals and Building Resilience in the Global Uncertainty. November 16th 2020, Univeristas Diponegoro Fakultas Ekonomika Dan Busnis, Semarang, Indonesia.

Veuger, J. (2020e). Decentralized finance. Paper presented at the Short Course Program 2020. Achieving Sustainable Development Goals and Building Resilience in The Global Uncertainty. November 17th 2020, Univeristas Diponegoro Fakultas Ekonomika Dan Busnis, Semarang, Indonesia.

Veuger, J. (2021). (Netherlands) blockchain & finance and decentralized finance [Veuger Jan (Netherlands) Blockchain & Finance and Decentralized Finance]. Moscow Russia. Paper presented at the 5th International Scientific and Practical Conference Biennal ‘System Analysis in Economic 2020.

Veuger, J., Kos, T., & Nguyen, J. (2021). Bitcoin SV MOOC launch. The Netherlands: Bitcoin SV and Saxion University of Applied Sciences.

Veuger, J. (2020). Blockchain convergentie (pp. 84). Deventer: Saxion University of Applied Sciences.

Veuger, J., & Bitcoin, S. (2021). Bitcoin SV massive open online course. The Netherlands: Bitcoin SV and Saxion University of Applied Sciences.

World Economic Forum. (2019). Central banks and distributed ledger technology: How are central banks exploring blockchain today. Switzerland: World Economic Forum.

Footnotes:

2.In total from the three programmes, the 31 WVC members were enrolled with a response of 41.9% (n = 13 31), although it should be noted that the response varied per programme: AC 50.0% (n = 6 12), FTA 18.1% (n = 2 11) and FC 62.5% (n = 5 8). All the responses received were 100% usable.

3. An explanation for a lower response rate of 12.8% in 2020 compared to 41.9% in 2021 can be explained by the high number of SRAs in which members were asked to participate in the research without obligation via a newsletter and the WVC and universities were specifically approached in the name of a professional.